As a student, managing money isn’t just about paying bills or sending money to friends—it’s about balancing your daily expenses with your bigger plans for the future. Between splitting the rent with roommates, paying for groceries, and saving for that much-needed holiday break, financial management can quickly get overwhelming. This is where LOOP steps in, not just as an app, but as a lifestyle tool that simplifies your financial journey.

With LOOP, paying bills, managing money, and even planning for group expenses becomes effortless. Whether you’re setting up standing orders to handle regular payments, using Money Pool to organize a group trip, or tracking your spending with the Grow section, LOOP integrates into your life and makes managing your finances easier than ever.

Scenario 1: Splitting Rent and Utilities with Roommates Made Simple

One of the most common struggles students face when living with roommates is managing shared expenses like rent and utilities. Keeping track of who owes what and making sure everyone pays on time can be a headache. That’s where LOOP’s standing order feature comes to the rescue. With standing orders, you can set up automatic payments that make sure your rent, electricity, and water bills are paid on time, without you having to remember each month.

Use Case: Automating Rent Payments

Let’s say you and your two roommates need to contribute KES 10,000 each for rent. Instead of one person collecting the money manually or risking someone forgetting to pay, you can each set up a standing order on LOOP.

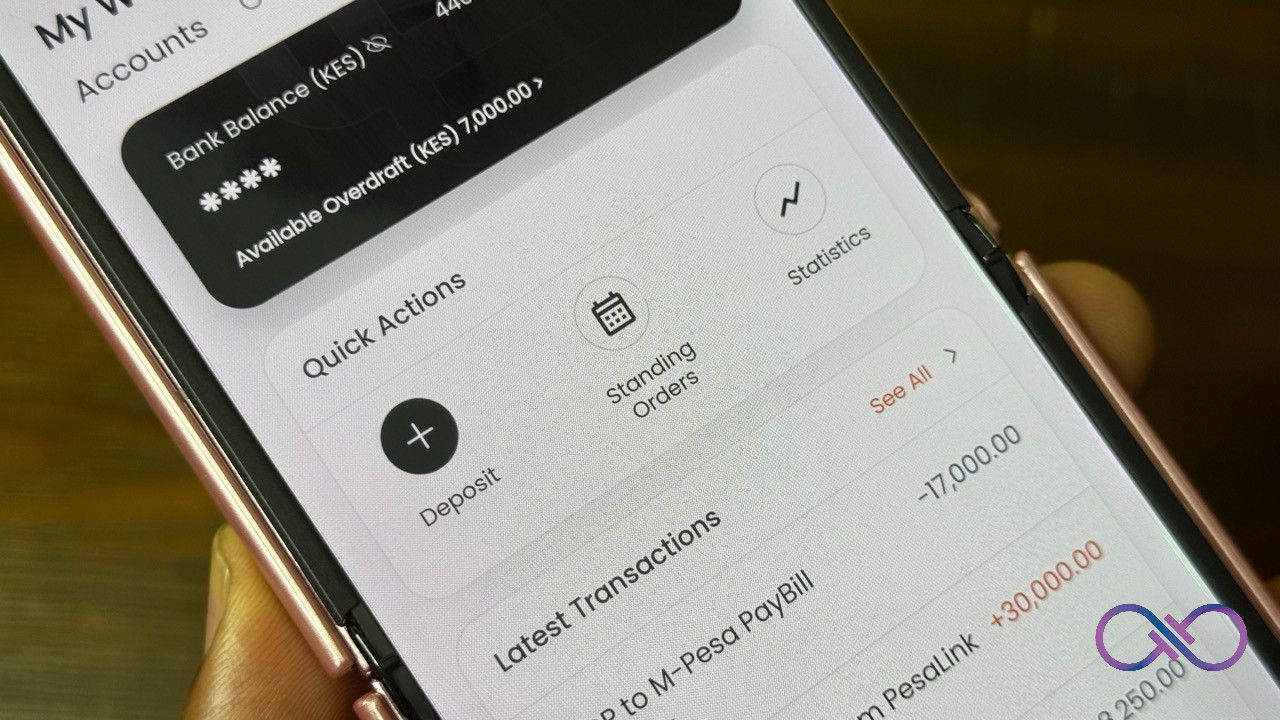

- Step 1: Open the LOOP App: Open the app and navigate to your bank or wallet section.

- Step 2: Set Up a Standing Order: In the Wallet or Bank sections, tap on the option for standing orders. Enter the amount (KES 10,000), the landlord’s paybill or bank account details, and choose the date for the payment to go out automatically each month.

- Step 3: Sit Back and Relax: Now, each month, the rent will be paid automatically, and you won’t have to scramble to send money at the last minute. You can do the same for utilities – set a standing order for your electricity or water bills and let LOOP handle the rest.

Lifestyle Perspective:

With standing orders, LOOP helps you focus on what matters – whether it’s hitting the books or planning your next night out with friends. You won’t have to worry about missing a payment or chasing after your roommates to contribute. It’s automated, simple, and stress-free.

