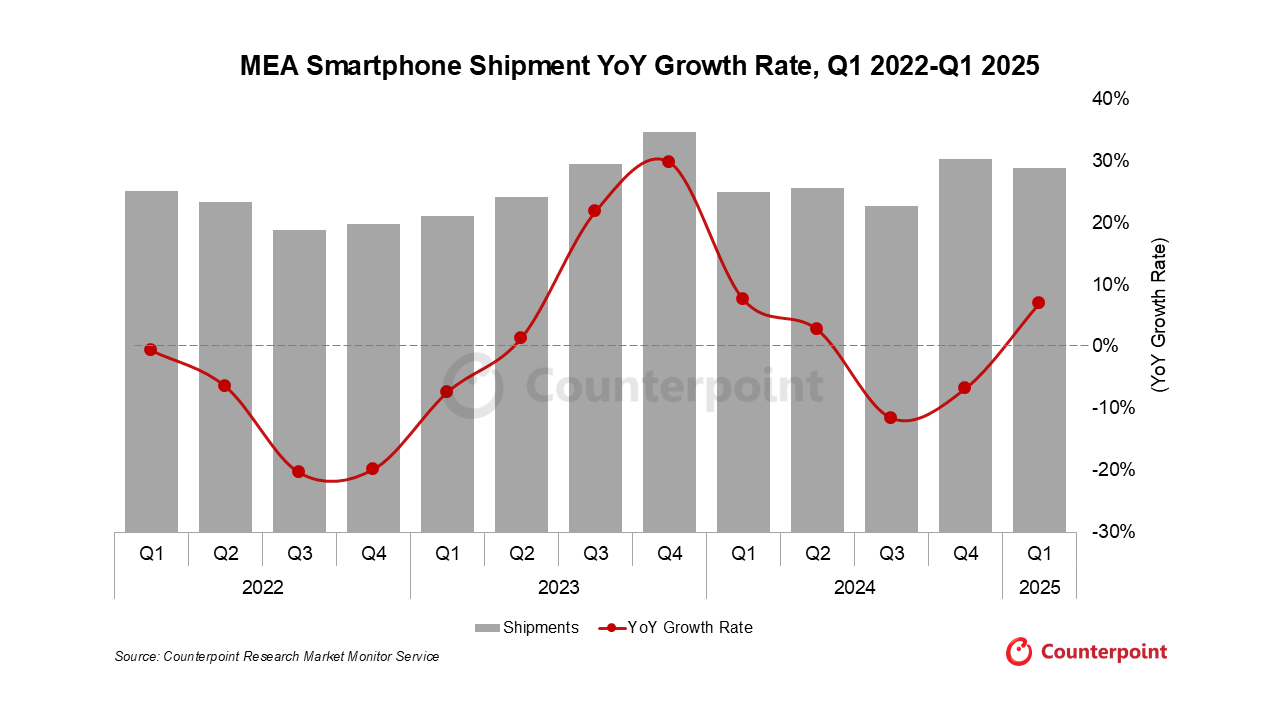

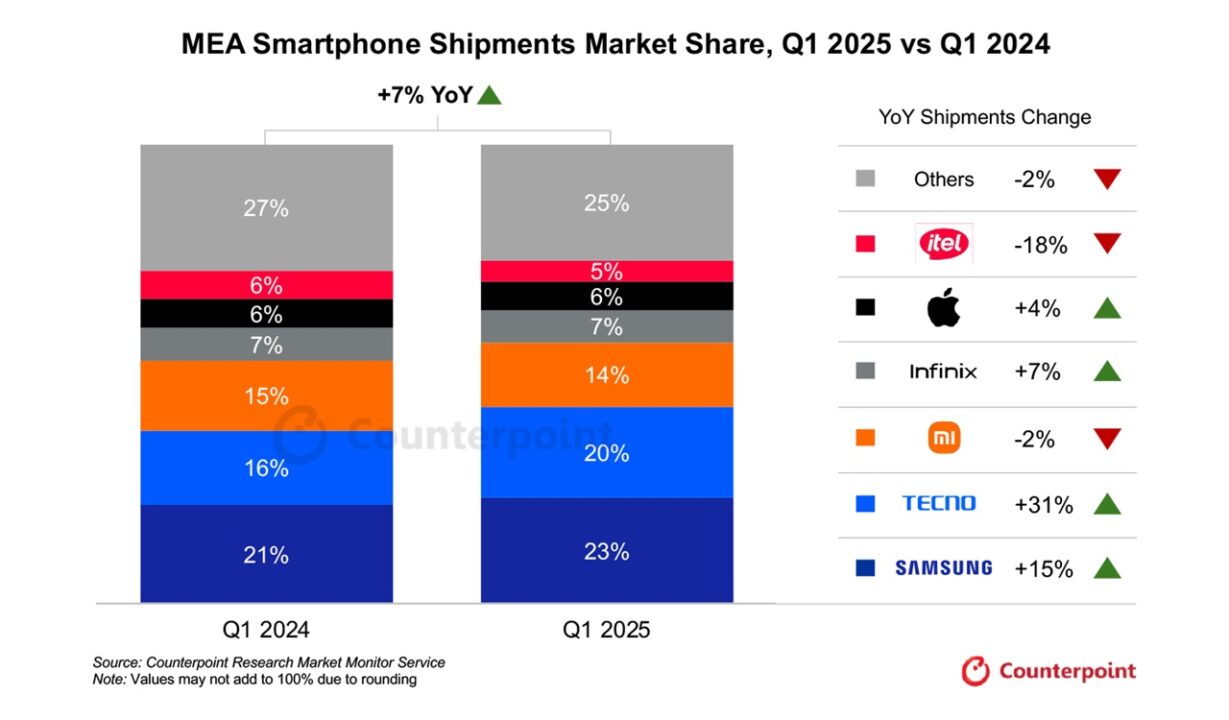

The Middle East and Africa (MEA) smartphone market finally found its spark again — growing 7% year-on-year in Q1 2025, according to new data from Counterpoint Research. This isn’t a random bump in the numbers — it’s the result of a mix of festive timing, economic recovery, and a fresh wave of budget 5G smartphones that actually deliver on performance.

1. Double Festive Season, Double the Spending

Let’s start with the calendar. Ramadan and Easter/Lent overlapped in Q1, creating a rare shopping frenzy across several African markets. These festivals traditionally drive gifting and upgrades, but this year, with more affordable phones and better retail reach, the effect was supercharged. It looks like consumers who had paused on spending through 2024 came back with a vengeance.

2. Inflation Chilled Out (Finally)

After months of high costs and tight wallets, inflation slowed across much of the region. That shift restored confidence — and crucially, freed up disposable income. Combined with flexible financing options (think instalments and “buy now, pay later”), even premium phones started to feel within reach for more people.

3. Budget Phones Got a Serious Upgrade

Here’s where the magic really happened: sub-$100 (under KES 15,000) smartphones became genuinely good. Brands like TECNO, Xiaomi, and itel rolled out devices with super-smooth big screens, long battery life, decent cameras — and even 5G in the mid-range. People didn’t just buy more phones. They bought better ones, without stretching their budgets.

4. Digital Life Demanded More

Africa’s mobile-first reality means smartphones aren’t just gadgets — they’re our bank, school, office, and entertainment hub. And that’s driving up demand for quality. That’s how 5G adoption hit 33% and OLED displays jumped to 42%. People are tired of laggy connections and grainy screens — and now, they don’t have to settle.

5. Brands Got Savvier About Africa

Transsion (TECNO, itel, Infinix) stayed on top with 32% market share, but Samsung, Xiaomi, and even Apple got sharper in how they approach African markets. From fewer, better phones to deeper retail and distribution partnerships, the competition is hotter — and that means more choice and better deals for everyday consumers.

So, what really caused the 7% MEA growth? In Africa’s case, it’s clear: holiday-driven demand, falling inflation, better budget phones, and rising digital needs combined to reignite consumer interest. Hopefully, brands will keep delivering smarter devices at honest prices.