Kenyan social media-based businesses, online entrepreneurs, and content creators may soon face a new 15% tax on their earnings, as part of recent proposals aimed at expanding the country’s tax base. This move is outlined in a draft proposal detailing key tax amendments from the National Treasury to address costs associated with digital services.

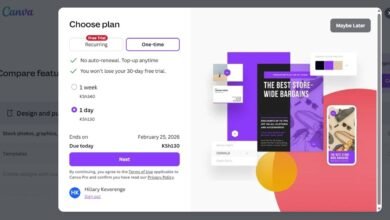

The Tax Laws (Amendment) Bill 2024 introduces a 15% excise duty on social media and internet services. If enacted, it could lead to higher costs for millions of Kenyan internet users, affecting content creators, small businesses, and everyday consumers. This proposal marks the latest step in Treasury CS John Mbadi’s fiscal strategy, following a major cabinet reshuffle after public backlash led to the rejection of the Finance Bill 2024. Now, as the government re-evaluates its approach to revenue generation, the proposed 15% tax on social media stands at the center of an evolving debate over digital taxation in Kenya.

Digital Taxation:

Kenya’s taxation of the digital economy is currently managed by the Finance Act 2023, which set rules on specific tax obligations for digital platforms and online content creators. Key provisions included:

- Digital Content Monetization Tax: Content creators and influencers were subjected to a 5% withholding tax on their earnings, with a 20% rate for non-residents. This tax covered a wide range of income sources, including advertisements, brand partnerships, affiliate marketing, and subscription payments.

- Digital Asset Tax (DAT): A 3% tax was imposed on the transfer and exchange of digital assets such as cryptocurrencies, tokens, and non-fungible tokens (NFTs), creating a framework for taxing digital transactions.

These taxes were aimed at broadening Kenya’s tax base, aligning with global standards in digital taxation as economies worldwide grapple with the complexities of monetizing digital services. However, the Finance Act 2023 also raised concerns among content creators and small businesses over increased compliance costs and diminished profit margins, particularly for those operating on tight budgets. Despite these challenges, the Act can be seen to have laid the groundwork for Kenya’s approach to taxing the digital sector, paving the way for future proposals like the 15% tax on social media revenue.

The Finance Bill 2024: Public Rejection and a New Approach

In 2024, the Kenyan government introduced a Finance Bill proposing a range of new taxes to address fiscal challenges across multiple sectors, including essential goods and services. However, this bill ignited significant public discontent, with widespread protests erupting over the rising cost of living and perceived financial burdens on low- and middle-income earners. Tensions reached a peak with a large demonstration at Parliament, leading to fatalities and injuries. President William Ruto ultimately rejected the Finance Bill 2024, acknowledging the public outcry.

In the aftermath, Ruto enacted a major cabinet reshuffle, appointing John Mbadi as the Treasury Cabinet Secretary. This move was aimed at restoring public confidence while pursuing a more balanced approach to revenue generation. Mbadi’s strategy has involved selectively reintroducing “progressive” elements of the rejected Finance Bill, carefully navigating the need for revenue without sparking further public unrest. Central to his approach is the new Tax Laws (Amendment) Bill 2024 which proposes a 15% tax on social media and online businesses.

The 15% Social Media and Online Business Tax: Proposed Impact

The proposed 15% tax on social media and online business income represents one of the most direct attempts to tap into Kenya’s digital economy. This measure could create a ripple effect across various sectors and impact a wide range of stakeholders:

- Content Creators and Influencers:

Content creators, who already face withholding taxes under the Finance Act 2023, could see their income further reduced. This additional 15% tax may make it difficult for smaller creators and influencers to sustain themselves, potentially slowing the growth of Kenya’s vibrant digital content industry. - Small and Medium-Sized Enterprises (SMEs) in E-Commerce:

Online businesses, especially SMEs that depend on social media for advertising and sales, may face increased operational costs. To maintain profit margins, these businesses could be forced to pass the tax burden onto consumers, potentially reducing demand for e-commerce products and affecting sales growth. - Advertising and Marketing Costs:

Digital platforms may transfer the additional tax burden to advertisers, raising the cost of online advertising. For small businesses with limited budgets, this could mean reduced visibility and customer reach, making it harder to compete with larger companies. - Subscription-Based Services and Streaming Platforms:

Services like Netflix, Spotify, and YouTube Premium might increase subscription fees to cover tax costs, affecting affordability and accessibility for Kenyan consumers. This could limit the reach of educational and entertainment content, impacting both consumers and content providers. - Telecommunication and Data Services:

Telecom providers may pass on the increased costs of social media and digital services to users, potentially raising data prices. Higher internet costs could reduce access for lower-income groups, widening the digital divide and impacting internet penetration rates. - Employment in Digital Services:

The tax could stifle growth in Kenya’s digital sector, particularly in social media management, digital marketing, and content creation. As businesses reassess their digital budgets, employment opportunities in these fields could diminish, affecting job prospects for young Kenyans and reducing Kenya’s competitiveness in the digital economy.

Proposed IMEI Registration and Expanded Digital Marketplace Taxation

In addition to the 15% tax, CS Mbadi’s approach includes other significant measures targeting the digital sector:

- Proposed IMEI Registration for Taxation:

Effective January 1, 2025, all mobile devices imported or assembled in Kenya will need to have their International Mobile Equipment Identity (IMEI) numbers registered with the Kenya Revenue Authority (KRA) for taxation purposes. This measure, aimed at reducing smuggling and increasing tax compliance, raises privacy and cost concerns for consumers and businesses. The registration requirement could further increase device costs, affecting individuals who use multiple devices for content creation, e-commerce, or online transactions. - Expanded Digital Marketplace Taxation:

The Tax Laws (Amendment) Bill 2024 proposes expanding the scope of the digital marketplace to include ride-hailing services, food delivery services, freelance work, and professional services. By broadening the definition, the government aims to capture more revenue from the digital sector, bringing diverse online services and platform owners into the tax net. This expansion could increase compliance costs for service providers and potentially lead to higher service fees for end-users, impacting affordability and access to these platforms.

Implications of a Comprehensive Digital Tax Strategy

Together, the 15% tax on social media, IMEI registration, and expanded marketplace definitions reflect a comprehensive attempt by the Kenyan government to capitalize on the growth of the digital economy. However, these proposals pose complex challenges that policymakers will need to navigate carefully. Potential impacts include:

- Consumer Access and Affordability:

Increased costs for internet data, subscriptions, and online services could restrict access to digital resources, disproportionately affecting low-income Kenyans and widening the digital divide. - Digital Sector Growth and Innovation:

A heavy tax burden on digital businesses could deter investment and stifle innovation in Kenya’s digital economy, reducing the country’s ability to compete with other African markets in the digital space. - Employment and Economic Empowerment:

Digital jobs, especially for youth, may become less available as businesses reduce spending to accommodate higher taxes. This could impact Kenya’s efforts to build a skilled digital workforce and drive youth employment. - Data Privacy and Compliance:

The IMEI registration requirement introduces privacy concerns, as it mandates device tracking for tax purposes, which may raise questions about data security and personal freedom.

Conclusion: Weighing Fiscal Responsibility with Digital Inclusion

The proposed 15% tax on social media and online businesses, along with additional measures like IMEI registration and expanded digital marketplace taxation, represents a multifaceted strategy to address Kenya’s fiscal needs. However, as Kenya seeks to increase revenue from its growing digital sector, policymakers must also consider the balance between fiscal responsibility and digital inclusion. An approach that imposes high costs on users and businesses risks limiting access to digital resources and curtailing growth in an economy that has empowered young people, created jobs, and fostered innovation.