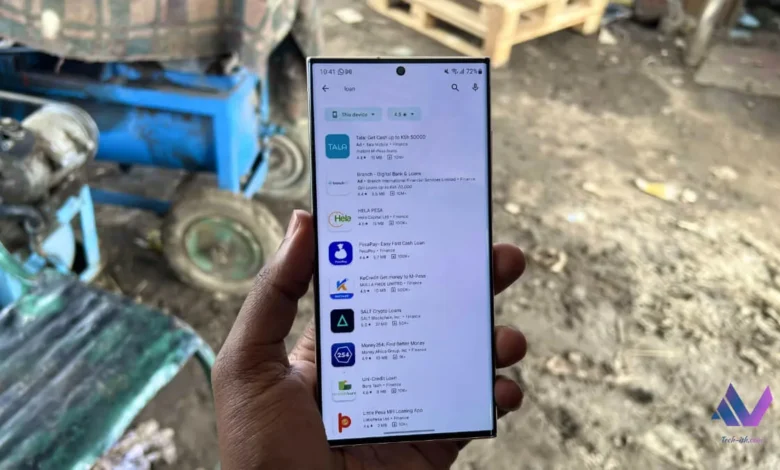

In January of this year, Google Play Store adopted a new policy requiring loan apps in Kenya to be approved by the regulator, the Central Bank. This was meant to curb Kenyans from fraudulent loan apps. Earlier last year, the Central Bank had also required that these apps provide information on their sources of funds, to prevent bad players from illegal business like money laundering.

As of the end of March 2023, only 32 Apps have received license from the Central Bank. Google has gone ahead to delete hundreds of Apps from the Play Store. They may only be reinstated once the Central Bank gives them licenses to operate.

The only approved loan apps in Kenya, thus are the following:

- Anjoy Credit Limited

- Asante FS East Africa Limited

- Ceres Tech Limited

- Colkos Enterprises Limited

- EDOMX Limited

- Extend Money Service Limited

- Fourth Generation Capital Limited

- Getcash Capital Limited

- Giando Africa Limited (Trading as Flash Credit Africa)

- Inventure Mobile Limited (Trading as Tala)

- Jijenge Credit Limited

- Jumo Kenya Limited

- Kweli Smart Solutions Limited

- Letshego Kenya Ltd.

- Little Pesa Limited

- MFS Technologies Limited

- M-Kopa Loan Kenya Limited

- Mwanzo Credit Limited

- Mycredit Limited

- MyWagepay Limited

- Natal Tech Company Limited

- Ngao Credit Limited

- Pezesha Africa Limited

- Rewot Ciro Limited

- Risine Credit Limited

- Sevi Innovation Limited

- Sokohela Limited

- Tenakata Enterprises Limited

- Umoja Fanisi Limited

- Zanifu Limited

- Zenka Digital Limited

This list will be updated once more companies are licensed by the Central Bank. It is imperative to ensure that you only work with apps that are licensed to ensure your data is safe, and that the interests are well controlled.