Pesalink moves billions of shillings every month, connecting Kenya’s banks in a fast, cheap, and convenient way. It’s the product the Kenya Bankers Association (KBA) proudly launched in 2017 to rival M-Pesa, and it has since become an essential part of our financial ecosystem.

But behind the official success story is a very different tale, one that doesn’t feature a boardroom full of executives but instead a single man, Stephen Muikia Njongoro, who says Pesalink is his innovation. And while banks profit from it, he sells tissue papers in the streets of Nairobi to survive.

The Banker Who Saw a Gap

According to Stephen, he spent five years inside Co-operative Bank of Kenya working as a Loans Clerk from 2010 until January 8, 2015 when he was fired. Back then, interbank transfers were slow, expensive, and anything but real-time. There was no Pesalink, no instant settlement. After leaving Co-op Bank, Stephen decided to solve that problem. He documented and registered two solutions with the Kenya Copyright Board (KECOBO):

- The All-in-One Banking Innovation

- Air Money Virtual Bank Transfer Solution Innovation

These weren’t just concepts. They were certified innovations.

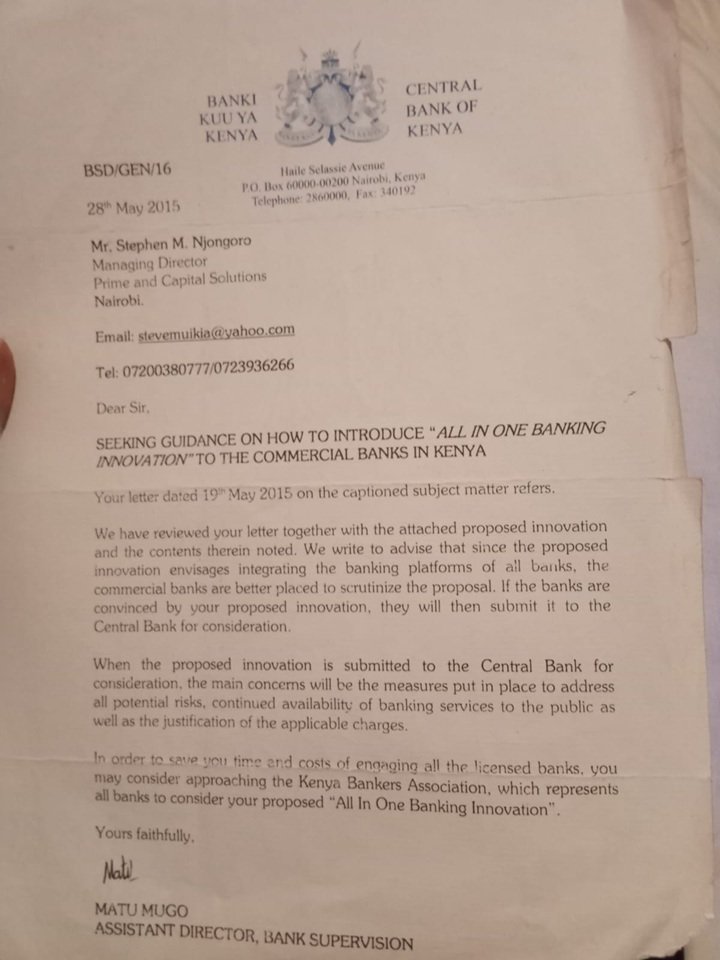

Armed with his certified innovations, he approached the big dogs: the Central Bank of Kenya (CBK) and the Kenya Bankers Association (KBA). And they didn’t just ignore him; they acknowledged receipt in writing. A letter from CBK dated May 28, 2015, advised him to engage directly with commercial banks and the KBA, noting that if banks were interested, they would circle back to CBK for guidance. This is a crucial detail, because it suggests that, at the time, such a system wasn’t on the CBK’s radar.

