Contrary to what most people think debt can be both good and bad. Factors may vary but bad debt is one that doesn’t give you back any interest once spent whereas good debt is one that repays itself and leaves you a small percentage to pocket.

Hopefully by the end of this article you’ll know which side you’ve accumulated because of the blurred lines extra money may cause

Brands/Apps

Gone are the days where one needed to fill a heap of paperwork to get a loan whether for an emergency or as an advance to your usual salary.

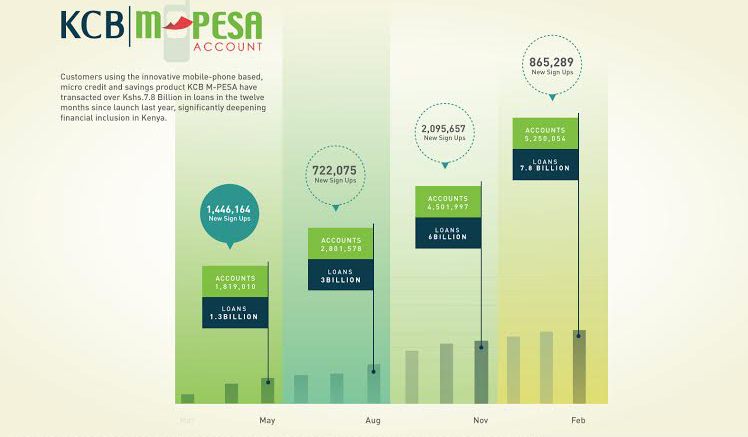

Since 2015, we’ve seen money lending apps such as: Mshwari, KCB Mpesa, M-Coop, Equity bank’s Equitel, Branch, Tala, Saidia just to mention a few grow, tremendously grow in both number of users and profit turn over.

Look at this for example, depicting KCB MPesa growth in a matter of months (2016)

Technology has definitely fanned up the wrong fire, resulting in heavy borrowing culture. But let’s appreciate it a bit:

Benefits/convenience

No paperwork

I mean all you have to do is download an app or visit your M-Pesa menu. For most apps, you instantaneously qualify for a loan. For some you have to wait for a week (bummer right).

Some sign ups like Branch require a Facebook login because one can have numerous emails, other require ID number and other personal details. Needless to say, you’ll have an account in minutes.

Short approval time

Approval time is down to between an hour and 24hrs. It’s safe to assume they check their records and CRB records to see if you’re a good citizen or a spoilt potato bringing rot to their profit!

Emergency!

Thankfully most of their processing systems are automated which means you can apply for a quick loan in the middle of the night whilst stranded and without anyone to call for cash.

I’m referring to moments you’re in need of cash for a cab home not more cash to drink (that’s not a real emergency) Definitely a life saver when at a supermarket/ petrol station with no wallet! They should make that a catch phrase: Saving face since…

Loan limit increase

I remember when I was an active borrower. That loan limit increase text gave me euphoria similar to winning the jackpot. Like camaaan, Bob chose me!

Cons

Aaaaand of course we have the ugly side of things!

Cuts through salary

In some cases such as Equitel, you could have the loan+interest cut directly from your salary before it even warms your bank account. Well that’s sadder than…. honestly I can’t think of anything more traumatic than that.

Pay back only to borrow again

This is subsequent to the previous point where you find yourself in a rat race of sorts, where you borrow Peter(Branch) to pay Paul (M-Shwari) but have James (Platinum creditors) on your tail.

CRB

Please recognize this abbreviation and have some respect for it. You think just a certificate of good conduct is important? Well woe unto you! The Credit Reference Bureau will pull out records of items you forgot you owed. Especially HELB.

Every time those university students go on strike claiming they need their money and how it’s their right; it’s comically a sheep strutting into an abattoir claiming it’s delicious and deserves every right to be slaughtered.

Do you know your credit score? You’ll just have to tender your application through a registered credit reference bureau in Kenya. You will have to pay Ksh. 2200 to get the certificate (which is valid for only a day so please get one when only necessary). Registered bureaus you can approach include:

- iCredit Info

- Metropol Credit Reference

- Credit Reference Bureau Africa Limited t/a TransUnion

If you want to be sure, you can get your credit report by simply registering with mobile based platforms. SMS your name to 21272 and pay Ksh. 50 to get an annual report free of charge.

So as you swim in the abundance you derive from borrowing, be wary. Start thinking of wealth instead of lifestyle.

Which side of debt are you? I personally stand clear of both because they have the tendency to screw you over in the end. All I’m saying is remember who’s the servant and who’s the master.

Feel free to comment below or email me on ndutah@tech-ish.com

How can I get my loan limits increased

Well, the paperwork may be missing for some, till you come across 1. that requires you to log-in via social media platforms, and I dont mean Google plus – Facebook etc – do they wish to send you friend a friend request ama?

The other one, you will need to tell them why you need the money, what you need it for, etc, those long questions you reach half way and exit the app 🙂

Hey Calleb, interestingly I haven’t seen any of them sending friend requests but I’ll be on the look out. For the tedious processes, it’s one way to filter out jokers. They rarely ask the purpose of the money, what they really care about is if you’ll pay back.