On 19 February 2026, the Capital Markets Authority (CMA) approved a highly unusual three-working-day extension for the Kenya Pipeline Company (KPC) Initial Public Offering (IPO). According to the official press release, the offer, initially scheduled to close at 5:00 p.m. that day, will now remain open until Tuesday, 24 February 2026, at 5:00 p.m.

Dr Janerose Omondi, stepping in as the acting Privatisation Authority Managing Director, framed this extension as a benevolent response to retail investors who “expressed the need for additional time” during public participation forums. The state also touted the recent integration of electronic Central Depository System (CDS) account opening into the KPC IPO digital platform to supposedly enhance user convenience.

However, peering beneath the carefully curated corporate communication reveals a deeply troubled offering. For international finance observers, witnessing an IPO deadline extended under the guise of overwhelming retail demand, while the state simultaneously floods digital channels with aggressive marketing, is an unprecedented anomaly in modern capital markets.

The “Reverse DDoS”

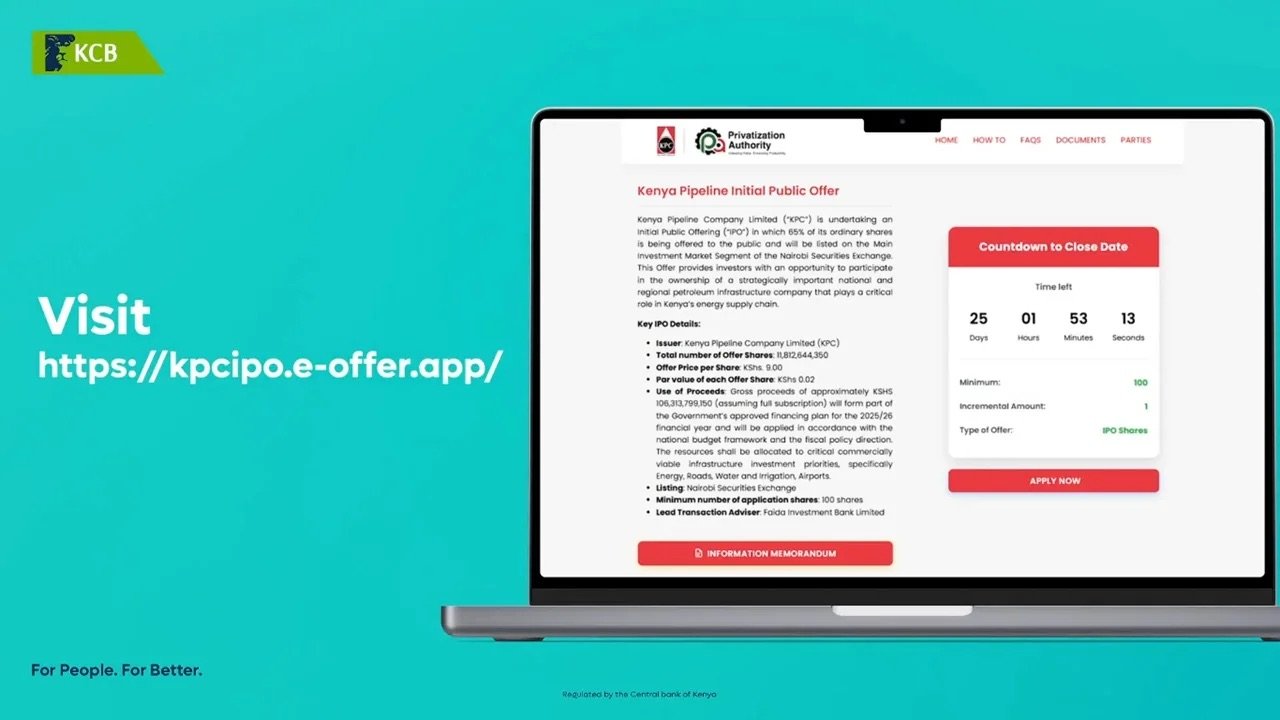

Faced with a massive retail boycott, the government has transformed a standard state divestiture into an aggressive digital dragnet. Citizens across the country report receiving relentless, unsolicited text messages from Safaricom, various commercial banks – including Equity, KCB, and Co-op Bank – and the Central Depository and Settlement Corporation (CDSC), all simultaneously urging them to buy into the IPO.

