Kenya’s saving culture is wanting. At 14% saving rate, we lag behind Uganda’s 22% rate and Tanzania’s 36% rate. According to the FinAccess Household survey report of 2021, a majority of Kenyans identified the need to meet day-to-day expenses, emergencies and education as the key drivers of them saving.

In the survey, the main reasons given for not having any savings plan included the lack of enough money, the need for regular income, the preference not to save, the lack of understanding, the costs incurred to save, the lack of proper mechanisms to save, and the need for a referee.

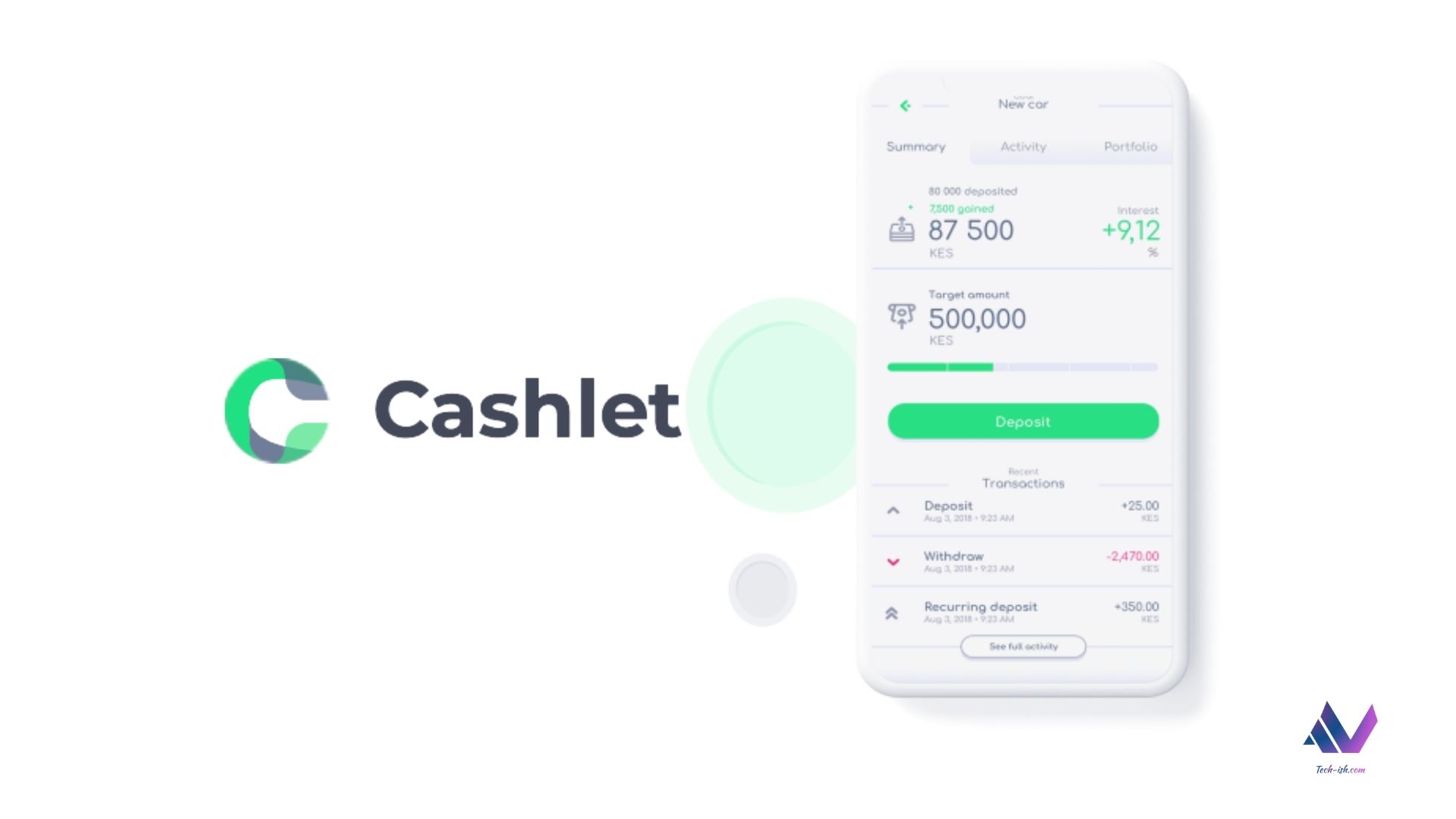

Of late, there has been an increase in the number of ventures looking to excite more Kenyans into a proper savings culture. One of such companies is Sycamore Capital Limited whose new app Cashlet seeks to make it very simple for Kenyans to invest in different unit trusts and money market funds from a single app, in a simple process, with as little as KES 500.

At the end of January we published an article on the company receiving approval from the Capital Markets Authority to join its Regulatory Sandbox program allowing them to roll out to early adopters.

Well, the App is now live on the Google Play Store. Download it and sign up. If you’re keen to know what to expect before signing up, I have a detailed review of the app here.

In light of the launch, I sat down with Kwaku Foh, Co-founder at Cashlet to discuss a couple of topics around both their App, and around Kenya’s saving culture. It was an in-depth conversation where he shared very interesting insights as you’ll see below.

Introduce yourself:

My name is Kwaku Foh. I am a co-founder at Cashlet. I spend most of my time on the commercial and operational side of the business.

What is Cashlet?

Cashlet is a personal finance application that allows users to manage money in a more effective and modern way.

Our target market is around millennials in Kenya. They are historically excluded from the tools and solutions that older, wealthier people would have when it comes to managing their money. We’ve also built Cashlet in a way that everybody can use it. But we are making an extra effort when it comes to the millennial target group.

When I say personal finance, what I mean is anything that allows you to budget, save, invest, and grow your money.

We are starting with Unit Trust products because:

- They are simple.

- They are diversified.

- They are able to earn attractive interest on your funds.

Eventually, we think of Cashlet as being able to help our target market through the whole spectrum of personal finance. Over time we are going to add things like, stocks, bonds, real estate, budget, and insurance such that we get to a point where if you think about managing your money, you know Cashlet is the go-to place for you.

