Every year, Counterpoint Research drops the list of the top 10 best-selling smartphones globally. And every year, looking at it from Nairobi, Lagos, or Johannesburg feels like peering into a parallel universe.

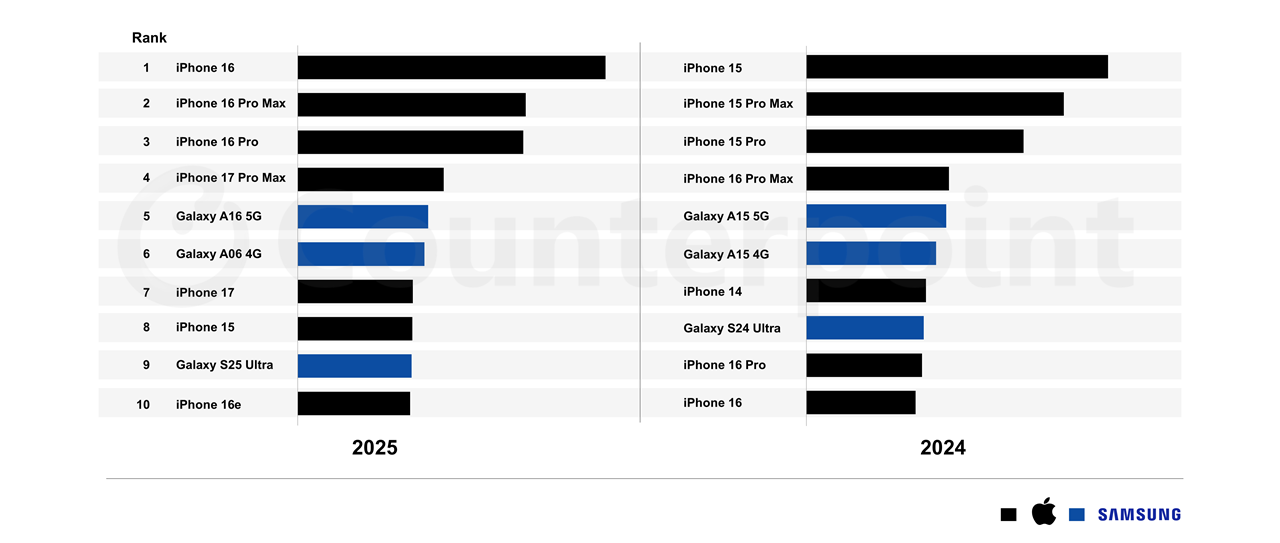

The newly released figures for 2025 are no different. Apple has, once again, swallowed the chart whole, occupying 7 out of 10 spots. The iPhone 16 is the king of the world. The Galaxy S25 Ultra is the king of the Android elite.

But let’s be honest: This list is broken. Or at least, it is becoming increasingly irrelevant to the reality of the world’s youngest, fastest-growing smartphone market here in Africa.

Every phone that has topped Counterpoint’s global Top 10 list since 2021 shares a quiet advantage that rarely gets talked about in African markets. None of them depend purely on upfront affordability. Instead, they are sold through systems that spread cost over time.

Monthly carrier plans, trade‑ins, buy‑now‑pay‑later schemes and thriving refurbished markets all do the same thing: they reduce the psychological barrier of purchase. A device that looks expensive on paper suddenly feels reasonable when its cost is broken into manageable pieces.

The “invisible” kings of the continent

If you walk down Moi Avenue today, you won’t see a sea of iPhone 16s. You will see Tecno Sparks, Infinix Notes, and Itel sturdy-bricks. Transsion Holdings (the parent company of Tecno, Infinix, and Itel) is an absolute titan in Africa, often commanding over 50% of the market share.

Yet, look at the global top 10 for the last five years. Not a single Tecno or Infinix phone appears.

Why? It’s a flaw in how the “game” is scored. Apple releases three or four phones a year; Tecno releases forty. Apple funnels millions of sales into a single SKU, skyrocketing the iPhone 16 to the top. Transsion, meanwhile, fragments its sales across dozens of localized variations. For instance, the global Spark 40 5G sells as a Spark Go 5G in India.

The result is a “Global Top 10” that rewards portfolio consolidation, essentially erasing the brand that actually powers the African internet. It paints a picture of a world obsessed with $1,000 flagships, completely ignoring the massive volume of sub-$150 devices connecting the next billion users.

Notably, ultra‑budget smartphones are excellent at driving first‑time adoption, but they struggle to anchor long‑term relationships. They are replaced rather than upgraded, swapped rather than committed to. From a global perspective, they also fragment into countless variations, each selling decently but none selling enough.

