Tax

- News

Kenya’s banks just paid a KES 195 billion tax bill, and a new report shows where the money really came from

Kenyan banks paid KES 195B (8.09% of all government tax) in 2024, with the Affordable Housing Levy surging, a report…

- News

Twitch pulls monetization in Kenya, another casualty of Kenya’s chaotic digital tax policy

Twitch just switched off Kenyan payouts. Policy chaos has consequences. Here is why this should worry every digital business.

- News

KRA Extends Tax Filing Deadline Following iTax System Challenges on June 30th

Kenya Revenue Authority extends tax return deadline to July 1, 2025, after iTax system failures on June 30, aiding compliance

- Business

Hayo Launches National Mobile Registry Platform: Revolutionizing Digital Tax Collection in Emerging Markets

Hayo launched National Mobile Registry platform helping emerging market governments regulate mobile imports, combat counterfeits, and boost digital tax revenues.

- Business

KRA Rolls Out eRITS to Digitize Rental Income Tax Compliance Across Kenya

KRA launches eRITS to automate rental income tax compliance and simplify taxation for landlords in Kenya.

- News

Kenya Proposes New 15% Tax on Social Media and Online Businesses

Kenya proposes a 15% tax on social media and online businesses, impacting creators, SMEs, and digital services to boost revenue.

- News

Kenya’s New Mobile Phone Tax Compliance Rules Raise Privacy and Cost Concerns

Kenya's new IMEI registration rules raise privacy, cost, and practicality concerns, impacting consumers, businesses, and tourists; implementation challenges remain.

- News

Kenyan Tax Tribunal Rules Withholding Tax Inapplicable on Foreign Agency Fees, Providing Relief for Businesses

The Kenyan Tax Tribunal ruled withholding tax inapplicable on foreign agency fees, providing significant relief for businesses using non-resident agents.

- News

Bento Advocates for Digital Taxation in Africa with New White Paper

Bento's White Paper urges African nations to adopt digital tax solutions to boost revenue and combat economic challenges.

- News

All Facebook advertisers to pay 16% VAT in Kenya starting November

Facebook (Meta) users in Kenya will be required to pay an extra 16% VAT when running adverts on the company's…

- News

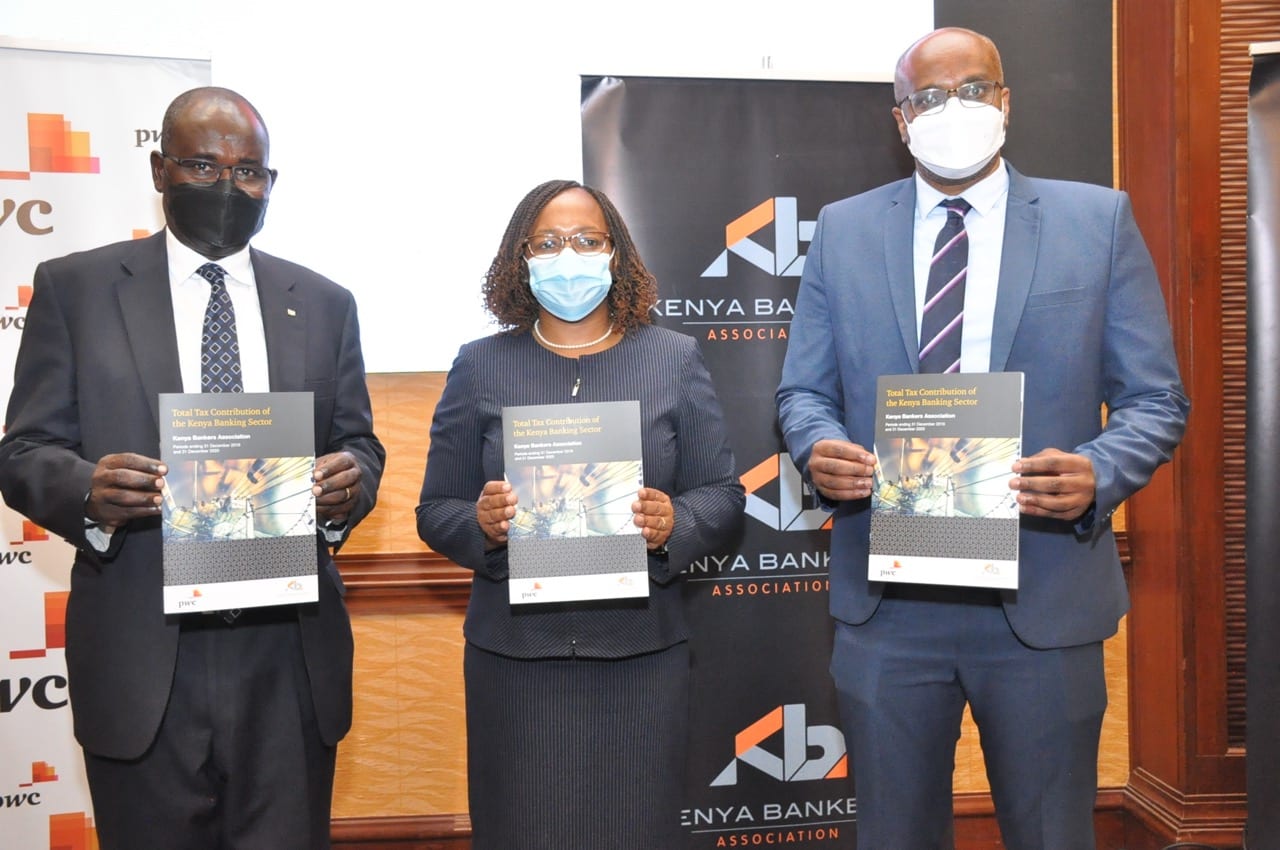

Banking Sector contributed 27% of all Corporate Taxes in Kenya in 2020 & 2019

The Banking report also notes that the Banks that participated in the study contributed 7.5 percent of the total government…