From a technological standpoint, this coordinated bombardment functions almost like a state-sponsored “Reverse DDoS” (Distributed Denial of Service) attack. Instead of a botnet flooding a server to take it offline, the state has co-opted the nation’s private telecommunications and banking infrastructure to flood citizens’ mobile devices, attempting to force financial conversion through sheer notification fatigue.

Leveraging private monopolies and banking databases to blast citizens with state equity marketing raises severe data privacy concerns. Under the 2019 Data Protection Act, this cross-pollination of user data without explicit, opt-in consent crosses ethical and legal boundaries, rightly earning the label of “digital harassment” from mobile users.

The market data explains the state’s desperation: just days before the original deadline, the massive KES 106.3 billion capital raise was languishing at a dismal 10% subscription rate, capturing merely KES 11 billion. The coordinated SMS bombardment signals deep systemic distress within the administration, exposing an attempt to manufacture retail momentum via digital strong-arming.

Legal Resistance

This digital desperation is compounded by the fact that the government aggressively pushed for the divestiture despite immense pushback from citizens and high-profile legal challenges.

In early January 2026, Senator Okiya Omtatah and civil society groups filed a constitutional challenge in the High Court to halt the KPC privatisation. The lawsuit cited a blatant lack of public participation and accused the state of selling off profitable, publicly owned strategic assets to satisfy International Monetary Fund (IMF) conditionalities.

Frequent Scandals and the Valuation Chasm

The reluctance of the retail market is further justified by the physical and operational reality of the asset. Retail investors are being asked to buy into a company plagued with severe infrastructural leaks and legal liabilities:

- Environmental Liabilities: A catastrophic 2015 oil spill in the Thange River resulted in a multi-billion-shilling court-ordered compensation mandate that KPC has failed to fully settle.

- Asset Seizures: Because of these unsettled mandates, auctioneers have recently targeted the company’s assets over a KES 2.8 billion debt.

- Procurement Fraud: Ongoing multi-million-shilling corruption convictions by the Ethics and Anti-Corruption Commission (EACC) continue to damage the firm’s reputation.

Despite these massive liabilities, the National Treasury priced the state’s 65% stake at KES 9.00 per share, implying a staggering valuation of KES 163.56 billion. Independent analysts immediately pushed back against this financial engineering. Institutional firms like Uganda’s Old Mutual valued the intrinsic worth at a mere KES 4.61 per share, a massive 49% downside, while independent consensus placed it as low as KES 3.28.

Also Read: KPC’s IPO: A Slow-Motion Train Wreck

What Happens if the Extension Fails?

The ultimate question now looms over the Nairobi Securities Exchange: What will the government do if, by the end of the extension period, IPO uptake still does not meet regulatory expectations?

Market regulations for Initial Public Offerings mandate a minimum subscription threshold, often strictly enforced around 50%, to protect market integrity and prevent underfunded listings. If the total valid bids fall short of the required KES 53.1 billion mark by the new 24 February deadline, the CMA will be forced to declare the offering unsuccessful and cancel the IPO entirely.

In that disastrous scenario, all funds currently blocked via the digital IPO portal, stockbrokers, and mobile short codes must be refunded by the scheduled 6 March 2026 deadline, and the proposed 9 March listing will be scrapped. A failure of this magnitude would deal a devastating blow to the Treasury’s broader privatisation playbook. For the international tech and finance community watching, Kenya’s pipeline privatisation has become a glaring example that even with aggressive digital marketing, SMS spam, and extended deadlines, retail citizens will not blindly absorb an overpriced, scandal-ridden asset to bail out a desperate sovereign balance sheet.