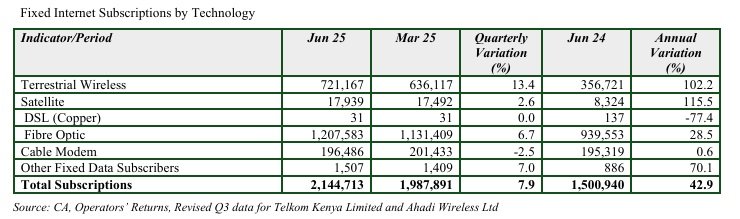

Kenya’s fixed internet sector is expanding, but the reality on the ground isn’t as rosy as the subscription numbers suggest. According to the CA’s latest ICT report (Q4 2024/25), fixed broadband subscriptions rose to 2.14 million by June 2025, up from 1.99 million in March. Fibre connections lead the way, while wireless and even satellite (think Starlink) are making inroads.

Yet, this growth hides a frustrating truth: Kenya ranks 145th out of 153 countries globally for fixed internet speeds. The median download speed is a meagre ~15.4 Mbps, compared to a global average of over 100 Mbps. Yes, speeds have grown by +22.4% year-on-year, but for most users, “improvement” just means fewer buffering wheels and not truly world-class connectivity.

Access is even more unequal. Only 0.6% of rural homes in Kenya have fixed internet, compared to 17.3% of urban households. Nationally, that averages out to about 7% of homes connected via fixed broadband. The rest either rely on mobile data or go without. In other words, fixed internet is still very much an urban luxury.

The competitive landscape remains lively, though. As of March 2025, Safaricom led the market with 678,118 fixed subscriptions, giving it a 36.5% share. Jamii Telecom (Faiba) came second at 418,309 subs (22.5%). Zuku and Poa Internet are locked in a close fight for third, each with about 14% share (~260K subscribers each). Meanwhile, Ahadi Wireless had carved out a niche with 7.5% of the market, and Starlink, despite its hype, controlled less than 1% (17,066 connections).

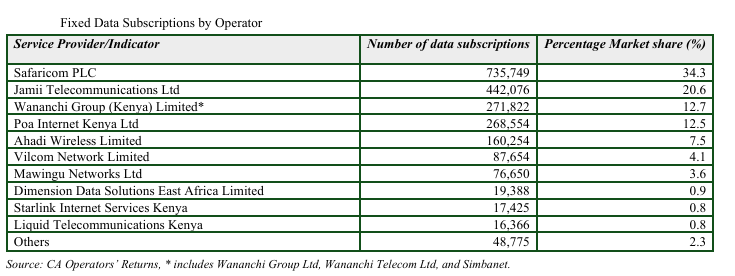

And now, here is the fixed internet market share in Kenya as of June 2025, as per the latest CA report:

- Safaricom PLC: 735,749 subscriptions with a 34.3% market share means it’s still top dog.

- Jamii Telecom (Faiba): 442,076 (20.6%).

- Wananchi Group (Zuku): 271,822 (12.7%).

- Poa Internet: 268,554 (12.5%).

- Ahadi Wireless: 160,254 (7.5%) — a notable entrant with serious traction.

- Vilcom: 87,654 (4.1%); Mawingu: 76,650 (3.6%); Dimension Data: 19,388 (0.9%); Starlink: 17,425 (0.8%); Liquid: 16,366 (0.8%); Others: 48,775 (2.3%).

Comparing March → June: Safaricom added 57,631 subs (~+8.5%), Jamii +23,767 (~+5.7%), while Mawingu and Vilcom posted sharp percentage gains (~+29.9% and +22.3% respectively). Starlink inched up slightly (+359), while Liquid dipped a touch (-58). Meanwhile, Ahadi’s 160,254 subs make it a breakout player this quarter.

So what does all this mean? On one hand, more Kenyans are signing up for fixed internet than ever before, and competition is forcing providers to expand their networks. On the other, the country is still stuck with painfully slow speeds, expensive entry-level packages, and a massive urban–rural divide.

For Kenya to unlock the true potential of fixed broadband, the next chapter has to be about speed, access, and affordability. Faster base packages (ditch the 5–7 Mbps starters), bigger investment in rural rollout, and smarter regulation to encourage competition could make the difference.

Until then, fixed internet will remain a tale of two Kenyas: city dwellers juggling Safaricom, Zuku, or Poa packages, and millions elsewhere stuck with costly mobile bundles as their only lifeline online.