- News

Finance Bill 2021 proposes DST should apply to non-residents only

The Finance Bill, 2021 published on 30 April 2021 proposes amending the applicability of the digital service tax (“DST”) to…

- Opinion

PwC urges Kenyan taxpayers to comply with Digital Service Tax

PwC's view is that Digital Service Tax is applicable if there is an existence of a digital marketplace (multiple buyers…

- Business

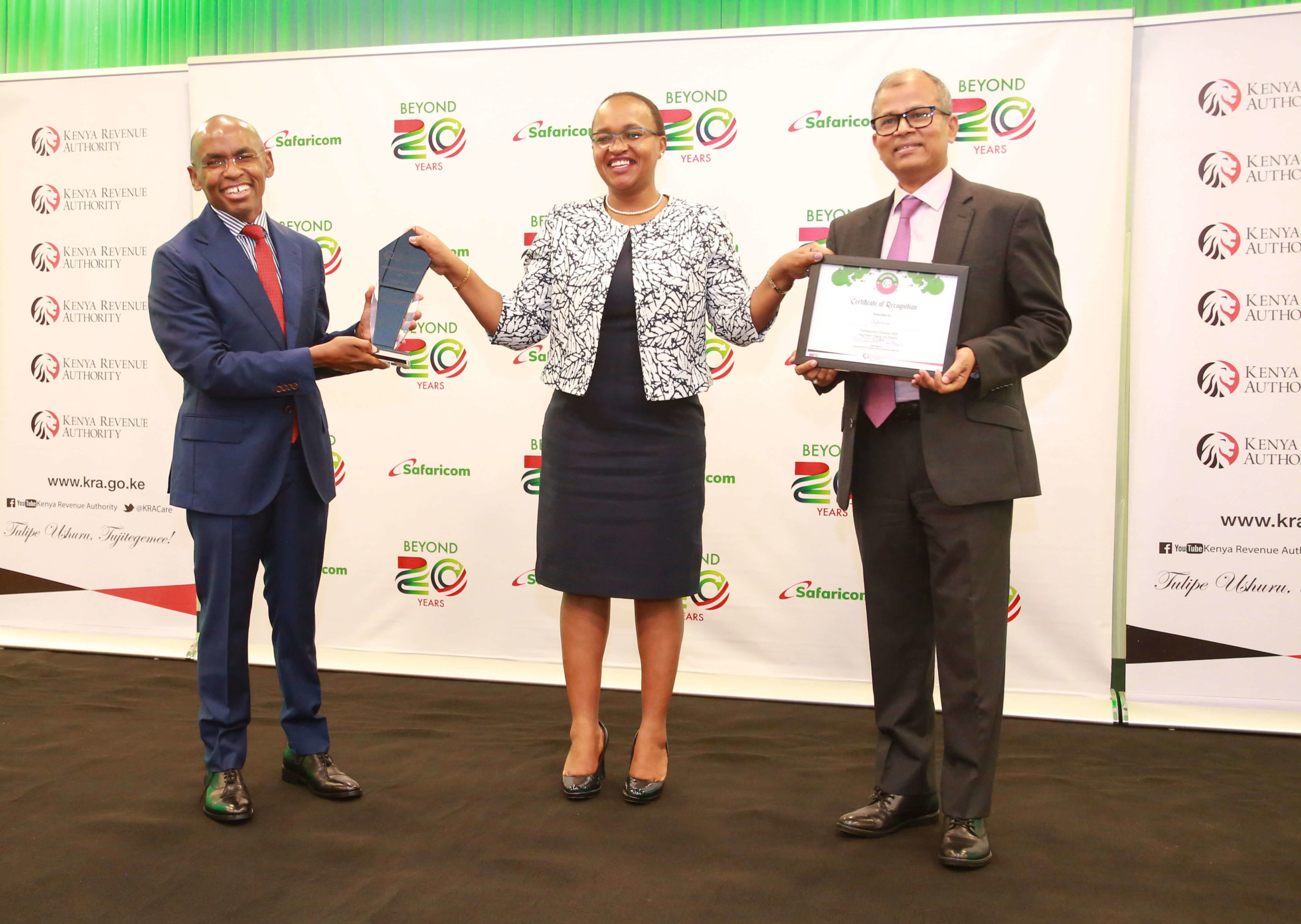

KRA Awards Safaricom for being top Taxpayer

Safaricom paid KES. 98 billion in duties and taxes, in addition to KES. 20 billion in dividends to the Government…

- News

Businesses advised to familiarize themselves with Minimum Tax to avoid Non-compliance Penalties

PwC Tax experts have today appealed to Kenya businesses to acquaint themselves with recently introduced tax initiatives by the government…