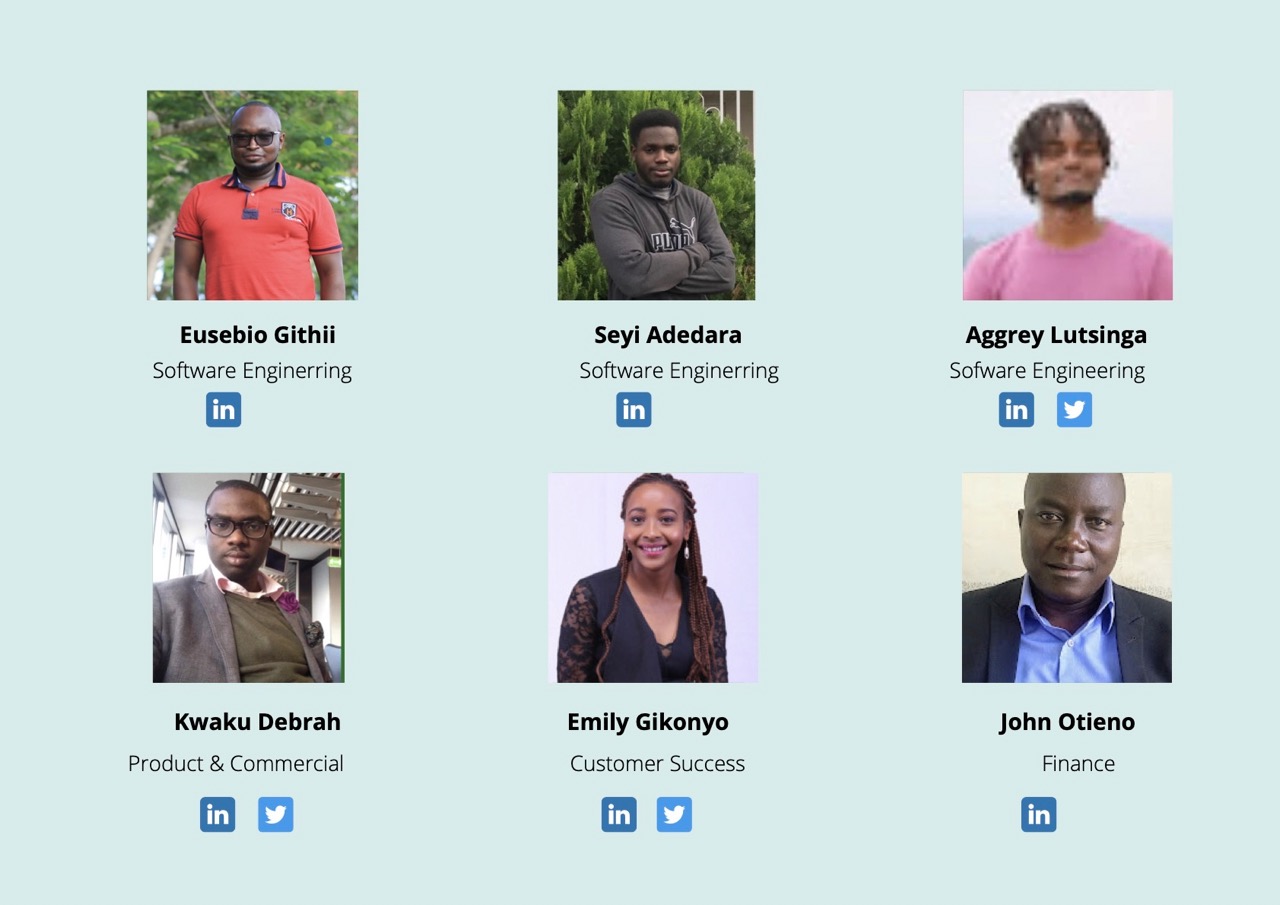

Tell us about the Team behind Cashlet:

We are a startup. So a relatively small, diverse and hardworking team of around 8 people.

I handle the commercial and operations side of things. We’ve got, four developers, some backend, some frontend. We’ve got a finance person, customer success person, and an operations person.

What’s unique about the Cashlet Team?

We come from diverse backgrounds. We have people who have deep experience on the technology side from the likes of Andela and Microsoft.

We also have people like myself, and others, who come from the financial services side with experience in local financial institutions, like I&M and international investment banks like Goldman Sachs.

We are a good combination of the tech side, the finance side, and the strategy side.

What motivated the idea behind the Cashlet App?

The idea behind Cashlet is grounded on some interesting facts we discovered a couple of years ago:

- First, If you look across the East Africa region, Kenya is the biggest economy yet Kenya has the lowest savings and investments rate. An average Tanzanian saves about three times more than an average Kenyan. Which is pretty incredible because Kenya is the bigger economy with incomes about two times higher. That presents a real challenge.

- Secondly, if you look at Kenyan adults, only about 17% are financially healthy. Which means around 8 out of 10 Kenyans aren’t. They don’t put money aside for the future. They can’t manage crises. That’s scary and alarming. Especially with emergencies. If something were to happen, only about 25% of Kenyans would be able to raise a lump sum of money.

These two factors really motivated us to design Cashlet as a product that allows people to become a bit more disciplined. So that people are able to put aside some money for emergencies, or to invest for the future.

What’s your mission?

If we can in the next 5 years get about 5 million Kenyans to become financially healthy, our mission would be achieved.

Do you have any investors?

No. At the moment, we are a self-funded startup. We don’t have any external investment. We’ve spoken to a few people in the past, and we might be more serious about it in the future, but for now we have enough cash to keep us going.

We are very much focused on building a great product versus looking for investors which can be distracting.

