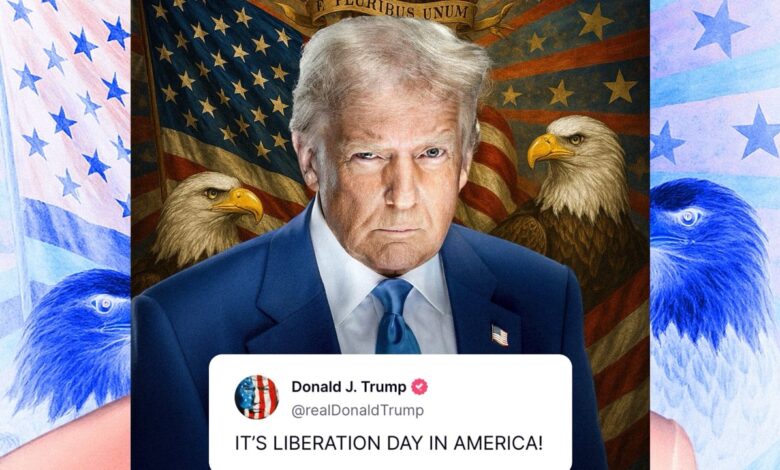

In early April 2025, the United States under President Donald Trump announced a sweeping shift in its global trade policy through what was called “Liberation Day“. This initiative imposed a baseline 10% tariff on all imports into the U.S.and higher “reciprocal” tariffs targeting specific nations based on their trade practices with the U.S.

Kenya, among the African countries affected, now faces a 10% tariff on its exports to the U.S. The move marks a significant disruption in global trade dynamics and coincides with the upcoming expiry of the African Growth and Opportunity Act (AGOA) — a policy that had for years allowed many African countries, including Kenya, to export to the U.S. duty-free.

Why Trump Is Doing This

The Trump administration argues these tariffs are necessary to:

- Revitalize U.S. domestic manufacturing

- Correct decades of what it calls “unfair trade practices”

- Achieve “economic independence”

The reciprocal nature of the tariffs means countries that levy duties on U.S. goods will now face similar or discounted reciprocal rates when exporting to the U.S.

Global Reactions and Economic Tremors

Reactions have been swift and varied. Countries like Lesotho (50%), Madagascar (47%), and Mauritius (40%) are among the hardest-hit African nations. Global markets responded negatively, with dips in Asian indices and uncertainty clouding future trade talks.

The backlash is not limited to adversaries; even allies like the UK and Australia have criticized the U.S. move, highlighting its disruptive nature. The abrupt departure from multilateralism and free trade has signaled a potential long-term shift toward transactional and protectionist policies globally.

Kenya – U.S. Trade Relations: A Shifting Landscape

In 2024, the total value of trade between Kenya and the U.S. stood at USD 1.5 billion, broken down as follows:

- Kenyan exports to the U.S.: USD 737.3 million (down 17.5% from 2023)

- U.S. exports to Kenya: USD 782.5 million (up 61.4%)

- U.S. trade surplus with Kenya: USD 45.2 million

Kenya primarily exports textiles, coffee, tea, and horticultural products, many of which previously enjoyed duty-free status under AGOA. The U.S., on the other hand, exports machinery, aircraft, mineral fuels, pharmaceuticals, and tech equipment to Kenya.

Immediate Impacts for Kenyan Exporters and Importers

With the 10% tariff now in place, Kenyan exports to the U.S. — particularly textiles and agriculture — are significantly less competitive. Profit margins in Kenya’s textile industry typically range from 15% to 30%, and the new tariff threatens to erode this completely, leading to:

- Reduced export volumes

- Loss of jobs in export-focused factories

- Decreased foreign revenue

On the import side, Kenyan businesses bringing in technology hardware, pharmaceuticals, and industrial equipment from the U.S. will see costs rise, pressuring both operational expenses and consumer pricing.

The Kenyan Tech Sector at Risk

Kenya’s fast-evolving digital ecosystem — popularly dubbed “Silicon Savannah” — has long relied on a steady flow of U.S.-imported hardware, software, and cloud services. From basic laptops to advanced infrastructure and licensing for productivity suites, the impact of the newly imposed 10% U.S. import tariff will be felt across the entire digital value chain.

Digital Infrastructure Projects Will Become More Expensive

Kenya’s ambitious national programs — such as the Digital Superhighway Project — depend on importing fiber networking gear, routers, servers, power systems, and data center infrastructure. Much of this comes from U.S. tech firms. With the new tariff, the cost of expanding broadband networks and deploying public Wi-Fi will go up, potentially delaying or downsizing these critical efforts aimed at connecting schools, health centers, and rural areas.

Consumer Tech and Daily Digital Tools Will Cost More

Everyday Kenyan users will also feel the pinch. Devices from U.S. brands like Apple, HP, Dell, and Microsoft Surfaceare already premium-priced — and with a 10% import tariff, expect to pay significantly more for:

- iPhones, MacBooks, and iPads

- Windows laptops and desktops

- PC accessories, monitors, and networking hardware

Beyond hardware, there’s also software licensing, which is heavily reliant on U.S.-based services. Prices for essential tools like:

- Microsoft Office 365

- Adobe Creative Cloud (Photoshop, Premiere, Illustrator)

- AutoCAD and design software

- Cybersecurity suites like Norton and McAfee

could all go up. Whether paid for by companies or freelancers, these costs are typically charged in U.S. dollars, and the new trade friction may lead to either direct price adjustments or inflated currency conversion rates.

