Ride-hailing giant Uber has quietly stopped accepting Visa card payments in Kenya, marking a significant shift in how the company is adapting its payment infrastructure to local market realities. The change, which took effect in December 2025 and became widespread in January 2026, cuts off a payment option that was once central to Uber’s pitch to business travelers and expatriates in East Africa’s largest e-hailing market.

Uber confirmed the decision following an inquiry from TechCabal, attributing it to rising global payment processing costs. “Payment costs globally are on the rise, which impacts businesses and their consumers,” an Uber spokesperson said. “We regularly review our payment methods on a market-by-market basis to ensure we’re keeping costs reasonable while balancing any potential impact on consumer experience. We’ve taken this step as a result of this review process.”

The decision applies across both the Uber and Uber Eats platforms, according to Business Daily Africa, which reported that users in Kenya saw a notification stating: “Visa cards are no longer accepted by Uber in Kenya. Please add a different payment method.”

The Economics Behind the Move

The underlying economics reveal a fundamental restructuring of how global platforms are positioning themselves in African markets. Most Visa-based Uber rides in Kenya were previously processed through Uber’s global merchant-of-record structure, with transactions routed offshore. Each transaction carried multiple layers of costs including foreign exchange spreads, interchange fees paid to cardholders’ issuing banks, card scheme charges, and cross-border processing fees typically ranging from 1.5 percent to 3.5 percent of transaction value.

With global interest rates remaining elevated and currency volatility persisting, these accumulated costs became economically unsustainable. Local payment methods, by contrast, settle instantly in Kenyan shillings and avoid cross-border charges entirely.

Visa Seeks Resolution

Visa acknowledged the discontinuation and signaled its desire to restore the payment option. “We are aware that Visa cards are not currently being accepted by Uber in Kenya. We are in touch with the Uber team, and we are working to resolve this as soon as possible,” a Visa spokesperson told TechCabal. However, no resolution timeline has been announced.

M-Pesa Emerges as Primary Alternative

The primary beneficiary of Uber’s decision is M-Pesa, the Safaricom-owned mobile money service that dominates Kenya’s payment landscape. Unlike Visa cards, M-Pesa transactions settle locally without foreign exchange conversion, enabling Uber to offer direct debits from riders and near-instant payouts to drivers. The service also reduces chargebacks and disputes common with international card transactions.

Kenyans moved KES 636.2 billion ($4.93 billion) through mobile money in the 12 months to February 2025, with the M-Pesa agent network expanding from 320,182 to 394,853 and active subscriptions rising from 77.3 million to 84.6 million.

Available Payment Alternatives

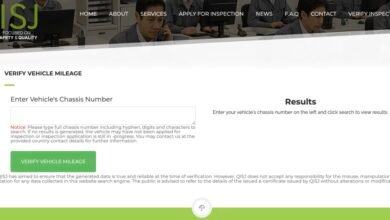

Uber users in Kenya now have access to several payment methods: Mastercard, cash, M-Pesa and PayPal. Notably, Mastercard continues to function despite facing similar cost pressures, suggesting either lower fees or different contractual arrangements with Uber.

Impact on Corporate Users and Historical Context

The decision creates friction for corporate riders who rely on credit cards for expense reimbursement, airline miles accumulation, and corporate float. Many corporate travel policies do not accommodate cash or mobile wallet payments, forcing these users to either adopt alternative payment methods or migrate to competitors.

The irony is that Uber’s current move represents a complete reversal from its early positioning in Kenya. In 2017, Uber partnered with Visa specifically to enable electronic card payments in Nairobi, marketing cards as a signal of trust and safety in a cash-heavy city. By 2023, Uber had integrated M-Pesa for trip payments, marking the beginning of its strategic pivot toward local payment rails.

Previous Billing Issues

The move follows months of complaints from Kenyan Uber users about Visa card payment problems, including double-charging for single trips, failed transactions with delayed refunds, inflated charges from improperly ended trips, and unauthorized deductions. While Uber did not explicitly link the Visa suspension to these billing issues, according to Business Daily Africa and Soko Directory, the transition to local payment methods may reduce disputes inherent to international card processing.

The decision signals how global platforms operating in emerging markets are increasingly optimizing their payment infrastructure around local rails rather than international card networks—a trend likely to accelerate as cross-border payment fees continue rising and local payment infrastructure matures across the continent.