Kenya’s mobile lending boom has brought financial access to millions, but it has also created a troubling trend: rising loan defaults. With 16.6% of borrowers defaulting on loans in 2024 compared to 10.7% in 2021, credit education and monitoring have become critical for sustainable financial inclusion.

The Growing Default Crisis

The 2024 FinAccess Household Survey reveals a stark reality about Kenya’s digital borrowing landscape. Nearly one in six adults defaulted on loans in 2024, representing a 55% increase from 2021 levels. This surge coincides with the widespread adoption of mobile loans, which now represent 52.79% of all active loan accounts in Kenya.

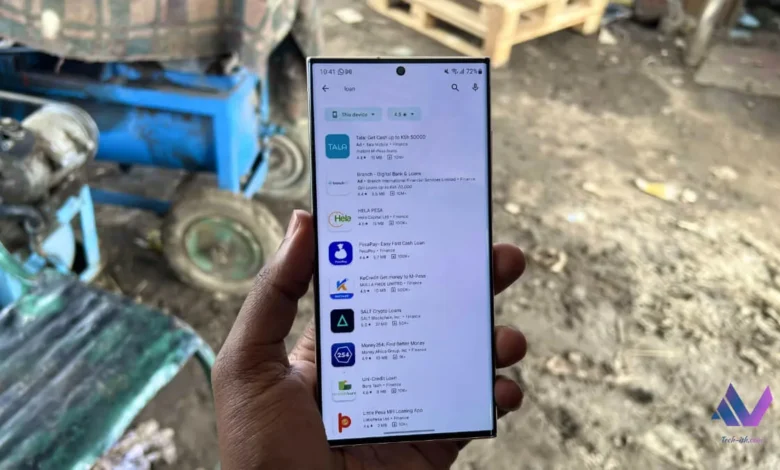

Mobile loans have become the backbone of consumer credit, with 3.92 million new mobile loan accounts opened in Q1 2024 alone, marking an 11.02% increase from the previous quarter.However, this rapid expansion in credit access, particularly among under-35s, has not been matched by adequate financial literacy, leading many borrowers into avoidable debt cycles.

TransUnion’s Response: The Nipashe Solution

In response to this crisis, TransUnion Kenya is actively promoting its Nipashe app as a crucial tool for young and first-time borrowers to monitor their credit health. The free application allows users to check their credit reports instantly via mobile app or SMS by texting their name to 21272.

“Credit, when used wisely, can be a powerful enabler, opening doors to education, entrepreneurship, and personal growth,” said a TransUnion spokesperson. “But without a solid foundation in financial literacy, we risk seeing many young people excluded from future economic opportunities because of poor credit decisions made today”.

Key Features of Nipashe

The Nipashe app addresses critical gaps in financial awareness by providing users with several essential features:

- Instant credit report access via mobile app or SMS

- Early detection of errors or loan defaults before they escalate

- Comprehensive credit score insights and influencing factors

- Personalized financial improvement recommendations

The Broader Context of Kenya’s Financial Inclusion

While formal financial access has increased to 84.8% of Kenyan adults according to FinAccess 2024, the reality behind these numbers reveals significant challenges. Digital loans have become the primary entry point for millions of new borrowers, but without proper understanding of interest accumulation, loan terms, or credit scoring mechanisms, many remain vulnerable to financial distress.

This challenge is particularly acute given Kenya’s position as a leader in digital fraud attempts. Recent data shows that 4.6% of all digital transactions originating in Kenya were flagged as potentially fraudulent, with retail experiencing the highest fraud rates at 11.7%.

Smart Credit Guidelines for First-Time Borrowers

TransUnion has outlined five essential tips for responsible credit use:

- Early Credit Monitoring: Regularly checking credit status using tools like Nipashe helps identify and address potential issues before they become major problems.

- Borrowing Within Means: Only borrowing amounts that can be comfortably repaid prevents missed payments, credit score damage, and financial stress.

- Starting Simple: Beginning with manageable credit products like mobile loans or retail accounts helps build a positive credit history.

- Essential Use Only: Avoiding credit for non-essential purchases or entertainment prevents unnecessary debt accumulation.

- Understanding Credit Mechanics: Learning how payment history, credit utilization, and loan mix affect credit scores enables better borrowing decisions.

The Economic Imperative

“Encouraging smart credit use isn’t just about personal finance, it’s about building a generation that can participate meaningfully in Kenya’s economy,” emphasized TransUnion’s leadership. “When young people are given the tools to make responsible financial choices, the ripple effect is felt across families, communities, and the country at large”.

This perspective aligns with broader efforts to enhance financial inclusion through technology, as AI and digital tools increasingly play crucial roles in expanding access to financial services while promoting responsible usage.

Industry-Wide Implications

The rising default rates have implications beyond individual borrowers. Financial institutions are adapting their approaches, with banks like Standard Chartered introducing products like SC Juza that charge interest only for active loan days, encouraging early repayment.

Similarly, Safaricom has expanded its business credit offerings through products like Fuliza Biashara and Taasi Till, providing more flexible repayment options that align with business cash flows.

The current situation underscores the need for comprehensive financial literacy initiatives that combine technological solutions with education programs. As Kenya continues leading Africa’s digital financial revolution, tools like Nipashe represent essential infrastructure for sustainable credit market growth.