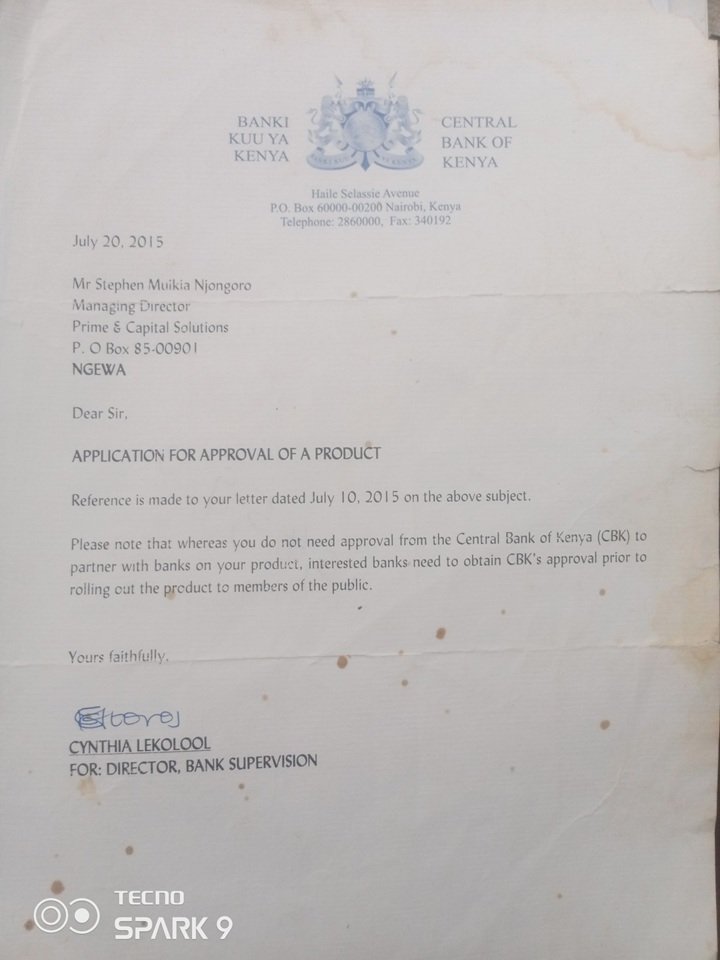

Another letter from CBK in July 2015 reiterated that while Muikia didn’t need their approval to partner with banks, the banks themselves would need a green light from CBK before launching the product. It seemed like he was on the right track.

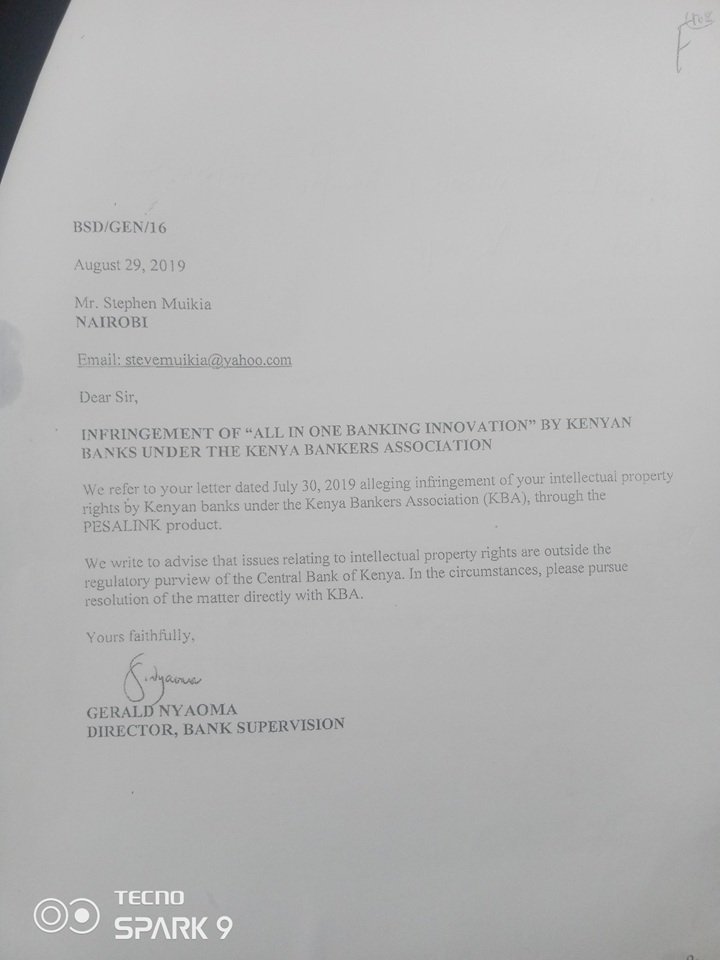

And in another August 2019 letter in reference to the infringement of Stephen’s All in One banking innovation, after Pesalink was already active, CBK’s Gerald Nyaoma said IP rights were outside CBK’s jurisdiction and told him to “pursue resolution of the matter directly with KBA.”

Over the years, Pesalink has become a cornerstone of digital payments in Kenya. Recent developments like its integration with M-Pesa and a 2024 survey showing its widespread use underscore just how lucrative the platform is. The problem? Muikia claims this was his innovation, implemented without his knowledge, consent, or a single shilling in compensation.

Feeling betrayed, Muikia did what the law says you should: he went to court in 2019 (Case No. HCC/E438/2019), hoping for justice. What followed, according to him, was years of judicial nightmare.

He claims his case was dismissed on flimsy technicalities. “The judge said that I used the word ‘idea’ instead of ‘innovation.’ That was a blatant lie,” Muikia stated in a viral post on X (formerly Twitter). He also alleges the judge falsely claimed he was still a bank employee when creating the innovation, a fact he says his Certificate of Service from Co-op Bank, showing his last day was January 8, 2015, can easily disprove.