Scenario 2: Planning the Perfect End-of-Semester Party with Money Pool

As the semester comes to an end, there’s always that one thing on every student’s mind – a celebratory party. But organising a party can be tricky, especially when it comes to collecting money from friends for food, drinks, and decorations. Luckily, LOOP’s Money Pool feature makes it easy to pool funds together for group projects, events, or any collective expense.

Use Case: Using Money Pool for a Party

Imagine you’re planning an end-of-semester bash with your classmates, and you need to raise KES 15,000 for the event. Instead of manually collecting the money or trying to keep track of who’s paid, LOOP’s Money Pool simplifies the process.

- Step 1: Create a Money Pool: Open the LOOP app, go to the Grow section, and select Money Pool. Create a new pool and name it “End of Semester Party.”

- Step 2: Set the Target and Invite Friends: Set the goal to KES 15,000 and invite your friends to contribute. Each person can transfer their share directly into the pool, and LOOP will keep track of who’s paid and how much is left to collect.

- Step 3: Monitor Contributions: As your friends contribute, the app will show you the progress toward your target. Once everyone has pitched in, you can start using the money to organize the party, and there’s no need to worry about chasing anyone down for their share.

Lifestyle Perspective:

Planning group events and managing shared expenses is part of student life, but it doesn’t have to be stressful. With LOOP’s Money Pool, everyone knows what they owe, and you can easily track the contributions. This way, you can focus on making the event memorable, not on the logistics.

Scenario 3: Handling Daily Expenses and Tracking Spending with LOOP’s Grow Section

As a student, keeping track of daily expenses is just as important as saving for big goals. Whether it’s budgeting for groceries, transport, or those spontaneous coffee breaks with friends, staying on top of your spending can help prevent financial stress. LOOP’s Grow section provides an easy way to monitor what’s coming in and going out, so you can keep your finances under control.

Use Case: Tracking Your Weekly Budget

Let’s say you’ve set yourself a weekly budget of KES 2,500 for food, transport, and leisure. With LOOP’s Grow section, you can track how much you’re spending and see where your money is going.

- Step 1: Open the Grow Section: In the LOOP app, go to the Grow tab, where you can see your income and expenses at a glance.

- Step 2: Monitor Your Spending: Every time you make a payment—whether it’s buying groceries or paying for a ride—you’ll see the transaction recorded in the Grow section. This makes it easy to spot trends in your spending and adjust if you’re going over budget.

- Step 3: Adjust Your Habits: Based on your spending habits, LOOP will show you where you might want to cut back or how much you have left to spend. It’s like having a financial advisor in your pocket, helping you make smarter decisions without complicating your life.

Lifestyle Perspective:

The Grow section doesn’t just help you track your spending—it’s a tool that gives you control over your finances. Instead of worrying about running out of money at the end of the week, you can keep track of everything in one place, giving you peace of mind and letting you focus on enjoying your student life.

Scenario 4: Saving for Big Goals with LOOP Invest

Students often think that investing is something for the future — something you’ll do once you’ve graduated and started working. But with LOOP Invest, you can start growing your money even now, while you’re still a student. Whether you’re saving for a major purchase, like a laptop or a holiday, LOOP helps you lock in amounts and earn interest over time.

Use Case: Saving for a Laptop

You’ve been eyeing a new laptop that costs KES 80,000, and you’ve saved up KES 30,000 so far. Instead of leaving that money sitting idle, you can invest it and earn interest, bringing you closer to your goal faster.

- Step 1: Open LOOP Invest: In the Grow section of the app, select Invest and browse the available investment options. You can choose to lock in your money for a certain period to earn interest.

- Step 2: Choose the Amount and Duration: Decide how much of your savings to invest (in this case, the KES 30,000), and select how long you want to lock it in. LOOP will show you the potential returns based on the duration.

- Step 3: Watch Your Money Grow: As your money earns interest over time, LOOP will show you the growth in the Grow section of the app. You’ll get closer to your laptop goal without even lifting a finger.

Lifestyle Perspective:

LOOP Invest turns saving into something more rewarding. Instead of letting your money sit in a regular savings account, you can start earning interest now. Whether you’re saving for a big purchase or just want to see your savings grow, LOOP helps you make the most of your student income.

Why LOOP Is More Than Just a Payment App

With LOOP, making payments and managing your money isn’t just about keeping track of bills — it’s about simplifying your life. Whether you’re splitting rent with friends, pooling money for a party, or planning for the future, LOOP integrates into your lifestyle, making financial management an effortless part of your daily routine.

From setting up automatic payments to tracking your spending or saving for something special, LOOP offers tools that go beyond what you’d expect from a typical banking app. It’s designed to help you manage your money smarter, giving you more time to focus on what really matters — enjoying student life.

Parting Shot: Make Payments Easier, Live Smarter with LOOP

Whether it’s automating your bills or saving for a big goal, LOOP has everything you need to make smarter financial decisions without the stress. It’s not just an app — it’s a way of managing your money that fits into your lifestyle. So why wait? Download LOOP today and start making payments, managing expenses, and tracking your savings like never before. With LOOP, you can focus on living your best life while your finances are taken care of.

This article is for informational purposes only and does not constitute financial or investment advice.