Insights At a Glance:

- While BNPL should be empowering, Kenyan providers are instead trapping low-income earners in expensive digital debt — all while claiming to bridge the digital divide.

- You end up paying up to triple the retail price of phones when using BNPL providers like OnFon Mobile — e.g. a KES 13K phone could cost you over KES 37K by year-end!

- Some cheaper phones cost more than expensive ones under OnFon’s pricing model, making the whole logic behind “installments” flawed and exploitative.

Look, I’m not one to throw around the word scam lightly. But after what I just uncovered, someone’s got to say it out loud: BNPL services in Kenya like OnFon Mobile are bleeding Kenyans dry all in the name of “convenient phone ownership.”

If you’re a Kenyan who’s been struggling to keep up with the ever-rising cost of living, you’ve probably seen the sweet-sounding offers from Buy Now Pay Later (BNPL) services like OnFon Mobile, Aspira, M-KOPA, and so on. You’ve probably been tempted. Who wouldn’t want to own a new phone without coughing up tens of thousands in one go? But dig a little deeper, and you’ll realize what these BNPL companies are offering isn’t a lifeline – it’s a financial trap dressed up as convenience.

These services are modern-day digital shylocks. They dangle the latest smartphones in your face, make you feel like you’re winning, then bleed you dry over the course of a year. For this piece, I dug into OnFon Mobile’s pricing — yes, actual numbers, real breakdowns, not marketing gibberish or vague bots. And what I found will leave you absolutely furious, especially since Kenya’s Central Bank recently stepped in to regulate BNPL services.

Shout Out to OnFon for Transparency (But That’s Where the Praise Ends)

Credit where it’s due: OnFon Mobile at least puts their numbers out in the open on their website. Unlike M-KOPA and Aspira, whose sites and bots will have you jumping through hoops for the most basic breakdown, OnFon spells it out. But once you do the math, the numbers will make your blood boil.

Here’s What I Did — And Why You Should Care

Like millions of Kenyans, I was curious about this whole “lipa mos mos” phenomenon. BNPL (Buy Now Pay Later) has been sold to us as the future — a magical gateway to owning smartphones without the financial pain. But is it really? Or is it a cleverly disguised trap that exploits our struggles and steals from our future?

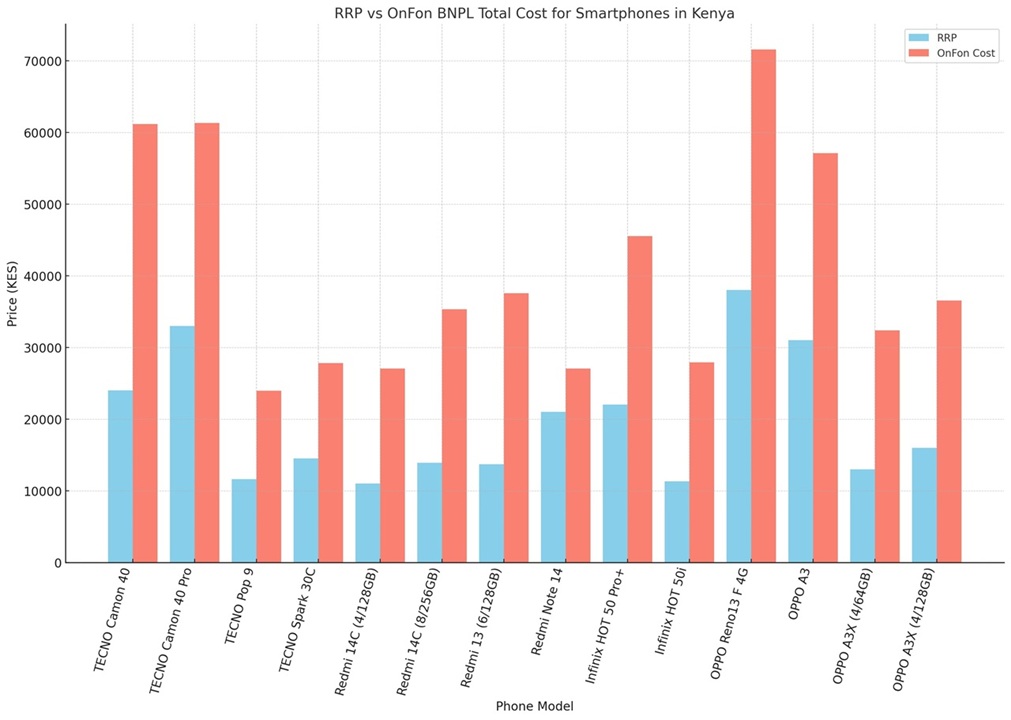

To find out, I compared the Recommended Retail Price (RRP) of multiple smartphones with what OnFon charges you in total after a year of daily payments. Spoiler alert: the results are INSANE.

The Numbers Don’t Lie – They Scream Exploitation

Take the TECNO Camon 40 (8/128GB). Market price? KES 23,999. OnFon price over a year? KES 6,400 upfront + KES 150 daily x 365 = KES 61,150. That’s a 155% increase. The Pro model? KES 32,999 RRP, but ends up costing KES 61,325 through OnFon. So whether you go standard or Pro, you’re paying virtually the same. Make it make sense.

