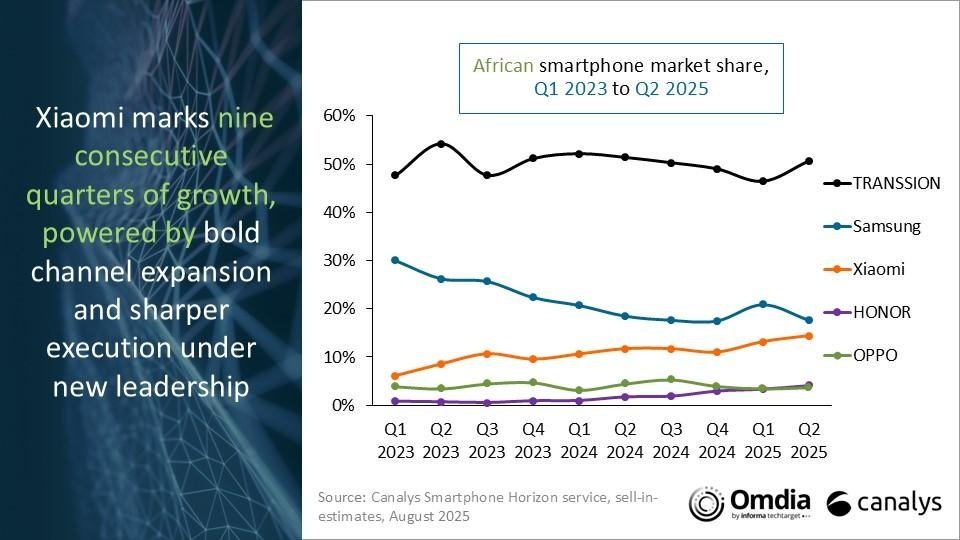

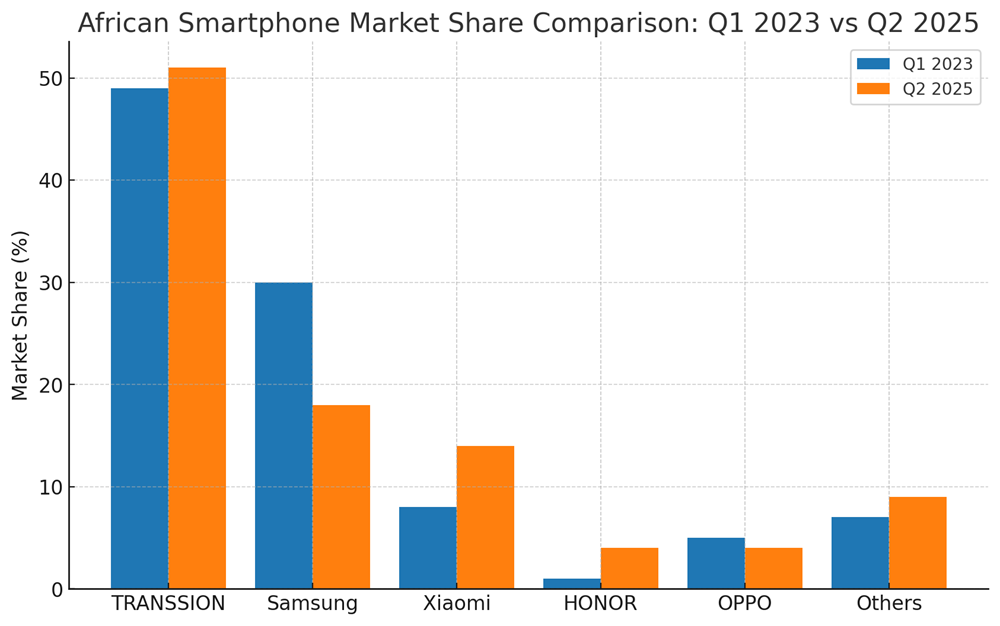

Africa’s smartphone market has a new rivalry brewing, and the latest Canalys numbers tell the story in bold strokes. Between Q1 2023 and Q2 2025, Samsung has quietly slipped from about 30% market share to just 18%, while Xiaomi has climbed steadily to 14%, marking nine consecutive quarters of growth.

Samsung’s Slow Slide

Over two years ago, Samsung sat comfortably at about 30% market share in Africa. But quarter after quarter, the blue line on the Canalys chart keeps dipping. By Q2 2025, Samsung’s share is hovering around 18%, its lowest point in years.

What happened? Well, Africa’s smartphone battlefield has shifted:

- Affordability reigns supreme. Sub-$100 devices grew 38% this year alone, and Samsung hasn’t been able to compete aggressively in that segment.

- Operator tie-ups and financing models in South Africa gave Samsung a boost (with 5G shipments up 63%), but beyond that, the company has struggled to replicate its premium-to-midrange dominance in countries like Nigeria and Kenya.

- And perhaps most importantly, rivals like Xiaomi and TRANSSION have been laser-focused on the entry-to-midrange categories where most African buyers are shopping.

Xiaomi’s Meteoric Rise

Meanwhile, Xiaomi is having its African moment. Back in Q2 2023, Xiaomi’s share was a little over 7%. Fast forward to Q2 2025, and it’s hitting 14% after nine consecutive quarters of growth. That orange line on the Canalys graph is climbing steadily, powered by bold channel expansion, aggressive retail partnerships, and sharp execution.

Even more telling: Xiaomi has just appointed new bosses across Kenya, East and West Africa, part of a wider strategy to cement its place as Africa’s next big smartphone brand. The leadership shake-up shows Xiaomi isn’t just happy to sell budget Redmi devices. It wants a bigger slice of Africa’s midrange and premium pie too.

What About Everyone Else?

- TRANSSION (TECNO, Infinix, itel): Still the unshakable king of Africa, holding firm at around 50% market share. Its dominance comes from being everywhere, from Nairobi’s streets to rural Nigeria, with devices that feel tailor-made for local wallets and lifestyles.

- HONOR: A late bloomer, but what a growth story! From almost invisible two years ago to 4% share in Q2 2025, HONOR’s focus on budget-friendly models and operator deals is paying off.

- OPPO: The green line on the graph shows stagnation. OPPO hasn’t broken out in the same way Xiaomi has, and with its recent 11% shipment dip, it’s in recovery mode, focusing on Egypt with flashy new stores and service centers.

Africa is now the smartphone market to watch especially now that feature phones have taken the back seat. Global shipments are slowing, but Africa just posted its ninth straight quarter of growth. And within that growth, the shifts are dramatic: Samsung’s once-unchallenged dominance is slipping, and Xiaomi is making all the right moves to position itself as Africa’s number two.

For Kenyan and African buyers, this shake-up means more competition, more choices, and hopefully better prices. If Xiaomi keeps up its streak while Samsung recalibrates, the next two years could completely redefine who holds power in Africa’s smartphone ecosystem.