NHIF to SHA: Did Kenyans’ Data Get Transferred Without Consent?

Confusion Looms as Kenyans Receive Conflicting Messages on NHIF to SHA Migration Amid Broader Concerns About SHIF

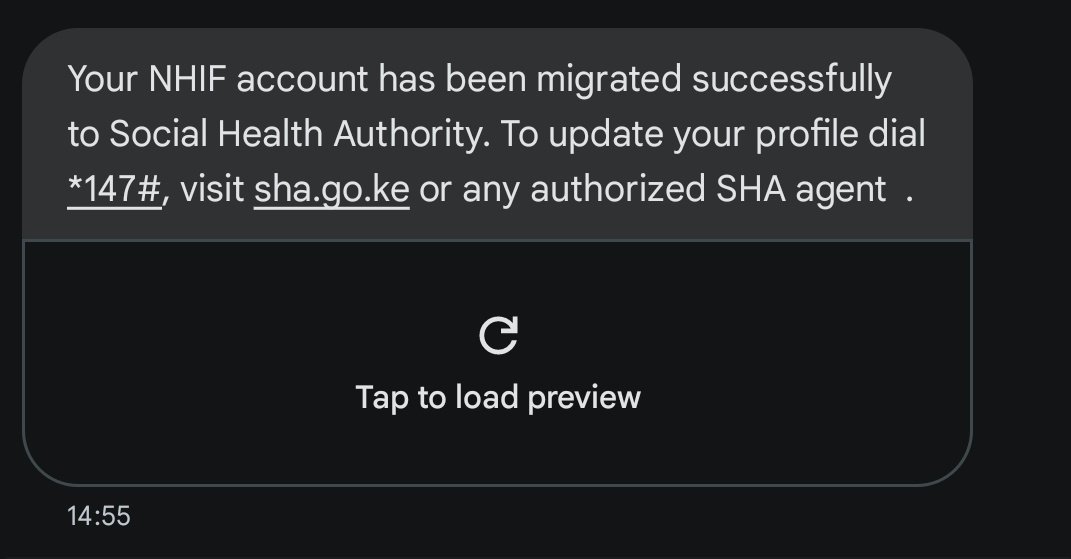

On October 2, 2024, Kenyans who are National Hospital Insurance Fund (NHIF) members were met with confusion as they received a text message notifying them that their accounts had been automatically migrated to the newly launched Social Health Authority (SHA). The message encouraged members to update their profiles via *147#, the SHA website, or through authorized agents.

However, this notification comes just days after an official Social Health Authority (SHA) post on September 30, 2024, clearly stated that opt-in consent was required for migration. This contradiction has raised significant concerns among Kenyans already wary of the transition from NHIF to the Social Health Insurance Fund (SHIF) under the SHA.

Contradicting Statements: Automated Migration vs. Opt-In Requirement

The conflicting messages between the automated migration text and SHA’s earlier tweet, which informed Kenyans they needed to opt-in for registration, have sparked concerns over data privacy. According to Kenya’s Data Protection Act, personal data can only be processed or transferred with the individual’s informed consent, unless there is a lawful exception. This has raised critical questions about whether the transfer of NHIF members’ data to SHA followed legal procedures, particularly regarding the requirement for explicit consent from those affected.

SHA had emphasized the need for active consent to comply with data protection regulations. However, the text message received by Kenyans on October 2, 2024, suggests that NHIF data was automatically migrated, leaving many wondering if their rights were violated. This has led to confusion, particularly since SHA earlier insisted on the opt-in requirement for data transfers.

The migration likely serves to ensure continuity of services, consolidate healthcare records, and avoid disruptions during the shift to the new system. However, if the data was transferred automatically, the question remains: Why was the opt-in process necessary if migration was done without it?

Without clarity, concerns about data security and compliance with the Data Protection Act persist, leaving Kenyans questioning the legality of the migration and calling for SHA to provide more transparency on how personal data was handled during the transition.