E-commerce Purchases from U.S. Platforms Could Be Hit

Many Kenyans now shop directly on Amazon, Best Buy, B&H Photo, and other U.S. platforms, importing items via freight forwarders or international courier services. These range from electronics and computer parts to smart home devices and wearables.

The new tariffs may introduce:

- Higher duties at customs

- Additional processing fees

- Increased final delivery costs

That makes it harder for ordinary users and even small tech businesses to access the latest tools and gadgets affordably.

Schools and SMEs May Struggle to Stay Digitally Equipped

Public and private schools, already operating under tight budgets, often depend on affordable devices and productivity software from the U.S. With price increases now expected, equipping classrooms with laptops, tablets, or educational software becomes even harder.

SMEs and early-stage startups, especially in tech-heavy sectors like e-commerce, creative services, and fintech, will face a similar squeeze. Whether it’s upgrading office laptops or renewing cloud-based business software, the cost barrier just got higher.

Kenya’s Cloud and AI Aspirations May Lose Steam

Cloud service adoption — through Amazon Web Services, Google Cloud, Microsoft Azure, and IBM Cloud – has been rising in Kenya. Many local businesses and government systems are migrating to these platforms. However, the infrastructure and tools used to support these transitions, often imported from the U.S., will now be more expensive to acquire and maintain.

Additionally, AI tools, machine learning platforms, and analytics suites — many of which are U.S.-developed and hosted — may also see subscription price increases or slowed adoption. These include:

- OpenAI tools like ChatGPT

- Google Gemini integrations

- Adobe Firefly and AI-based design platforms

Startups and developers depending on U.S. APIs and paid-tier AI tools may be forced to reassess usage due to rising costs.

Component-Level Risks for Local Builders and Integrators

While Kenya doesn’t have a large electronics manufacturing sector yet, emerging hardware startups, local PC assemblers, and IoT developers import U.S.-made components like:

- Semiconductors and chips

- Solid-state drives and storage modules

- Specialized power units and diagnostic tools

Even small increases in component costs could make it unviable to build or scale locally, particularly for firms operating on already tight margins.

A Difficult and Risky Pivot Away from U.S. Providers

While Chinese and other Asian brands do offer alternatives, U.S. tech is deeply woven into Kenya’s enterprise, government, and creative industries. Replacing systems built on Microsoft, Google, Adobe, or Apple software would be expensive, time-consuming, and potentially disruptive.

There’s also the broader risk of becoming entangled in geopolitical rivalries — with Kenya possibly caught between Western standards and Eastern alternatives — a balancing act that could influence long-term digital sovereignty.

Currency Pressure and Inflation Risks

The new tariffs threaten to worsen Kenya’s already delicate trade imbalance, which may put further pressure on the Kenyan Shilling (KES). A depreciating KES would:

- Make all imports — not just from the U.S. — more expensive

- Accelerate inflation, particularly for consumer and tech goods

- Lower purchasing power across households and businesses

Moreover, as tariffs tend to function like indirect taxes, higher prices could trigger broad inflationary effects, especially if other trade partners retaliate and global supply chains tighten further.

A Geopolitical Recalibration

The “Liberation Day” tariffs symbolize a geopolitical pivot away from globalism and cooperation toward nationalism and self-interest. With AGOA’s future hanging in the balance and trade preferences being replaced with hardline reciprocity, countries like Kenya must now adapt or risk marginalization.

What’s notable is that even countries with moderate tariff regimes toward the U.S. — like Kenya, which charges around 10% — have not been spared. This blunt approach could push African nations to look more toward intra-African trade (via AfCFTA), the EU, or Asia for stability and growth.

What Comes Next?

Kenya must urgently respond, as the convergence of tariffs and AGOA expiry could mark a major downturn for key export sectors. The following strategic moves are crucial:

- Diversify Export Markets: Leverage AfCFTA, deepen EU and China ties, reduce U.S. dependency.

- Boost Local Manufacturing: Especially in tech, agriculture, and textiles, to reduce import reliance.

- Engage in Targeted Diplomacy: Push for carve-outs or bilateral deals with the U.S.

- Support Tech Resilience: Offer tax incentives or import substitution strategies for the digital economy.

- Promote Value Addition: Process raw exports domestically to create higher-margin products.

- Monitor and Stabilize the KES: Through strong fiscal and monetary policy responses.

Update: Kenya’s Government Sees Opportunity Amid Tariff Shift:

In an official statement released on April 3, 2025, the Ministry of Investments, Trade and Industry acknowledged the challenges posed by the new U.S. tariffs but emphasized potential strategic advantages for Kenya.

The Cabinet Secretary, Hon. Lee Kinyanjui, noted that while Kenyan exports to the U.S. will now face a 10% tariff, this is significantly lower than what competitors like Vietnam (46%) or Bangladesh (37%) face. This, he argued, could give Kenya a competitive edge in textiles as U.S. buyers seek alternative suppliers facing lower tariffs.

The Ministry also highlighted the potential to:

- Expand local manufacturing and value addition in sectors like apparel, leather, and agro-processing

- Diversify exports into areas where competitors now face steeper costs

- Accelerate government support through infrastructure investment, stakeholder engagement, and targeted export programs

The Ministry committed to working with stakeholders and foreign partners to enhance Kenya’s export readiness, mitigate supply chain disruptions, and strengthen long-term economic resilience.

The 10% tariff will apply to Kenyan goods exported to the US and not Kenyan imports of US goods.

Thanks for this analysis. I was scouring the internet looking for specific information on how the new tariffs will impact Kenyan economy. Yours was the first one that I found.