Kenya’s capital markets regulator is continuing its quiet but deliberate push toward modernising financial oversight infrastructure.

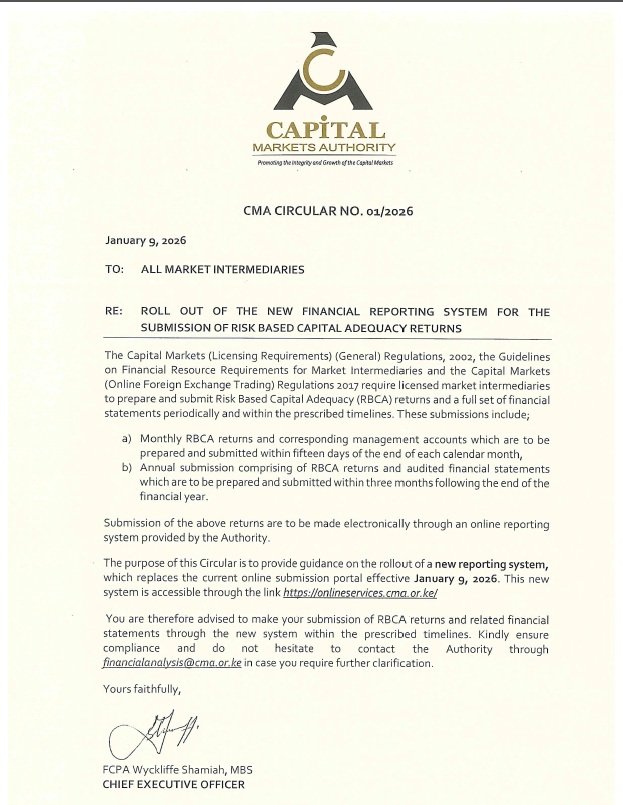

The Capital Markets Authority (CMA) has officially rolled out a new online financial reporting platform for the submission of risk-based capital adequacy (RBCA) returns by licensed market intermediaries. The system, which went live on January 9, 2026, replaces the Authority’s previous online submission portal and is now mandatory for all qualifying firms.

In a circular addressed to market intermediaries, the CMA said the new platform is designed to support the preparation and submission of RBCA returns, corresponding management accounts, and a full set of financial statements within the timelines prescribed by law.

Who the changes affect

In Kenya’s capital markets ecosystem, market intermediaries are licensed firms that sit between investors, issuers, and the broader market. These entities facilitate participation in activities such as trading in shares, bonds, and foreign exchange, while also offering advisory, custodial, and investment management services.

They include stockbrokers, dealers, forex brokers, investment banks, fund managers, investment advisers, authorised depositaries, REIT managers, and corporate trustees, among others — all of whom fall under the CMA’s regulatory oversight.

These are the firms now required to transition fully to the new RBCA reporting platform.

What the new system does

According to the circular, the system has been engineered to replace the existing reporting infrastructure and will enable licensed intermediaries to prepare and submit:

- Monthly RBCA returns alongside corresponding management accounting accounts, due within 15 days after the end of each calendar month.

- Annual RBCA returns together with a full set of audited financial statements, typically submitted within three months after the end of the financial year.

All submissions must now be made electronically through the CMA’s online services portal, marking the end of the old reporting system.

Beyond procedural efficiency, the Authority says the platform will play a central role in improving compliance levels across the industry. In that context, the CMA RBCA reporting system is positioned as both a supervisory tool and a compliance enabler, allowing the regulator to monitor capital adequacy trends more effectively while reducing friction for regulated firms.

Regulatory backing and compliance focus

The CMA noted that the changes are anchored in existing legal and regulatory frameworks, including the Capital Markets (Licensing Requirements) (General) Regulations, 2002, the Guidelines on Financial Resource Requirements for Market Intermediaries, and the Capital Markets (Online Foreign Exchange Trading) Regulations, 2017.

By digitising and standardising how RBCA and financial statements are filed, the regulator says it expects better reporting discipline, improved data quality, and more timely regulatory intervention where risks begin to emerge.

The push toward the introduction of a modern RBCA reporting platform suggests the CMA is laying foundational infrastructure for a more data-driven, transparent, and technology-enabled capital markets environment.

For market intermediaries, the immediate task is clear: ensure compliance with the new system. For the broader market, however, the shift signals a regulator increasingly willing to use digital tools to strengthen integrity and support long-term growth.

Here’s the full CMA statement: