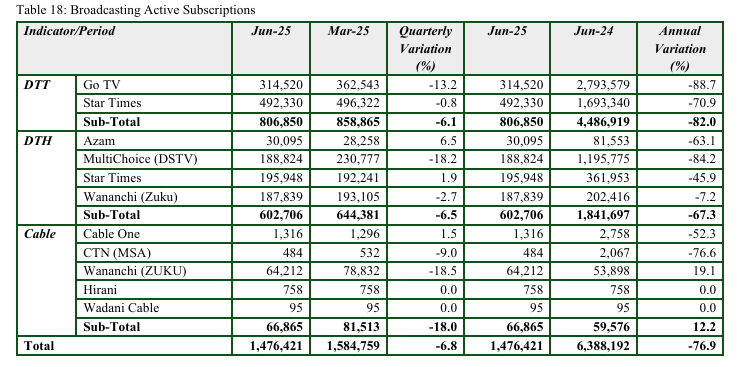

The latest sector stats from the Communications Authority are brutal for MultiChoice. By the end of June 2025, DStv’s active subscriber base in Kenya had collapsed to just 188,824. That’s an 84.2% drop compared to the same time last year (1.2 million) and an 18.2% decline from March 2025 (230,777).

GOtv, MultiChoice’s terrestrial arm, wasn’t spared either. Its active base fell to 314,520, down 13.2% quarter-on-quarter (362,543) and almost 89% year-on-year (2.8 million). Together, DStv and GOtv’s performance paints a worrying picture for a company that once seemed untouchable in Kenyan living rooms.

The CA’s new approach to reporting, counting only active subscriptions paid within the last 90 days, partly explains the dramatic year-on-year swings. But the quarter-on-quarter numbers reveal something more painful: customers are genuinely walking away.

And it’s not hard to see why. MultiChoice has hiked DStv prices several times this year, testing already stretched households. Promotions and Supersport-only packages show just how desperate the company has become to hold onto sports fans, its last major stronghold. Still, even the lure of live football is struggling to keep subscribers from downgrading or ditching satellite altogether.

The competition isn’t just other Pay-TV operators. StarTimes managed to keep its DTT numbers almost flat and even grew its DTH base slightly, while Azam TV posted modest gains. Zuku’s cable arm slipped, but far less dramatically than DStv. Meanwhile, streaming platforms like Netflix, YouTube, and Showmax (ironically owned by MultiChoice) are quietly winning the time and wallets of younger, urban households.

All of this lands just as Canal+ finally closed its $2 billion takeover of MultiChoice. The French broadcaster now inherits not just valuable sports rights and a powerful brand, but also a shrinking subscriber base and a business model under siege.

The question now is whether Canal+ can turn things around. Will it double down on streaming, roll out cheaper mobile-first bundles, or rethink bouquet pricing entirely? Because if the latest CA stats are anything to go by, the DStv Kenya of old with near-monopoly status and millions of subscribers may already be gone for good.