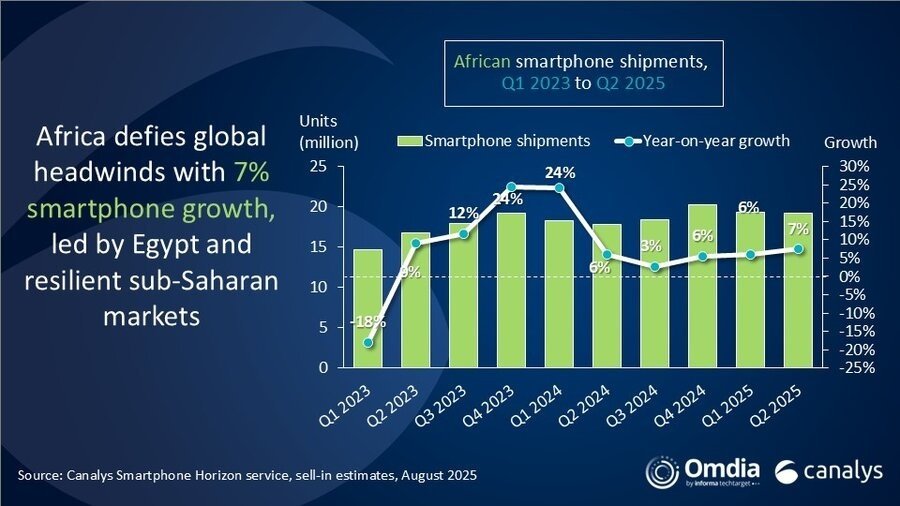

Africa’s smartphone story keeps getting better. According to the latest Canalys (now part of Omdia) report, the continent shipped 19.2 million smartphones in Q2 2025 between April and June, up 7% year-on-year. That makes it nine straight quarters of growth, a run most global markets can only dream of right now.

But while Nigeria rebounded 10%, Egypt surged 21%, and South Africa rode a 63% wave in 5G smartphone shipments, Kenya found itself slightly on the back foot. Our market slipped 2% year-on-year. Not exactly a collapse, but notable given how resilient Kenya usually is in the region.

This dip comes just weeks after the Kenya National Housing Survey confirmed that more than 90% of Kenyan households now own a mobile phone, with smartphones having surpassed feature phones. The growth slowdown isn’t about adoption fatigue — Kenyans still love their smartphones — it’s more about affordability, import costs, and the increasing dominance of ultra-low-cost devices.

The Battle of the Brands

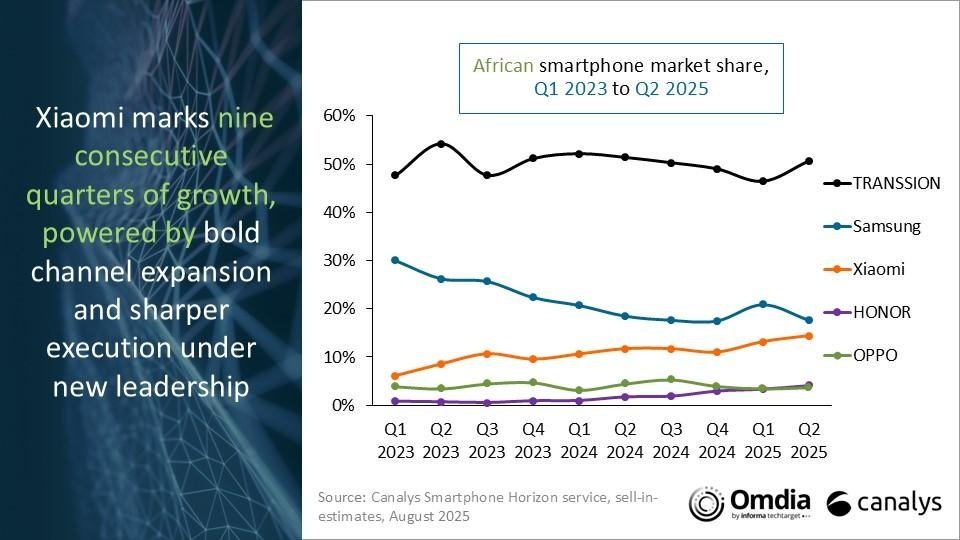

Across Africa, one name still dominates: TRANSSION (owners of TECNO, Infinix, and itel). With a 51% market share, they shipped 9.7 million smartphones in Q2 2025, up 6% year-on-year. TECNO’s push into mid-range territory is paying off, but the company still faces the uphill task of convincing users to stretch beyond entry-level models.

