Counterpoint Research has released its latest snapshot of the best-selling smartphone models for September 2025 across eight major markets, and the data paints a familiar yet nuanced picture: Apple’s iPhone 17 lineup is once again leading the global conversation, but regional preferences continue to shape which devices truly top the charts.

From the US and Europe to Asia’s biggest smartphone hubs, the report highlights how premium flagships and value-driven models are sharing the spotlight, depending on market dynamics, pricing strategies, and brand loyalty.

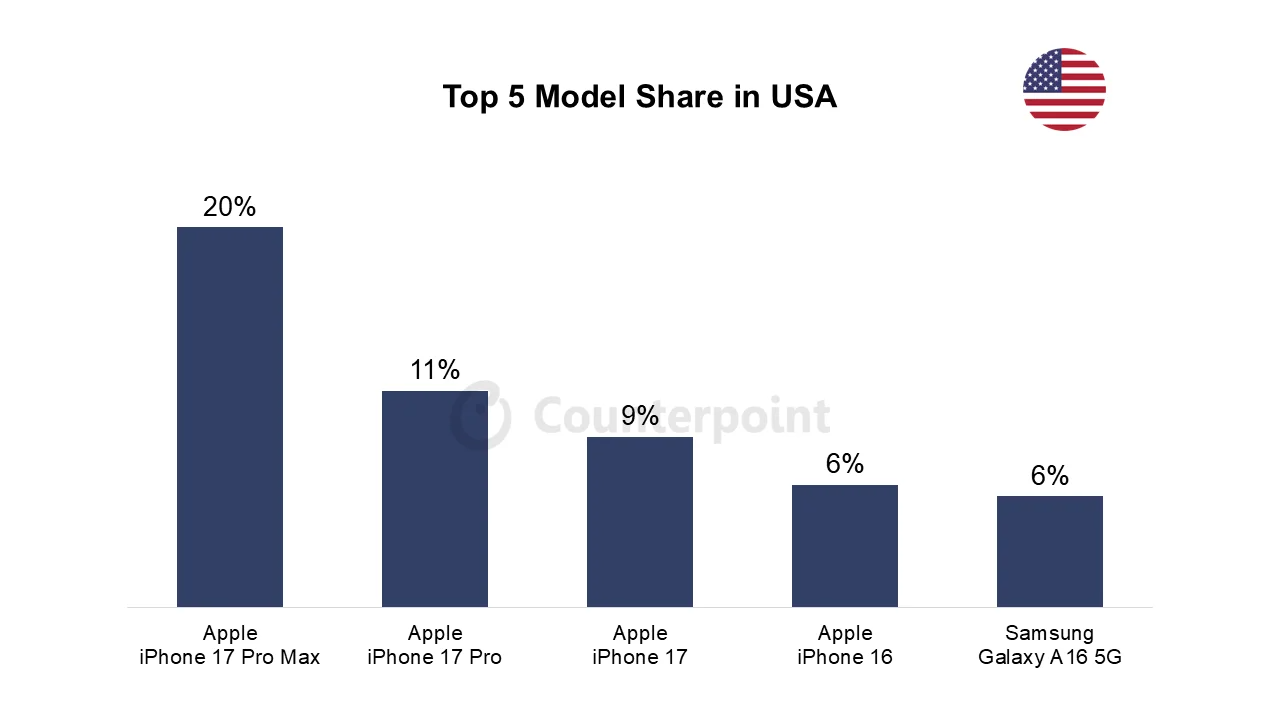

US: iPhone 17 Pro Max leads by a wide margin

In the United States, Apple remains firmly in control. The iPhone 17 Pro Max emerged as the single best-selling model in September, commanding a massive 20% sales share. It’s followed by the iPhone 17 Pro at 11% and the standard iPhone 17 at 9%, reinforcing Apple’s grip on all tiers of the premium segment.

Samsung’s Galaxy A16 5G only just made it into the top five with a 6% share, tying with the iPhone 16, which shows that even Apple’s previous-generation models still retain strong appeal.

