In today’s fast-paced financial landscape, having access to quick and flexible borrowing solutions can make all the difference when unexpected expenses arise or when you need a little extra to meet a financial goal. LOOP, the all-in-one financial platform, understands the importance of flexibility and convenience, offering users two key borrowing solutions: term loans and an overdraft facility. Both options are designed to provide hassle-free access to funds when you need them the most, all managed through a single app.

Let’s dive into how LOOP’s borrowing solutions work and why they’re a great fit for modern consumers who need financial flexibility.

LOOP Term Loans: Quick and Flexible Borrowing

LOOP’s term loans are designed to be simple, transparent, and flexible, allowing users to apply for and manage loans directly through the app. Whether you need funds for personal or business use, LOOP offers a streamlined process that eliminates the traditional barriers associated with borrowing money.

How Term Loans Work:

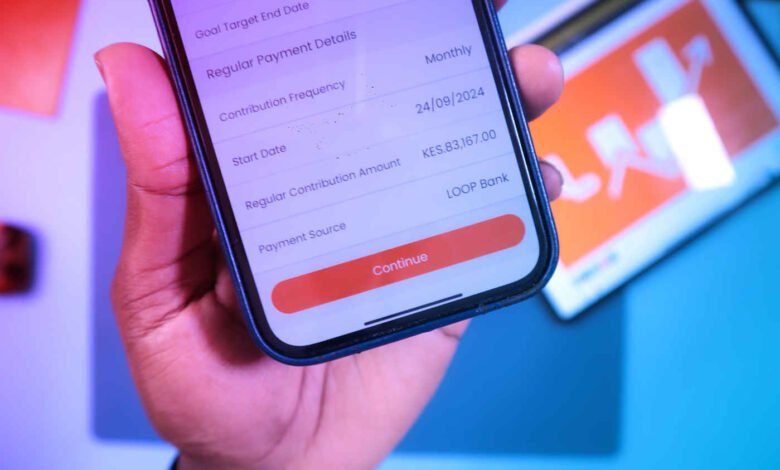

- Instant Credit Score Calculation: LOOP automatically calculates your loan limit based on your credit score, which is regularly updated according to your financial behavior. This means that the loan amount you’re eligible for is dynamic and reflects your current financial standing.

- Flexible Repayment Terms: Once you’ve determined your loan amount, LOOP allows you to select a repayment period that best fits your financial situation. Whether you need short-term funding or prefer to spread your repayments over a longer period, LOOP provides you with the flexibility to choose a repayment plan that works for you.

- Top-Up Feature: One of the standout features of LOOP’s term loans is the ability to top up your loan. If, after borrowing, you find yourself needing additional funds, you can top up your existing loan without having to go through the hassle of reapplying for a new one. This dynamic loan structure is ideal for users who may need ongoing financial support.

Example Use Cases:

- The Freelance Professional: Alice is a freelance graphic designer whose income can fluctuate month to month. When she experiences a slower month, she applies for a KES 50,000 loan through LOOP to help cover her expenses. Halfway through repaying her loan, she lands a new client but needs an additional KES 20,000 to upgrade her design software. Instead of applying for a new loan, she simply tops up her existing loan directly within the app, saving her time and effort.

- The Budget-Conscious Borrower: Maria uses LOOP’s term loans for planned expenses, like paying her daughter’s school fees. Rather than scrambling to gather the full amount upfront, she applies for a loan that matches her budget and selects a repayment period that aligns with her income. Should other expenses arise, she knows she has the option to top up her loan without disrupting her long-term financial plans.

LOOP Overdraft Facility: A Safety Net for Everyday Expenses

Unexpected financial shortfalls can happen at any time, and that’s where LOOP’s overdraft facility comes in. Much like Safaricom’s Fuliza product, LOOP’s overdraft offers an automated solution that covers shortfalls in your account, ensuring your payments go through without disruption.

This feature is seamlessly integrated into your LOOP account, meaning that when your balance runs low, if you have enabled it within the app, the overdraft automatically kicks in to cover the deficit. This ensures you never have to worry about payments being declined due to insufficient funds.

How the Overdraft Facility Works:

- Automatic: If your account balance falls short during a transaction, LOOP automatically activates the overdraft to cover the amount needed, ensuring your transaction goes through without any delays whether you’re paying with card, or from the app, or you have a standing order.

LOOP’s umbrella company, NCBA, who also built the similar solution Fuliza on M-Pesa, backs this overdraft facility, providing you with a reliable and secure financial safety net. With LOOP, there’s no need for manual intervention or worrying about whether you’ll be able to cover an unexpected shortfall—the system has you covered.

Example Use Cases:

- The Automated Safety Net: James, a small retail business owner, relies heavily on his LOOP account for business transactions. One day, an unexpected large order from a supplier leaves his balance lower than expected. Thanks to LOOP’s overdraft facility, the transaction is covered automatically, preventing any disruptions to his business. James repays the overdraft once his next payment comes in, keeping his business running smoothly without any manual intervention.

- The Everyday Consumer: Rachel, a working mother, uses LOOP for her day-to-day expenses. When her balance falls short at the grocery store, LOOP’s overdraft automatically kicks in to cover the remaining amount. She’s able to complete her purchase without issue and repays the overdraft within a few days when her salary hits her account.

Why LOOP’s Borrowing Solutions Matter

Having access to flexible borrowing solutions is crucial in today’s financial environment, where the need for quick funds can arise at any time. LOOP understands that traditional borrowing methods can be cumbersome, involving complex paperwork, long approval processes, and often rigid repayment structures. By offering term loans and an overdraft facility that are integrated into the app, LOOP provides users with a fast, user-friendly, and dynamic solution.

The Benefits of LOOP’s Borrowing Features:

- Seamless Integration: Both the term loans and overdraft facilities are integrated into the LOOP app, meaning users can manage their entire financial journey—borrowing, saving, investing—within one platform. This level of convenience sets LOOP apart from other financial services.

- Flexible Repayment Options: Whether you’re repaying a term loan or covering an overdraft, LOOP offers repayment plans that suit your financial situation. The ability to top up loans without reapplying is a huge benefit for those who might need additional funds as circumstances change.

- Automated Safety Net: The overdraft facility ensures that you’re never caught off guard by low balances. With automatic activation, there’s no need to monitor your account constantly—LOOP has your back when funds run low.

Empowering Users with Financial Control

One of the biggest advantages of LOOP’s borrowing solutions is the level of control it gives to users. Unlike traditional banks, where borrowing can feel like a cumbersome process, LOOP offers a streamlined, efficient, and user-centric experience. With the ability to manage loans and overdrafts directly through the app, users are in complete control of their financial health without the need to visit a bank or navigate complicated loan applications.

Conclusion

LOOP’s term loans and overdraft facility are designed with the modern consumer in mind—people who need quick, reliable access to funds without the hassle of traditional banking processes. The app’s dynamic loan structures and automated overdraft solution ensure that users can borrow smartly and efficiently, adapting to changing financial needs with ease.

Whether you need to bridge a financial gap, cover unexpected expenses, or plan for upcoming financial commitments, LOOP’s borrowing solutions provide the flexibility, transparency, and control you need to stay on top of your finances. By integrating these features into a single app, LOOP makes managing your financial life simpler, faster, and more intuitive.

No matter your financial situation, with LOOP, you can borrow smart and stay in control—whenever you need it.