Samsung held steady in second place with 18% market share, driven by budget-friendly devices like the Galaxy A06 and retail expansion beyond its traditional South African stronghold.

But the biggest fireworks came from Xiaomi. With a staggering 32% growth year-on-year, Xiaomi now holds 14% of the African market, cementing its third-place position. Nigeria and Egypt fueled the surge, but Kenya is now a crucial part of Xiaomi’s plans too. Just last week, the company appointed new bosses to head Kenya and East Africa operations, signaling a deeper local investment strategy. Considering Xiaomi was only at 12% market share a year ago, their momentum is hard to ignore.

Similar to Q1 2025, HONOR pulled off the biggest leap — 161% growth, albeit from a small base, thanks to budget-friendly hits like the X7c and 400 Lite. Meanwhile, OPPO is in the middle of restructuring after an 11% dip. Still, OPPO is doubling down on retail presence in Egypt, opening flashy Experience + Service Stores to remind customers it’s in Africa for the long haul.

African Smartphone Shipments and Annual Growth – Q2 2025

| Vendor | Q2 2025 Shipments (million) | Q2 2025 Market Share | Q2 2024 Shipments (million) | Q2 2024 Market Share | Annual Growth |

|---|---|---|---|---|---|

| TRANSSION (TECNO, Infinix, itel) | 9.7 | 51% | 9.2 | 51% | +6% |

| Samsung | 3.4 | 18% | 3.3 | 19% | +3% |

| Xiaomi (Redmi, POCO) | 2.8 | 14% | 2.1 | 12% | +32% |

| HONOR | 0.8 | 4% | 0.3 | 2% | +161% |

| OPPO | 0.7 | 4% | 0.8 | 4% | -11% |

| Others | 1.8 | 9% | 2.2 | 12% | -17% |

| Total | 19.2 | 100% | 17.8 | 100% | +7% |

Notes:

- Xiaomi numbers include Redmi and POCO sub-brands.

- TRANSSION numbers include TECNO, Infinix, and itel.

- Percentages may not sum perfectly to 100% due to rounding.

Kenya’s Puzzle: Growth in Ownership, But Slower in Sales

So why did Kenya dip while our neighbors soared? A couple of things stand out:

- Affordability remains king: Canalys says sub-$100 phones surged 38% in Q2, dragging down average selling prices. In Kenya, that trend is clear — itel, Infinix, and TECNO continue to rule, but margins are razor thin.

- Financing is the future: South Africa’s big growth story was fueled by smartphone financing partnerships with operators. Kenya has M-KOPA and Safaricom device financing programs, but their reach isn’t yet at mass-market levels. The Canalys Report earlier this year argued that better financing schemes could unlock faster smartphone adoption in rural areas.

- 5G remains niche: While Kenya now has over 2.5 million 5G subscriptions, most of the country is still operating on 4G (or even 2G). That means fewer incentives for consumers to upgrade unless devices get cheaper.

The Kenyan smartphone market is still incredibly dynamic. Even with a 2% dip, we’re far from stagnating. Device penetration is higher than ever, mobile money usage is driving digital demand, and new entrants like Xiaomi are heating up the competition.

The wider African story also shows where we’re headed:

- Local manufacturing in Egypt and Ethiopia is picking up, while Uganda and Algeria are slowly building their ecosystems. “Made in Africa” is no longer a pipe dream, it’s becoming a cost advantage.

- Rural Africa is the next frontier. With feature phones still entrenched in many low-income households, vendors are fighting hard with cheap smartphones, financing models, and operator tie-ups.

For Kenyans, even if Q2 looked a little shaky, the smartphone race is far from slowing down. Expect more aggressive promotions, more local investments, and a stronger push toward budget and mid-range devices as brands battle for your pocket.

And if Xiaomi’s recent leadership shake-up in Kenya is anything to go by, TECNO, itel, Samsung, and the rest better buckle up. The next few quarters could get very interesting.