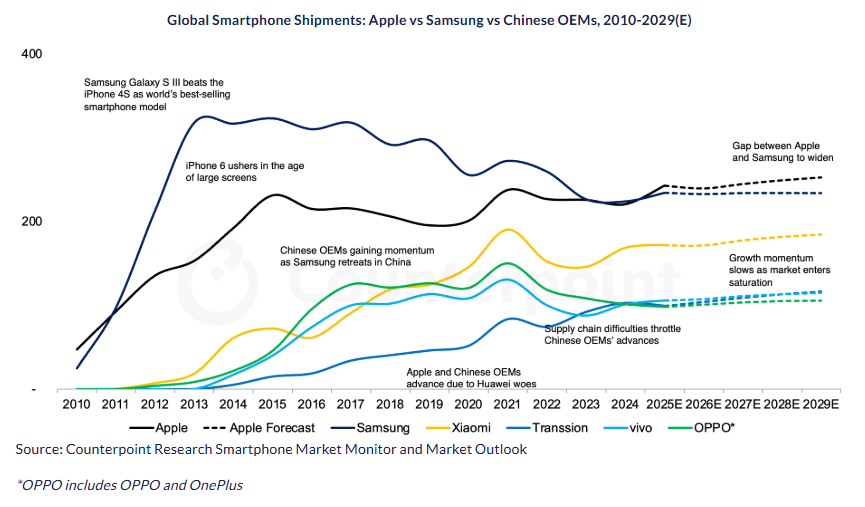

A tectonic shift is coming to the global smartphone market. According to the latest data from Counterpoint Research, Apple is set to surpass Samsung in annual smartphone shipments in 2025 for the first time since 2011, reclaiming the top spot after a 14-year run by the South Korean giant.

The research firm’s Smartphone Market Outlook Tracker paints a bullish picture for Cupertino, forecasting a global shipment share of 19.4% for Apple in 2025, narrowly beating out Samsung, which is expected to land at 18.7%. Even with Samsung expecting a respectable 4.6% YoY shipment growth, it will not be enough to hold off the momentum of the iPhone.

iPhone 17 and the replacement cycle drive Apple’s surge

Apple’s projected 10% YoY growth in 2025 is largely fueled by the strong global reception for the new iPhone 17 series.

“Beyond the positive reception for the iPhone 17, a major driver is the replacement cycle hitting its inflection point,” noted Counterpoint senior analyst Yang Wang. “Many consumers who purchased smartphones during the COVID-19 boom are now upgrading, supported by the growing second-hand iPhone market.”

Key drivers behind this massive forecast upgrade include:

- The iPhone 17 series momentum: Sales of the iPhone 17 lineup in the US were reportedly 12% higher than its predecessor, with China seeing an even bigger 18% bump in the first four weeks post-launch. The successful launch saw the new iPhone Air model replacing the previous Plus model, hitting a sweet spot with consumers.

- The upgrade inflection point: Senior analyst Yang Wang noted that a significant wave of consumers who bought phones during the COVID-19 boom are now due for an upgrade. This, combined with the 358 million second-hand iPhones sold between 2023 and Q2 2025, forms a “sizable demand base” expected to sustain iPhone growth for years.

- Macroeconomic tailwinds: Apple also benefited from a truce in the US-China tech war and lower-than-expected tariffs, helping streamline its supply chain efforts and boosting demand in key emerging markets.

The report suggests Apple will maintain this new leadership position through 2029, backed by future hardware like the iPhone 17e in H1 2026 and its first foldable iPhone expected by the end of 2026.

Samsung’s strategy leans on the A-series

While Samsung is expected to see a solid 5% shipment growth in 2025, the mid-to-low end of the market is where the company faces its biggest threat and where the African context becomes most relevant.

Samsung’s strategy to defend its turf relies heavily on a “strategic pivot for the A series,” featuring stronger specifications and competitive pricing. This is explicitly aimed at reinforcing its momentum in emerging markets, including India, Southeast Asia (SEA), and crucially for us, the Middle East and Africa (MEA) region.

While the global narrative focuses on Apple’s premium dominance, the local story across the African continent is less about the flagship battle and more about the fierce war for the budget and mid-range segments. In the African market, Chinese OEMs are not just competing with Samsung; they are looking to dominate it.

Counterpoint notes that major Chinese players, including Transsion (the group behind Tecno, Infinix, and itel, which command massive volume in markets like Kenya and Nigeria), Xiaomi, Vivo, and OPPO, are increasingly relying on overseas markets like MEA and LATAM for their future growth.

For years, Samsung’s A-series has been the gatekeeper of the mid-range experience, offering a recognizable global brand to aspirational consumers. However, the report highlights a shift where Chinese OEMs are pivoting to value. They are now moving away from solely volume-driven strategies and are investing heavily in premium devices, AI capabilities, and even foldables, directly challenging Samsung in the higher price tiers. Their strategy is to build on their massive low-end installed base by offering incremental upgrades into the mid-range.

The Korean giant’s defense rests on making the A-series more aggressive in terms of specs and pricing. The battle for the African consumer, who demands maximum value for their money, is a direct consequence of this global pressure. If Samsung fails to offer compelling enough devices in the KES 15,000–40,000 range, consumers are rapidly shifting to feature-rich and often cheaper alternatives from its Chinese rivals.

Interestingly, the report offers a potential short-term respite for Samsung. Supply chain jitters, specifically a growing shortage of LPDDR4 memory and skyrocketing component prices, are posing challenges for Chinese OEMs, “especially hurting the low-end smartphone segment.” This could throttle Chinese growth in 2026, which Counterpoint forecasts at only 1.7% YoY for the top four.

While Apple and Samsung are battling for global supremacy, the hyper-competitive pressure from Chinese OEMs in regions like ours is forcing all players to offer more for less. The ultimate winner in this regional skirmish will be the one who can best balance aggressive pricing with solid features, a fight that remains wide open in the dynamic MEA market.