Then there’s the Redmi 14C (4/128GB), which retails for KES 10,999. OnFon wants KES 3,300 upfront and KES 65 per day, totaling KES 27,025. You’re paying almost 2.5x the actual price. Who does that?

It gets worse with devices like the OPPO A3X (4/128GB), which costs KES 15,999 at retail. Through OnFon, it’ll cost you KES 36,550. That’s more than double. What are you paying for? Thin air and the audacity of predatory lending.

Basically, these phones cost nearly double on OnFon, and below is a table for comparison:

| Phone Model | RRP (KES) | OnFon BNPL (KES) | Difference (KES) |

|---|---|---|---|

| OPPO Reno13 F 4G | 37,999 | 71,575 | +33,576 |

| OPPO A3 (8/256GB) | 30,999 | 57,100 | +26,101 |

| Redmi 13 (6/128GB) | 13,699 | 37,550 | +23,851 |

| Infinix HOT 50 Pro+ | 21,999 | 45,525 | +23,526 |

| Redmi 14C (8/256GB) | 13,899 | 35,325 | +21,426 |

| OPPO A3X (4/128GB) | 15,999 | 36,550 | +20,551 |

| OPPO A3X (4/64GB) | 12,999 | 32,400 | +19,401 |

| TECNO Camon 40 | 23,999 | 61,150 | +37,151 |

| TECNO Camon 40 Pro | 32,999 | 61,325 | +28,326 |

| TECNO Pop 9 | 11,599 | 23,975 | +12,376 |

| TECNO Spark 30C | 14,499 | 27,825 | +13,326 |

| Redmi 14C (4/128GB) | 10,999 | 27,025 | +16,026 |

| Redmi Note 14 | 21,000 | 27,025 | +6,025 |

| Infinix HOT 50i | 11,299 | 27,925 | +16,626 |

Yes, you read that right. A phone that costs KES 11,000 in cash ends up costing you over KES 27,000 via OnFon. That’s more than double the actual price — just because you couldn’t afford to pay it all at once. And it gets worse: some lower-end phones end up costing the same or more than their premium counterparts after a year of “lipa pole pole.” For instance, the Redmi 13 (KES 13,699) ends up costing you KES 37,550 through OnFon, while the superior and newer Redmi Note 14 (KES 21,000) goes for KES 27,025.

To be fair to OnFon, at least they tell you upfront what you’ll pay. Visit their website and boom — deposit, daily rate, total. Easy math. I tried getting similar info from M-KOPA? A whole mystery maze. WhatsApp bots giving me the runaround. Aspira? No proper duration listings, you only see the monthly installments. It’s like they don’t want you to know what you’re signing up for. Transparency is a myth elsewhere — and that’s even scarier.

Hire Purchase or Highway Robbery?

Sure, you can argue that this is just how hire purchase works. But in developed markets, BNPL doesn’t mean you pay double. In the U.S. or UK, BNPL services allow people to split the cost of a phone into smaller chunks — without increasing the total cost. You pay the same amount, just over time. The service providers make money from brands or data, not by exploiting broke consumers.

Here in Kenya? You’re being charged interest rates upwards of 100% hidden behind cutesy slogans like “Own your dream phone today!”

It’s not a dream. It’s a nightmare.

This isn’t just about numbers. This is about the mwananchi who just wants a decent phone for work, school, or business. The hawker who needs to be on WhatsApp. The student trying to learn online. The mama mboga trying to take mobile payments. These are the people being fleeced.

Most of these “lipa pole pole” customers are hustlers. People trying to earn a living, stay online, run their side gigs, or just afford a decent phone for their kids. And yet, these BNPL services are essentially taxing poverty — making the poor pay twice as much for the same things the middle class buy easily. We are told to digitize. To work online. To join the digital economy. But how do you do that when a KES 11K phone ends up costing you almost KES 30K over the course of a year?

A Broken Promise of Digital Inclusion

Kenya prides itself on being Africa’s Silicon Savannah. But what kind of digital progress is this, when access comes with such exploitative costs? If BNPL services are meant to empower the underserved, they should do so without turning people into debt slaves.

What Needs to Change NOW

Let’s not just scream — let’s demand change:

- Better Models: Let’s push for zero-interest installment plans where merchants or telcos absorb the cost — not the buyer.

- Regulation: The government needs to do more and cap exploitative interest rates disguised as daily fees.

- Transparency Laws: Every BNPL provider should legally disclose the final cost of every product — loud and clear.

- Consumer Awareness: More Kenyans need to understand that BNPL isn’t free — it’s debt.

OnFon and its BNPL cousins are not doing Kenyans a favor. They are exploiting economic desperation and lack of regulation to make profits off the backs of people just trying to get by. Yes, they provide access. But at what cost?

If a smartphone costs KES 11,000, you should not have to pay KES 28,000 just because you want to pay over time. These are not small markups. These are financial landmines being sold to millions of Kenyans trying to survive. And the sad truth? Most people won’t realize they’ve been duped until they’re months into paying for a phone that lost half its value already.

Granted, if we don’t call out these practices now, we’ll soon have an entire generation locked in endless digital debt cycles – all for phones that should have cost half the price.

Kenyans, do the math before you do the deal. Share this with someone thinking of getting a phone via BNPL. They deserve to know the truth. And to OnFon Mobile, thanks for the transparency. Now give us fairness.