Background on SHA and SHIF

The transition from NHIF to SHA is part of the Kenya Universal Health Coverage (UHC) agenda, aimed at providing comprehensive and accessible healthcare to all Kenyans. Under SHA, the Social Health Insurance Fund (SHIF) is set to replace NHIF. The transition has been framed as a move toward better health services through the establishment of three main funds:

- Primary Healthcare Fund (PHCF): Geared towards preventive care.

- Social Health Insurance Fund (SHIF): The main fund for curative care and hospital admissions.

- Emergency, Chronic, and Critical Illness Fund (ECCIF): A specialized fund for critical conditions.

While the SHA has been presented as a progressive reform, public concerns have grown over the expensive contribution structure and the lack of clarity on coverage and benefits, especially compared to NHIF.

Contribution Structure: Too Expensive for Many Kenyans?

Under SHA, the contribution model has shifted from NHIF’s fixed rates to a percentage-based system, where individuals contribute 2.75% of their income. This change has sparked outrage among many Kenyans, especially salaried workers, as the new contributions are seen as disproportionately high for those with moderate to high incomes. For example:

- Someone earning KES 20,000 per month will pay KES 6,600 annually.

- Those earning KES 100,000 per month will see their contributions rise from KES 1,700 under NHIF to KES 2,700 monthly, or KES 32,400 annually.

- Top corporate executives with a salary of KES 500,000 monthly will pay KES 13,750 each month, totaling KES 165,000 annually.

There is no contribution cap, meaning those earning upwards of KES 10 million per month face deductions as high as KES 275,000 monthly.

For many, this steep increase in contributions is not justified by the benefits provided under SHA, with primary healthcare packages being limited to KES 900 annually for consultations, lab tests, and prescriptions. Dental coverage is limited to KES 2,000 annually, and optical care is capped at KES 1,000, leading to accusations that the promised benefits do not align with the contributions being demanded.

Benefits and Coverage: Falling Short of Promises?

SHA’s promises of improved coverage and benefits have yet to be fully realized. While the introduction of new services such as mental health, maternal care, and expanded renal care under the Social Health Insurance Fund (SHIF) has been touted, many of the benefits seem out of touch with the reality of Kenyans’ healthcare needs.

Key concerns include:

- Limited Coverage for Chronic Diseases: For those needing cancer screening and other chronic illness treatments, the available packages are not yet fully implemented. Cancer-specific screenings, for instance, will not be available immediately, and there have been reports where dialysis patients have been forced to pay out of pocket during the transition, as some hospitals remain unregistered with SHA.

- Caps on Hospitalization: While SHA offers inpatient coverage for up to 180 days annually, there is a cap of KES 806,000 per family—a limitation that many fear will not cover the full cost of long-term hospital stays or serious medical treatments.

- Lack of Preventive Care: Though SHA has promised more preventive care services, the actual packages, such as the KES 300 cholesterol monitoring or KES 1,000 HbA1c tests for blood sugar monitoring, are seen as insufficient for addressing widespread chronic diseases.

Public Concerns and Legal Challenges

Beyond the confusion over automatic migration, public dissatisfaction has grown over how the SHA rollout has been handled. Kenyans have expressed frustrations over the lack of public consultation, delays in communication, and ongoing concerns about the registration process for both salaried and informal sector workers. Many hospitals, particularly in rural areas, remain unregistered with SHA, leading to patients being turned away or forced to pay for treatment out of pocket.

This transition has also faced legal battles. In recent months, court orders have been issued to delay parts of the SHA rollout amid concerns over transparency and public consultation. A High Court order in August 2024 temporarily halted the imposition of mandatory contributions for some categories of workers, while challenges around the legality of the SHIF rates remain ongoing in Kenya’s judicial system.

As Kenyans continue to navigate the confusion around migration, many are now looking to the courts to provide clarity on how the SHA will operate and whether it will truly deliver the Universal Health Coverage (UHC) that it promised.