Today, I realized I can sign up for Ziidi. I’ve been on Mali for the longest time, and when Ziidi came about, there were Mali users who reported getting error messages when they tried signing up for Ziidi. That seems to not have happened to me. I am right now on both platforms. My Mali funds are there, and I’ve just signed up for Ziidi and added funds.

First Impressions

Throughout the past few days, the Ziidi mini-app initially displayed a “Coming Soon” notice. But after a quick refresh today morning, the option to opt into Ziidi appeared. It feels like Safaricom might still be ironing out some last-minute technicalities, but for now, the platform is live and functional.

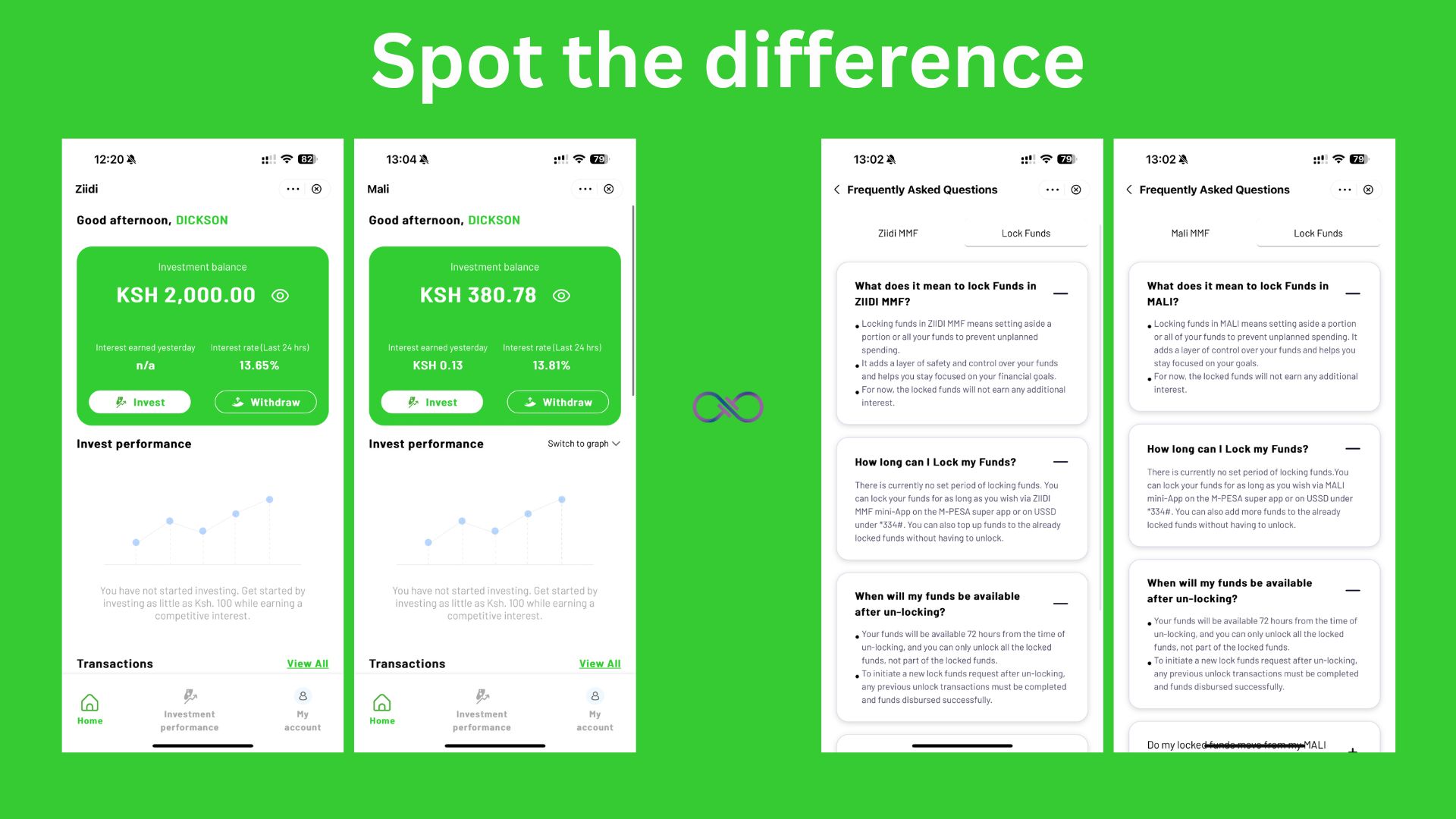

Here’s what’s intriguing: the interfaces for Mali and Ziidi are practically identical. The same green color scheme, the same app layout, and even the same user experience. If you didn’t look at the logo or the name at the top, you’d be hard-pressed to tell them apart.

I don’t know what to say about this duplication. I understand that these are products run by different fund managers, but all under the Safaricom banner. So, to me, the similarly doesn’t feel coincidental, especially given the reports of infighting within Safaricom’s ranks over these products, as mentioned in this Business Daily article.

Can You Have Both Ziidi and Mali?

It appears that users can indeed have accounts with both Mali and Ziidi. I’ve deposited funds into both accounts, and I’ll be sharing interest earned over the coming days.

The ability to hold accounts on both platforms raises questions about Safaricom’s strategy here. Are they giving users a choice between two competing services, or is this a temporary overlap until one is phased out? There’s no clarity yet.

One of the most surprising (and amusing) discoveries was the FAQs for both platforms. In many instances, they’re word-for-word identical. While this isn’t inherently a bad thing, it reinforces the sense that these platforms are doing the exact same thing, just operated by different entities. But when you remember Mali came first, and hasn’t yet fully opened up to everyone, you get a sense that there might be something going on.

Locked Funds Feature

One standout feature from the Ziidi FAQs is the “Locked Funds” option. This feature allows users to set aside a portion or all of their funds to prevent unplanned spending. It’s pitched as a tool for financial discipline, but there’s a caveat: locked funds do not earn additional interest. You can lock funds for an indefinite period, but unlocking them takes 72 hours, and you can only unlock all the funds at once, not partially.

I’ve seen the “Locked Funds” feature on Ziidi, but on Mali, there’s no option for the same. I say this because, interestingly, Mali also lists a “Locked Funds” feature in its FAQs.

What’s Really Going On?

At this point, it’s hard to ignore the parallels between Mali and Ziidi. Both platforms are essentially offering the same service: an easy way for M-Pesa users to invest in money market funds with no transaction fees and a relatively low entry barrier of KES 100. The duplication of features, design, and even FAQs makes me wonder what is going on in the background.

For now, I’m treating Mali and Ziidi as separate experiments. I’ll continue depositing funds into both accounts and comparing the interest rates, usability, and overall experience. If you’re curious about how they stack up, stay tuned.

One thing is clear: Safaricom needs to communicate better. The existence of two nearly identical platforms raises more questions than answers. Are they here to coexist, or is one destined to fade away? Why do the FAQs lack clarity? And most importantly, what does this mean for users looking for a reliable and straightforward way to invest?