Payday, a Pan-African neo-bank that provides global accounts (in USD, EUR & GBP) for Africans, has declared a $3M seed round led by Moniepoint Inc, with contributions from HoaQ, DFS Lab’s Stellar Africa Fund, Ingressive Capital Fund II, and angel investors, including Dare Okoudjou, Founder and CEO of MFS Africa and Tola Onayemi, CEO of Norebase. Techstars, Angels Touch, Ingressive Capital, and Now Venture Partners are among the follow-on investors, while Ethos VC, MAGIC Fund, Ventures Platform, Voltron Capital, and other existing investors are also involved.

The latest round brings the company’s total investment to $5.1m. The new capital will be used to secure operational licensing in the United Kingdom and Canada, as well as to expand operations in the United Kingdom where the company has recently been incorporated. The funding will also be used to increase talent acquisition, as the company looks to grow its team from 35 to 50 employees.

The Co-Founding team at Payday has also expanded with the addition of Elijah Kingson as CPO and Yvonne Obike as COO. Kingson, who previously led product design for Premium and subscription products at neobank Revolut, will bring his expertise to Payday’s product development. Obike’s experience working with Nigeria’s Bank of Industry to drive MSME growth and economic development will be invaluable in her role at Payday. The company has also welcomed Sean Udeke, a former Goldman Sachs and Expedia Product Manager, as Head of Products.

With this latest funding, Payday is poised to expand its operations and talent pool, bringing innovative payment solutions to a global market. The addition of experienced leaders to the Co-Founding team will help drive the company’s growth and product development efforts. Payday is well-positioned to continue fueling the future of work through its borderless payment alternatives.

Commenting on the fundraise, Favour Ori CEO and Founder of Payday said, “We’re thrilled that this round of funding will lay the foundation for the continued growth of our platform as we expand our services to a wider audience. This investment represents a significant milestone for our company and we are grateful for the trust and commitment shown by our investors both existing and new. We’re amped to scale our platform and reach more Africans, not only on the continent, but around the world. Our passion for empowering individuals and businesses with convenient and secure payment solutions is tangible, and we believe that this funding will allow us to do so on an even greater scale. Our goal remains the same: to make it easy and accessible for anyone to access their payments when on the continent, and with this new funding, we are one step closer to achieving that vision.”

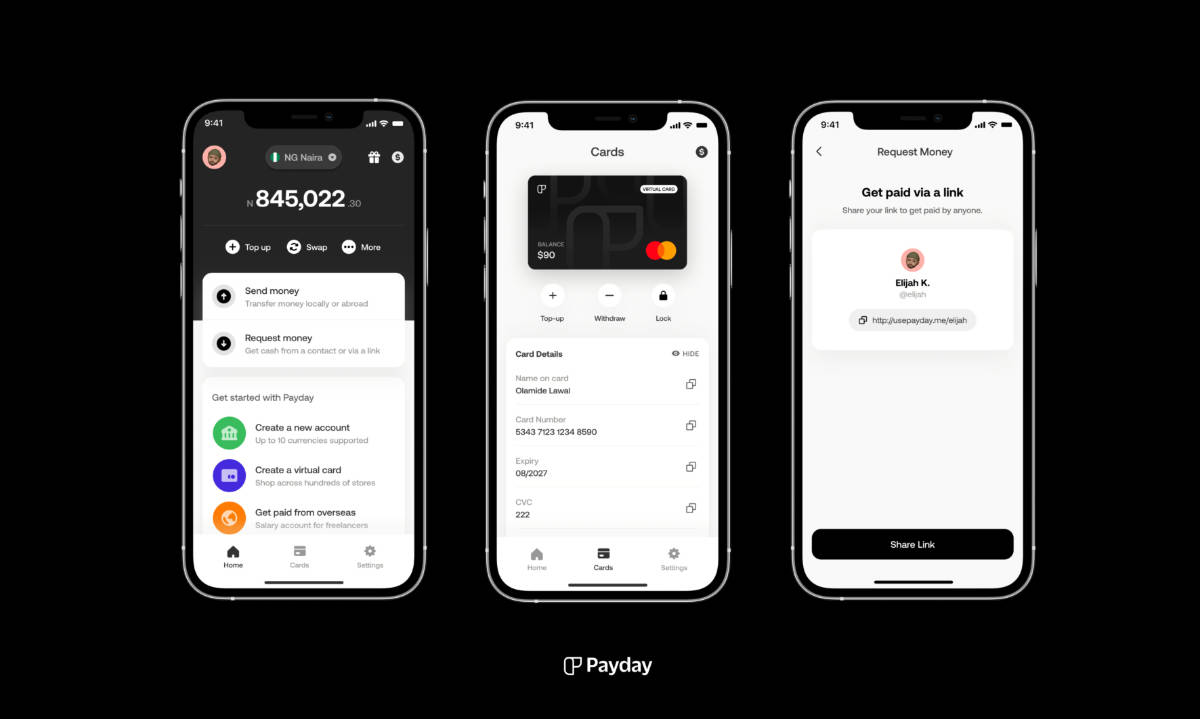

As Payday’s user base continues to grow by over 100,000 each month, the company has launched Payday 3.0 in January of this year, as an inevitable evolution of its services. The aim is to build a super app that improves and streamlines the user experience for customers. Payday 3.0 includes several new features designed to achieve this goal, such as:

- Global Accounts available in multiple currencies including USD, GBP, and EUR

- Virtual USD & NGN Cards for convenient and secure online transactions

- Currency Swaps to easily convert between different currencies

- Payment Links to simplify the payment process

- Local Bills Payment for seamless utility bill payments

- Peer-to-Peer Transfers for fast and easy money transfers

- Integration with platforms like Deel to enable users to receive salaries in minutes instead of days by adding account information