Stream, a Saudi-based fintech platform, has secured a $4M seed funding round. The company is trying to solve a problem that sounds basic but is a massive logistical headache for businesses in the Middle East and North Africa (MENA): managing billing and getting paid on time.

The round was led by Outliers VC, with participation from BYLD Ventures and notable angel investors like Careem co-founder Abdullah Elyas.

The funding is earmarked for accelerating product development, specifically in engineering, compliance, and payment capabilities, as well as strengthening its internal systems to handle a growing user base.

The Problem Stream Is Trying to Fix

According to a 2023 report from the Saudi Central Bank, the region’s payment landscape is paradoxical. In Saudi Arabia alone, payment transactions hit approximately $4.8 trillion in 2023, and 70% of all retail transactions are now digital.

But here’s the catch: only about 7% of those consumer transactions are reported to be recurring payments.

This creates a massive gap. While people are used to paying digitally, the collection of recurring payments – think tuition fees, rent, or SaaS subscriptions – is still stuck in a manual or semi-manual rut. Businesses are left chasing payments, managing messy spreadsheets, and dealing with cash flow uncertainty.

Stream, founded in 2024 by Ibrahim Aldlaigan, is designed to fix this.

“Most of the world’s innovation in payments has focused on how people spend,” said Aldlaigan, the founder and CEO. “We’re focused on how businesses get paid.”

He explained that many businesses in the region still demand 100% of payment upfront simply because they lack the systems to bill over time. “Stream gives them structure and control,” Aldlaigan added. “A business defines how and when payments happen – one-time, recurring or in parts – and we handle the rest. It’s about making payments predictable, flexible, and connected to the real flow of services.”

How It Works

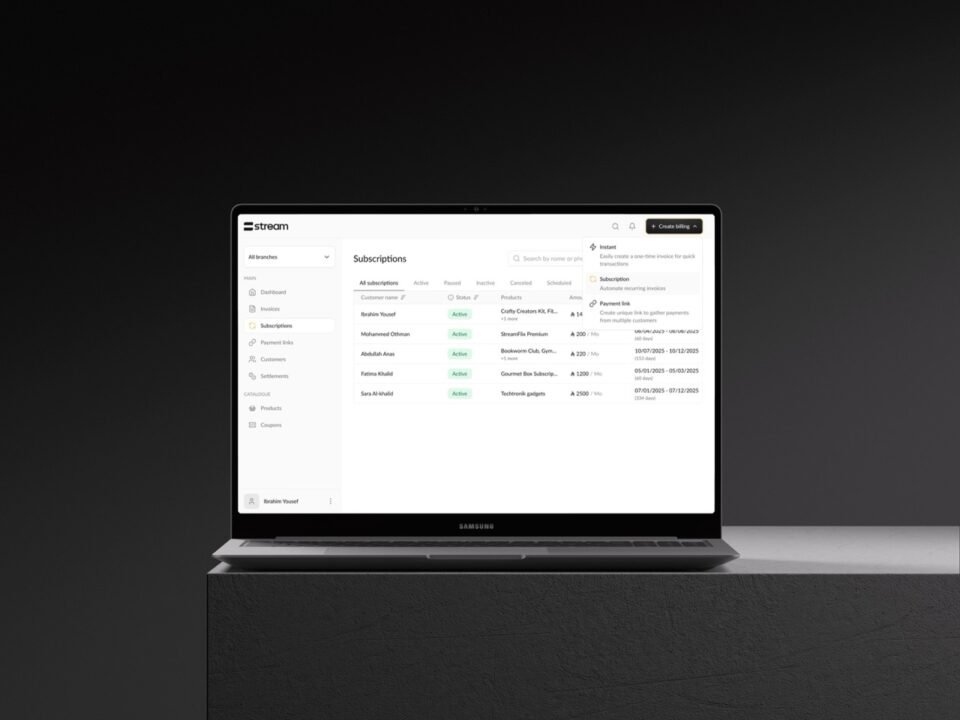

Stream isn’t a simple payment gateway. It’s a platform designed to manage and automate the entire payment lifecycle for a business.

This includes:

- Issuing branded invoices that don’t require the customer to download an app.

- Scheduling payments with flexible options (one-time, recurring, or installments).

- Collecting payments through local payment methods (local rails).

- Providing cash flow visibility.

- Automating reconciliation and record-keeping.

The company first found its footing by specializing in businesses in the early childhood education sector. It has since expanded into larger school networks, SaaS companies, and other verticals. Stream claims it has been growing 40% month-on-month, now processing “millions” in payments for thousands of customers across its merchant base.

The Investor Take

Investors see this as a foundational play for the region’s business infrastructure.

“Stream is built on deep local insight and a clear understanding of how businesses actually operate,” stated Sarah AlSaleh, General Partner at Outliers VC. “Ibrahim brings the rare combination of investor perspective and relentless product execution… Stream is laying the foundation for the next generation of payment infrastructure in the region.”

Youcef Oudjidane, Founder of BYLD, was even more bullish on the team’s potential, noting its “culture of intensity and technical excellence.”

“It wouldn’t surprise me if we’re talking about the ‘Stream mafia’ in the years to come,” Oudjidane said, referencing the “PayPal mafia” of former employees who went on to found other major tech companies.