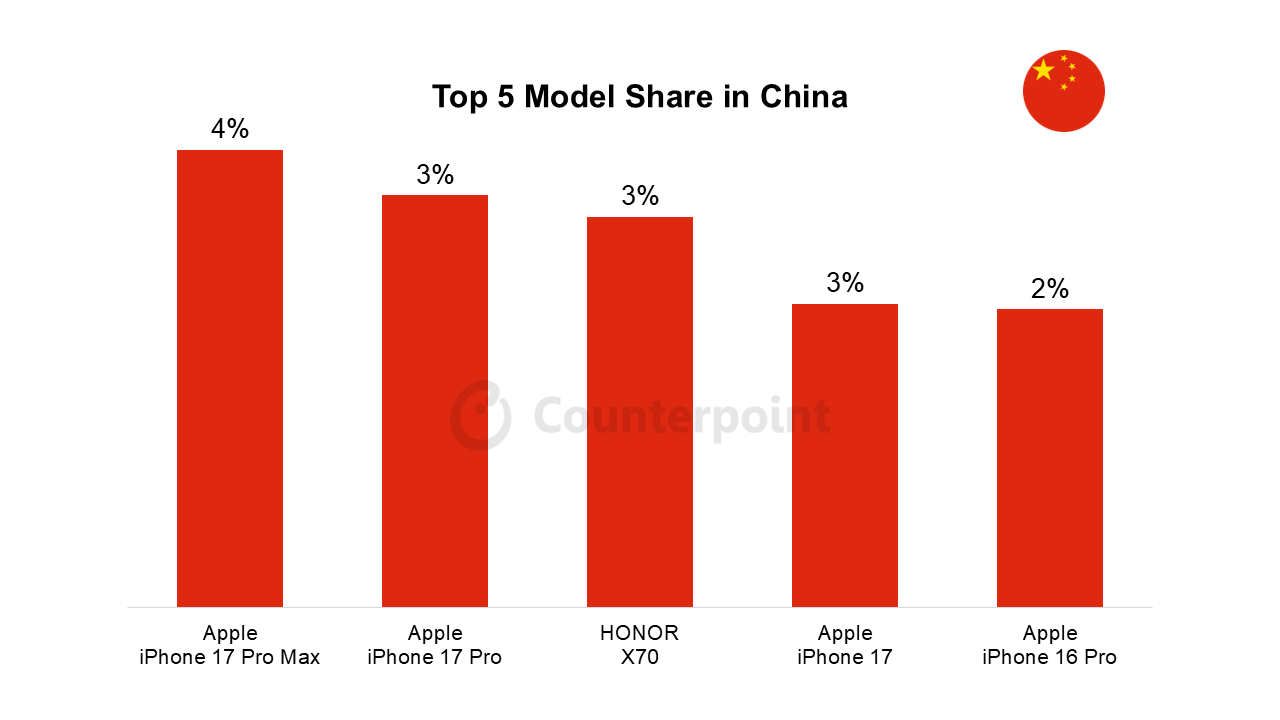

China: Apple leads, but competition is tight

China tells a more competitive story. While the iPhone 17 Pro Max still ranks first, its share drops significantly to 4%, with the iPhone 17 Pro and HONOR X70 close behind at 3% each. This narrow spread suggests a fragmented market where domestic brands continue to nip at Apple’s heels, especially in the mid-range category.

India: affordability shapes the leaderboard

In India, the chart looks very different. The iPhone 16 leads with a modest 4% share, but it’s surrounded by budget-friendly Android devices such as the Redmi 14C 5G, OPPO K13x 5G, and Vivo Y29 5G, all tied at 2%. Even the older iPhone 15 still holds a position in the top five, highlighting Apple’s gradual but steady growth in a price-sensitive market.

