AppsFlyer has released the 2021 edition of its State of eCommerce App Marketing report. The report outlines the key global trends to guide marketers in building what the platform calls a mobile-first experience that will drive engagement and sales fro the upcoming holiday season.

AppsFlyer analysed over 750 Million App instals across 7250 apps, and 3 billion re-marketing conversions across Africa, Europe and the Middle East. The report, linked below, found that the Africa mobile App market is showing continued growth with more people accessing goods and services online than ever before.

According to the AppsFlyer report, this year retail apps are already approaching the peak levels of usage witnessed in the 2020 holiday season. Installs of eCommerce apps have increased 55% on Android and 32% on iOS in 2021. Consumer spend has climbed over 55% overall, and the last quarter of 2021 – the holiday season – is expected to be more than record-breaking.

“With the holiday shopping season around the corner, retail brands should be prioritising mobile, and mobile apps, as part of their strategy,” said Daniel Junowicz from AppsFlyer. “Marketers should look at optimising the overall user experience, including the transition from mobile web to app. In addition, deep linking can be used to ensure customers reach their intended destination within a mobile app smoothly and contextually. If last year is anything to go by, marketers that get their mobile app strategy right will see significant revenue and acquisition growth.”

AppsFlyer Report Key African Insights:

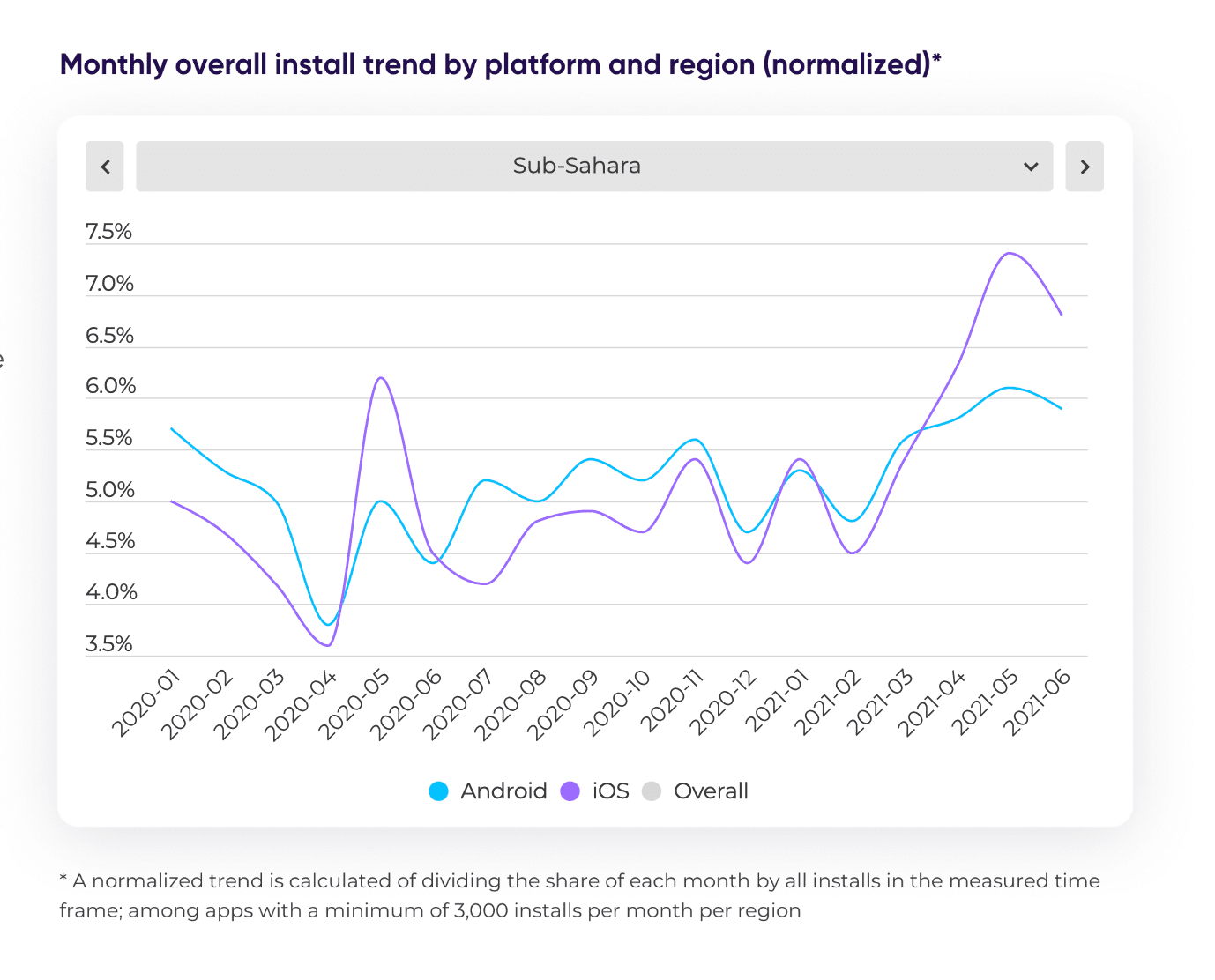

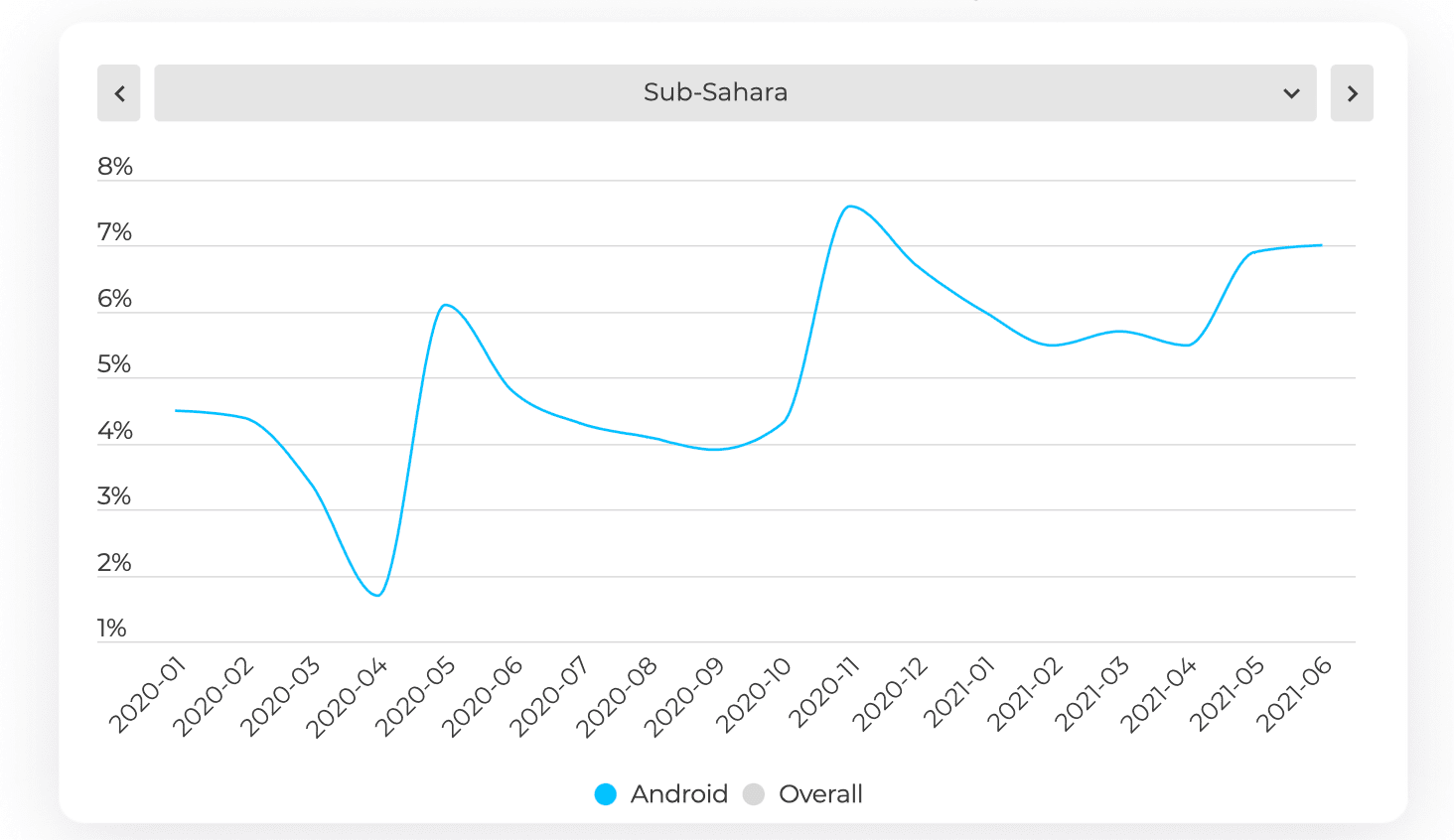

- eCommerce installs remained steady throughout 2020 but have already risen by 16% in 2021 (Q1 vs Q2)