Without financing, a $90 phone and a $160 phone compete in the same mental space. Both are judged purely on immediate affordability. Financing changes that equation entirely. It turns a purchase into a commitment, and commitments are what create best‑sellers.

Samsung is the only bridge between two worlds

The only brand successfully straddling these two realities is Samsung. They are the diplomatic bridge between the Western “Blue Bubble” elite and the budget-conscious Global South.

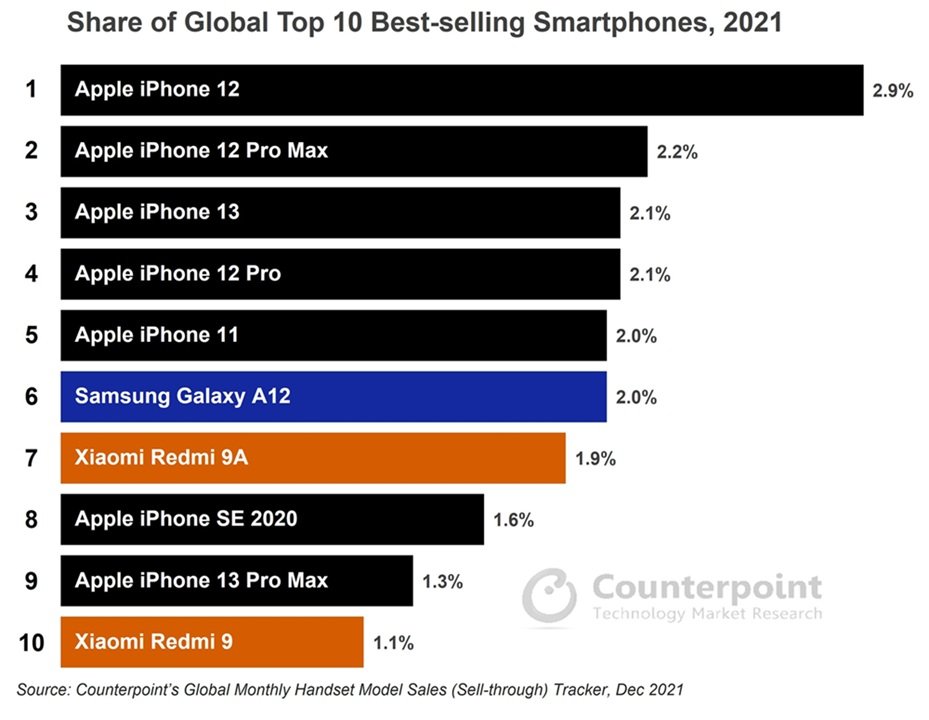

The data proves it. While the Galaxy S25 Ultra and the S24 Ultra before it wave the flag for the rich, the Galaxy A-series (A12 through A16) has been the stubborn, unkillable cockroach of the top 10 list for five years straight. It is the only budget Android phone that sells consistently enough globally to make the chart.

This is Samsung’s secret weapon. They have managed to make the Galaxy A16 the “default” Android phone for the world. It’s the Toyota Corolla of smartphones: reliable, available everywhere, and with just enough “premium” DNA to make you feel good about buying it.

Why 2026 looks scary for us

There is a buried lead in the 2025 report that should worry every Kenyan techie. Counterpoint predicts that in 2026, rising memory prices will “extensively impact” the entry-to-mid-price smartphone segments.

When memory gets expensive, Apple absorbs the cost since their margins are huge. But for budget phones? That cost gets passed directly to you.

This is the “poverty tax” of tech. If the price of RAM and NAND storage spikes, the successors to our favourite budget phones face a grim choice: either the price goes up, or the specs get slashed. We might see a 2026 where budget phones stagnate, forcing African consumers to hold onto old, cracked devices longer, slowing down 4G/5G adoption across the continent.

Can Xiaomi break the duopoly?

This leaves a massive opening for Xiaomi. The Chinese giant briefly cracked the code in 2021 with the Redmi 9 and Redmi 9A but has since vanished from the top 10.

However, their recent aggressive moves that include localized websites for Kenya, Nigeria and South Africa, and a renewed push into the continent suggest they smell blood. If Samsung is forced to hike prices due to the memory shortage, Xiaomi has a chance to swoop in as the “value savior.” But to get back on that global chart, they need to stop flooding us with confusing Note/C/A variants and give us one undisputed, globally available budget king.

The Global Top 10 is a fascinating look at what wealthy consumers in the US, China, and Europe are buying. But for Africa, it’s a reminder of the “digital divide.”

Until we see a Tecno Spark or Infinix Note fighting the iPhone for a spot on that list, the “Global” top 10 will remain a metric of Western luxury, not global reality.

What do you think? Does the global dominance of the iPhone surprise you, or does it just show how different our market is? Let us know in the comments.