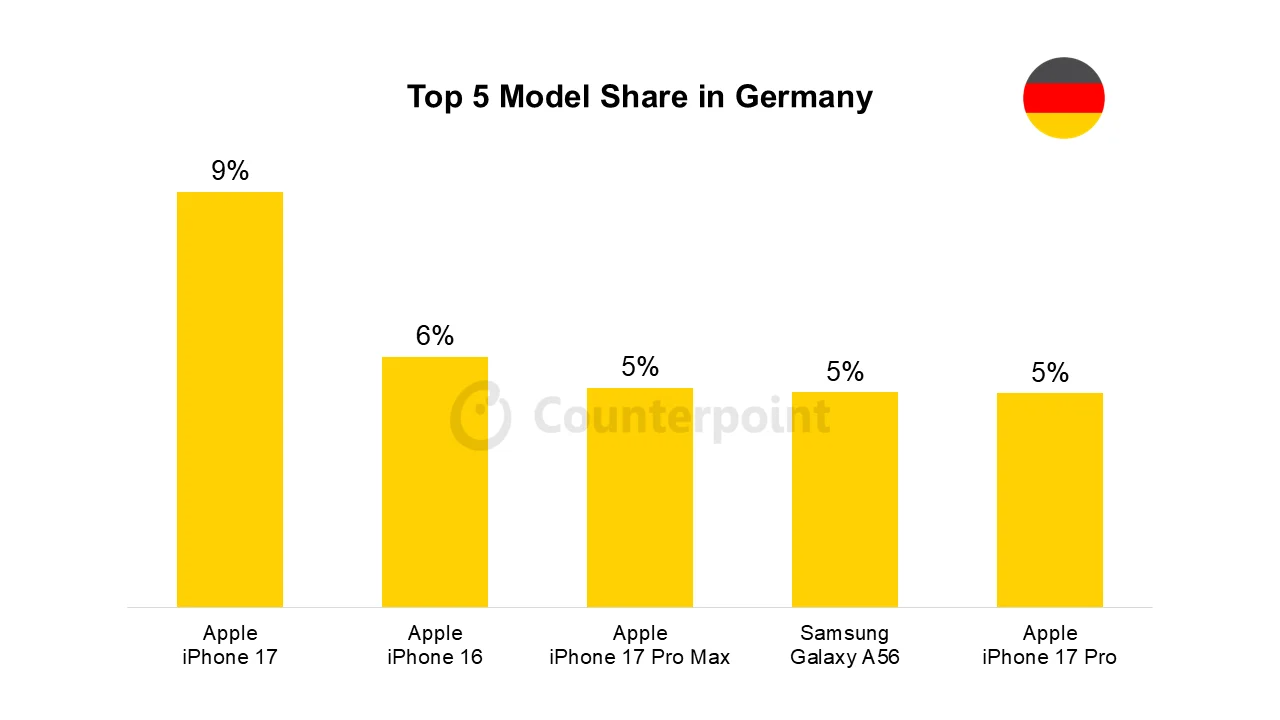

Europe: Apple’s stronghold with Samsung resistance

Germany and the UK both show Apple dominance, but with interesting variations. In Germany, the standard iPhone 17 tops the chart at 9%, followed by the iPhone 16 and iPhone 17 Pro Max. Samsung’s Galaxy A56 also features prominently, signalling continued demand for solid mid-range options.

The UK sees the iPhone 17 Pro and iPhone 17 tied for first place at 8% each, with the iPhone 16 and 16 Pro Max close behind. It’s a lineup that underscores Apple’s broad appeal across different price segments.