- iOS is showing particularly strong growth, with a 33% increase in the same time frame. By comparison, retail app installs on Android haven’t changed.

- Non-organic installs dropped 26% at the start of the pandemic: Marketers throughout the region were cautious when it came to spending budget at the start of the pandemic. Non-organic installs dropped by 26% between Q1 2020 (pre-pandemic) and Q2 2020 (as the pandemic hit). However, this level of cautiousness was short-lived, with non-organic installs rising by 18% in Q3. They’ve remained steady ever since.

- Remarketing: The 2020 holiday season saw heavy usage of remarketing as marketers looked to capitalise on key shopping periods. Between Q3 and Q4 2020 there was a 22% lift in remarketing conversion rates. This reached nearly 40% when comparing October to November.

- In many iOS dominant regions, remarketing took a hit following the loss of IDFA as part of Apple’s update to iOS 14, but given Android’s dominance in Sub-Saharan Africa this hasn’t been felt.

- In-app purchases increased 55% over 2020: Consumer spend fell by 50% at the start of the pandemic – between March and April – likely due to economic uncertainty as a result of lockdowns. However, as it became clear that consumers would need to adapt to digital methods of shopping in the absence of physical stores, spending quickly recovered. Indeed, between April and May 2020 there was a 256% rise in overall spending in retail apps! Overall there was a 55% increase in consumer spending in apps in 2020.

- Unsurprisingly, spending in 2020 peaked in November, coinciding with Black Friday and the lead-up to Christmas. As a result, between Q3 and Q4 there was a 60% uplift. This increase in spend has carried through to 2021. If we compare H1 2020 with H1 2021 we see a 65% increase in spending.