But even more interesting is that Muikia alleges the judge refused to release the written judgment for over two full years. Without this crucial document, he cannot file an appeal. His right to appeal has been effectively crushed by what feels like a deliberate judicial delay. Stephen reported this to the Judicial Service Commission (JSC) in 2023, 2024, and again in 2025. On 5 March 2025, JSC acknowledged his complaint as seen in the letter below, but nothing changed.

Interestingly, when the case was dismissed, the court awarded costs to the defendants. Yet CBK, KBA, and IPSL have never demanded payment, which is quite unusual behaviour for banks that rarely forget a debt.

KOX to The Rescue

This is where the story explodes. On August 8, 2025, a post by X user @_James041 detailed Muikia’s plight, complete with a heart-wrenching video of him selling tissue papers on the streets. The post went viral.

The cavalry arrived in the form of Law Society of Kenya (LSK) President, Faith Odhiambo, who publicly asked for the case details to intervene. Even former Chief Justice Dr. Willy Mutunga stepped in, confirming he had shared the post with the Judiciary’s communication team and the Judiciary Ombudsperson.

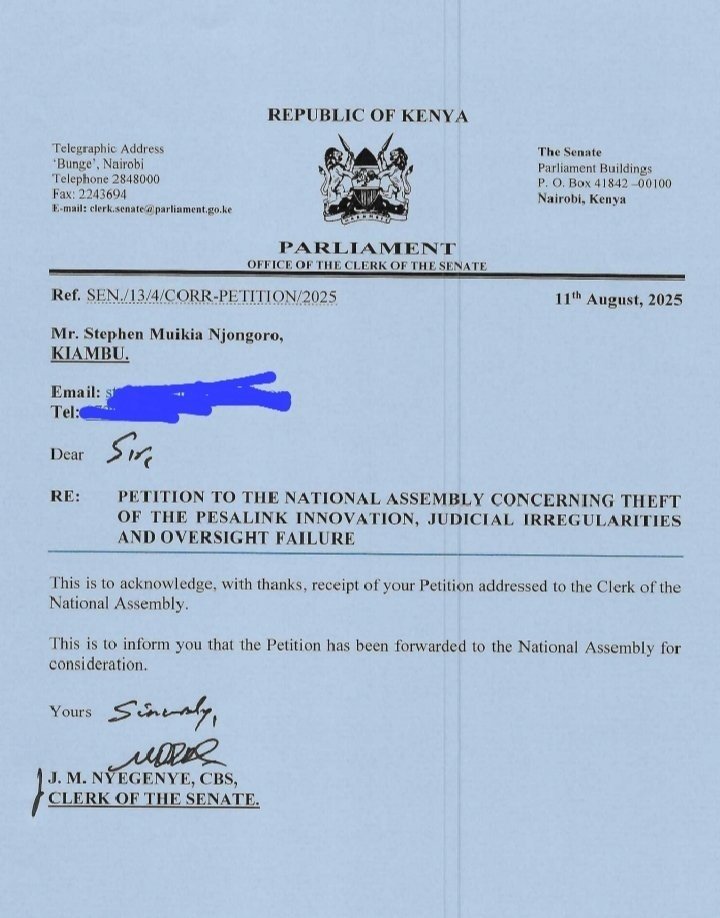

This public pressure seems to have worked. Muikia has since shared a letter showing his case has been escalated. The letter, which comes from the Clerk of the Senate dated August 11, 2025, acknowledges receipt of his petition, which has been forwarded to the National Assembly for consideration.

Thanks to the power of social media and the intervention of some very influential people, Steve Muikia’s case has been yanked from the dusty shelves of judicial delay and thrown into the court of public opinion and, now, parliamentary and JSC oversight.

It’s a stark and frankly, infuriating, contrast: the man whose innovation potentially powers billions of shillings in transactions every month is fighting for survival on the streets, while the institutions he accuses of theft are reaping massive profits.

Will this newfound attention finally bring him justice? Will he get the compensation he feels he rightfully deserves for an innovation that has truly transformed Kenya’s financial ecosystem? We’ll be watching this space.

Stephen’s case isn’t just about one man’s loss. It’s about whether Kenyan innovators can trust the system to protect them from powerful institutions. It forces us to ask:

- Why has the written judgment been withheld for two years?

- Why haven’t the banks claimed their awarded costs?

- Did CBK and KBA use his innovation without recognition?

For now, Pesalink continues moving billions across Kenyan banks, and Stephen continues selling tissues. But with Parliament’s involvement, there’s a glimmer that this David vs Goliath story might finally turn a corner.