Profitability? And how do you make money?

We are currently focused on actually building a great product fist. We believe if we build a great product that people like, profitability will come as a result.

We plan to make money is in two ways:

- With our partners, the regulated and licensed fund managers, we get a share for the work we do in terms of customer education, account creation, and KYC (Know Your Customer).

- We also charge a tiny fee of KES 40 for account holders with more than KES 20,000.

(This is explained on the review of the app article. So make sure you check it out.)

Why should someone choose Cashlet instead of going straight to the fund managers?

Our mission is to get you to save an invest. This is whether you do it through us or go directly fund manager. However, we have five reasons we believe our solution is the best option:

- We bring a whole bunch of fund managers and funds on our technologically advanced platform.

- We make the process much simpler than anywhere else. There’s no need for papers, queueing, or meeting people in offices. We make it easy to know how your money is performing, and there’s no need to send out emails, fill out forms, or call people.

- We make it easy for anyone, no matter their financial capacity to start investing. Unlike many of these funds where you need between 5000 and 10000, with some up to 500000. With us you can start with a little, and top up on a daily basis. If you need your money back, you can withdraw at any time.

- We also invest a lot in financial literacy and education to help people understand what they’re doing, how beneficial it is, and on user joinery to make It as smooth as possible.

- We also allow users to set as many different goals as they want on the app, and invest in each of them separately.

What has surprised you when building Cashlet?

Maybe three things:

- Incredible Feedback – The responses we’ve received from customers when testing have been amazing. People are like, “Wow, how come there’s nothing like this? I want to sign up! Can I even download and start using it?” This shows that the reason why the savings and investment rate is so low is not that people don’t want to, it is just because people don’t have the knowledge and the solutions that they need to be able to do it.

- Regulatory Support – Before we got the go-ahead, we had to go through six months of back and forth dialogue. What surprised me was the level of openness and engagement, because we had to really discuss and challenge some existing norms. They were always very open and understanding because I think they see that there’s a big role that innovation and innovative products like Cashlet can play in sort of the industry.

- Time needed – Unlike many other products which you can just build and launch, a financial product requires a look a lot of things like privacy, security, automated testing and more, because people’s money is at stake. It takes quite a while to build something good.

Do you see yourselves as an underdog in this industry?

Yes we do. And we enjoy being the underdog.

The great thing about being an underdog is we are forced to be extremely innovative. We are forced to challenge the way things have typically been done in the industry and we absolutely love that!

Secondly, we are also forced to be extremely customer and product-centric. So, if you take for example Safaricom, they are huge. They’ve got other things to think about. Their upcoming Mali is a new product in a series of hundreds of solutions and products that they have on the business side and also on the mission side.

For us, we are extremely focused on the one problem of helping you to save and invest your money. We don’t care about how you transfer your money. We don’t care about how you accept payments. We just want to see you to save and invest.

The last thing we enjoy about being the underdog is that we are in a position to really help shape the future of the industry.

What do you hope draws people to using Cashlet?

- Everything is fully digital. So, there’s no paperwork, no meetings, nothing it’s self-directed. You can sit on your couch and save your money whenever you want.

- You can start with as little as KES 500, deposit it and withdraw at any time. So, regardless of the income bracket, you’re free to join.

- Safety. We are working with fund managers and unit trusts that are regulated by the Capital Markets Authority (CMA). We’ve also made sure the application is very secure In terms of passcode protection as you can use biometrics authentication.

- We are customer-centric. We’ve invested a lot of time to make the journey as simple and intuitive as possible. We are constantly listening to feedback. People can call us anytime and we’ll talk to you.

Closing remarks:

We believe we are embarking on a very exciting journey. We think there’s a real opportunity to transform the personal finance industry in Kenya and broadly across East Africa. We want to get to a place where we are championing investments and savings to be open, accessible, and easy for anybody.

It is an exciting journey and we are really looking forward to it.

This article is for informational purposes only and does not constitute financial or investment advice.