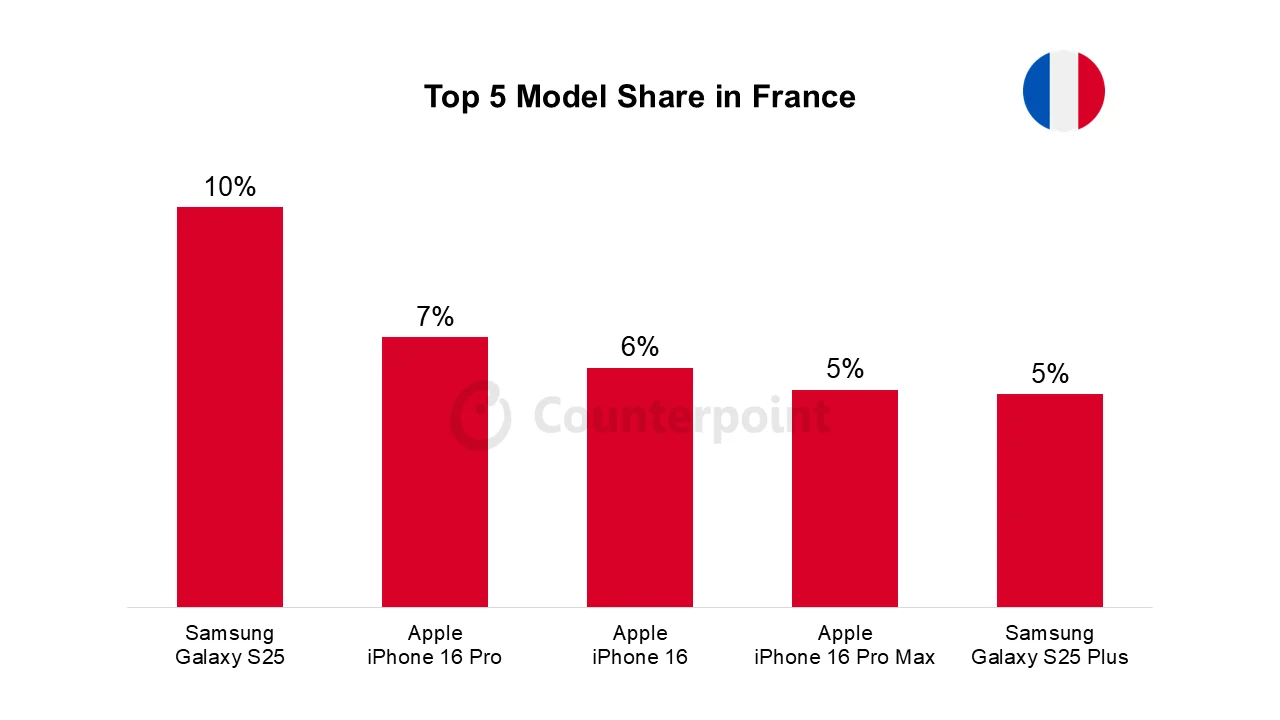

France, however, breaks the pattern. The Samsung Galaxy S25 takes the top spot with a 10% share, outpacing the iPhone 16 Pro and iPhone 16. The presence of the Galaxy S25 Plus also in the top five reinforces Samsung’s strong brand pull in the French market.

