Hisa is gearing up for a comeback, at least if its new online teasers are anything to go by. A year after being acquired by Nigeria’s Risevest, the company is promising to merge its Kenyan app with Chaka (its Nigerian sister platform) and relaunch as a single “super app” that lets users invest across Kenya, Nigeria, and the U.S. in one place.

According to teasers shared by Chaka on social media, users can expect a revamped experience featuring a fresh interface, auto-invest options, curated themes like the S&P 500, after-hours trading, and AI-powered research. The branding is expected to stick with “Hisa” since Chaka already rebranded to Hisa Nigeria.

“We’re bringing it all together: Hisa Nigeria (formerly Chaka) and Hisa Kenya are merging into ONE super app. Soon, you will be able to invest across the Nigerian, Kenyan, and U.S. markets in one place,” reads one of the promos.

From another teaser: “From Nairobi to Lagos. Soon you’ll be able invest in Kenyan, Nigerian and US stocks all on the upcoming Hisa app.”

And if you thought this was just marketing fluff, Hisa Kenya’s Operations Lead, Leah Wakarima, has also chimed in with a confident pitch about the new direction:

"Our vision is to scale Hisa across Africa, giving millions the tools to grow their wealth and take part in the global economy... With this new Hisa, we’re introducing a better trading experience. Yes, it’s faster and smarter, but more importantly, it’s built to make everyday trader feel supported, valued, and in control of their journey."Sounds exciting, right? Well, that’s the future Hisa is painting. And the timing couldn’t be better.

An app frozen in 2023, users losing patience

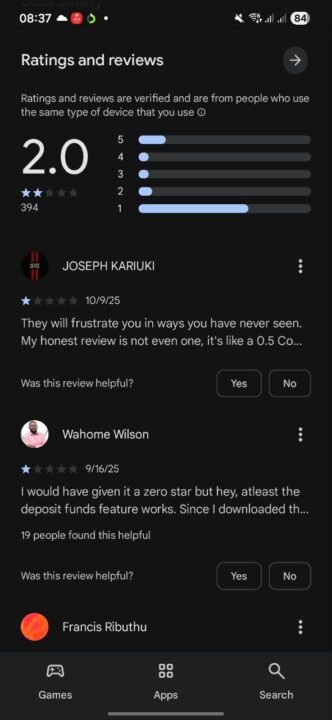

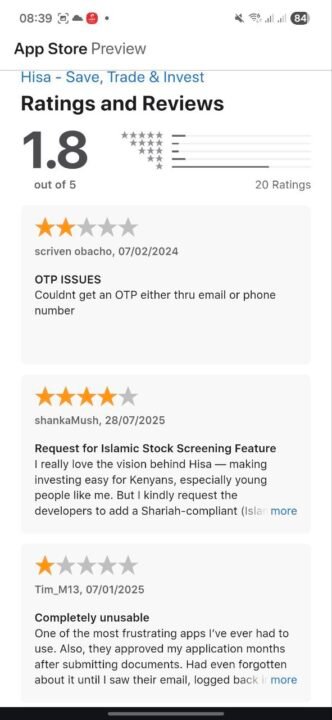

The promised “super app” makeover couldn’t be coming at a better time, because the state of the current Hisa app tells a story of neglect and frustration. Despite having over 50,000 downloads on the Google Play Store and a presence on the Apple App Store, the app hasn’t received a single update since September 2023. Yet the reviews pouring in throughout 2025 paint a picture of users still trying (and failing) to make the platform work.

Across both app stores, the ratings are dire. Hisa sits at a miserable 2.0 stars on Google Play and an even lower 1.8 on the App Store. Nearly every recent review from this year is a one-star warning label. Users complain of verification loops that never resolve, OTPs that don’t work, balances that don’t add up, lost shares, dead contact lines, frozen withdrawals, and the eerie feeling that no one is actually running the show. Several users said they’ve waited weeks or months for the simplest issue to be resolved. Others never got help at all. Some report losing money after app migrations, while others can’t even complete onboarding.

One reviewer said they would have given it half a star if allowed, describing customer support as hit-or-miss and technical fixes as painfully delayed. Another said the app seems to accept deposits instantly but makes withdrawals feel like a court petition. Even something as basic as contacting support within the app reportedly doesn’t function.

What makes it worse is the sense of abandonment. Users are questioning how an app that once won awards for stock trading has gone two full years without updates while the same complaints keep piling up. Out of nearly 400 reviews on the Play Store, more than 250 are one-star ratings. Not from random drive-by critics, but from people who tried to trade, deposit, withdraw, or onboard and got stuck in a loop of glitches and silence.

By the time you read enough of these experiences, it becomes obvious that this rebrand isn’t just a glow-up. It’s a rescue mission. The existing app isn’t just outdated; it’s actively frustrating users and eroding trust. The new Hisa super app isn’t arriving into a neutral market. It’s showing up to clean up the mess its predecessor left behind.