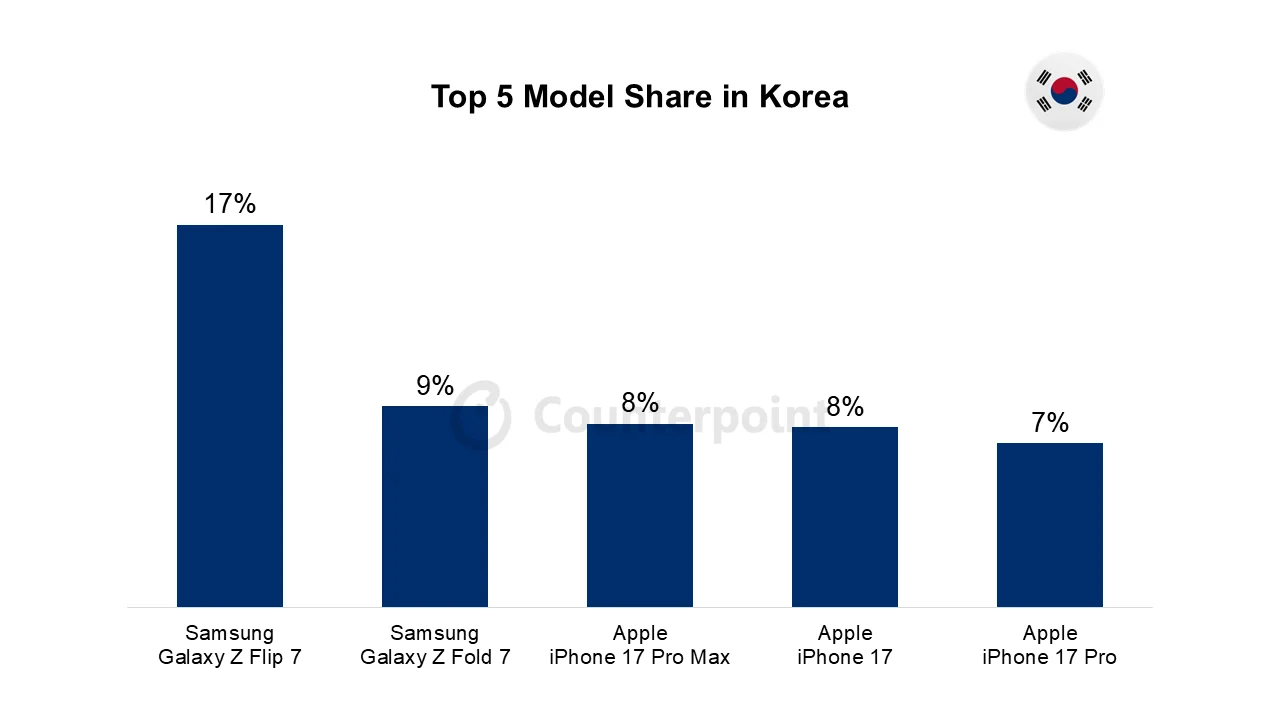

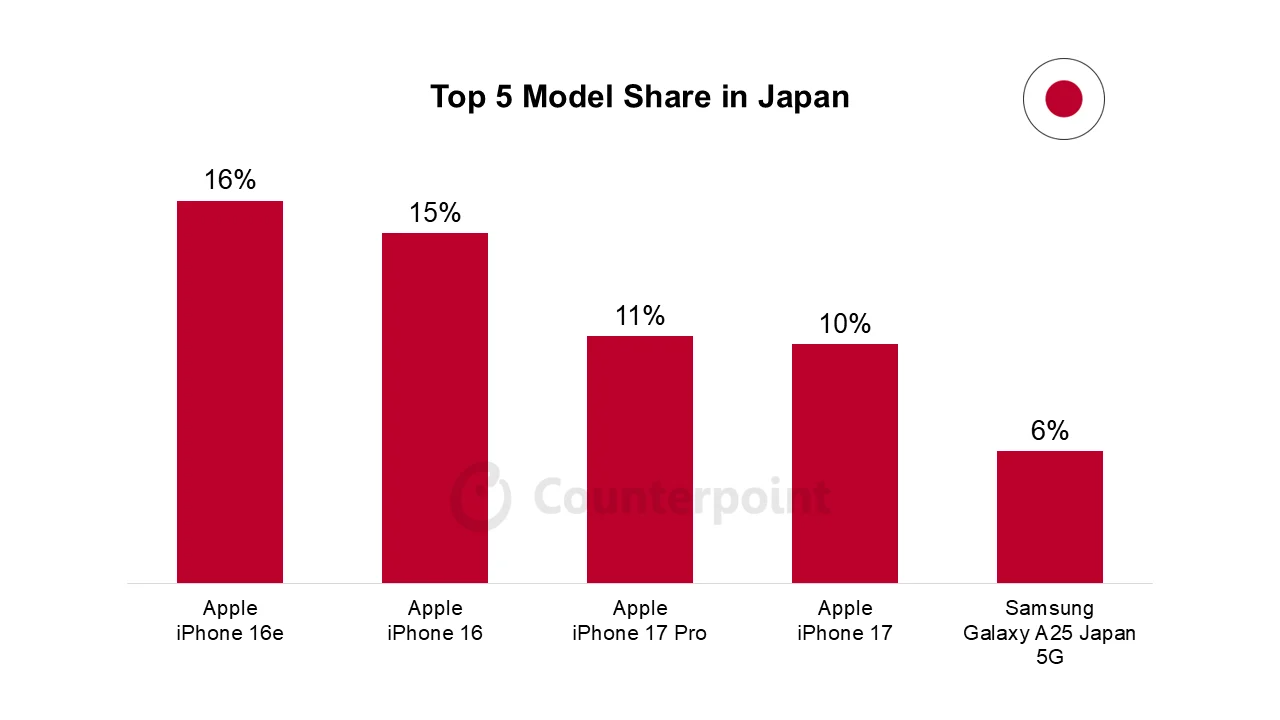

Korea and Japan: home advantage matters

Unsurprisingly, Samsung reigns in its home market of Korea. The Galaxy Z Flip 7 dominates with a commanding 17% share, followed by the Galaxy Z Fold 7 at 9%. Despite this, Apple still manages to place three iPhone 17 models in the top five, indicating healthy competition even in Samsung’s backyard.

Japan is another outlier, with the iPhone 16e claiming the top position at 16%, closely followed by the iPhone 16 at 15%. This suggests local pricing and model variations play a significant role in shaping purchasing decisions.

While Kenya isn’t directly covered in this Counterpoint report, the trends offer useful insight. Apple’s newest flagship models continue to dominate premium markets globally, but in regions where pricing sensitivity is high, mid-range and older flagship devices remain highly relevant. This aligns closely with Kenya’s smartphone landscape, where value-for-money Android phones often challenge more expensive iPhones for mass-market appeal.