Safaricom’s Fuliza credit facility, KCB Bank and Britam Insurance are among the top preferred brands in Kenya in the third quarter of 2021. This is according to Ajua’s quarter 3 customer loyalty benchmark report. Ajua describes itself as Africa’s first Integrated Customer Experience company for businesses on the continent.

The report, which is available on Ajua’s website details some of Kenya’s list exceptional brands in 9 industries from Banking to Healthcare providers. These, the company explains, are brands that customers want to continuously use, and give business because they genuinely focus on listening to their customers’ problems, empathising with them and most of all, eliminating their problems.

The ranking in the report used the NET Promoter Score (NPS), a globally recognised customer experience metric.

Here’s a summary from a few of the industries highlighted in the full report.

Banking Industry:

In the third quarter of 2021, Kenyan consumers in the banking industry mainly looked at customer service, interest rates and convenience as the three main reasons to stay loyal to their banks, says Ajua.

These were the top three banks as rated by Kenyans:

- KCB Bank – NPS score of 36

- Co-operative Bank – NPS of 35

- Equity Bank – NPS of 21

One delighted KCB Bank customer shared, “They are always concerned with their clients and their service is always the best.”

When asked why they preferred Cooperative Bank one customer shared, “Low-interest rates, readily available loans even to small scale retail business.”

Speaking on convenience an Equity Bank customer shared, “The bank is very convenient and affordable, it is also in small towns whereby even people in rural areas can get services easily.”

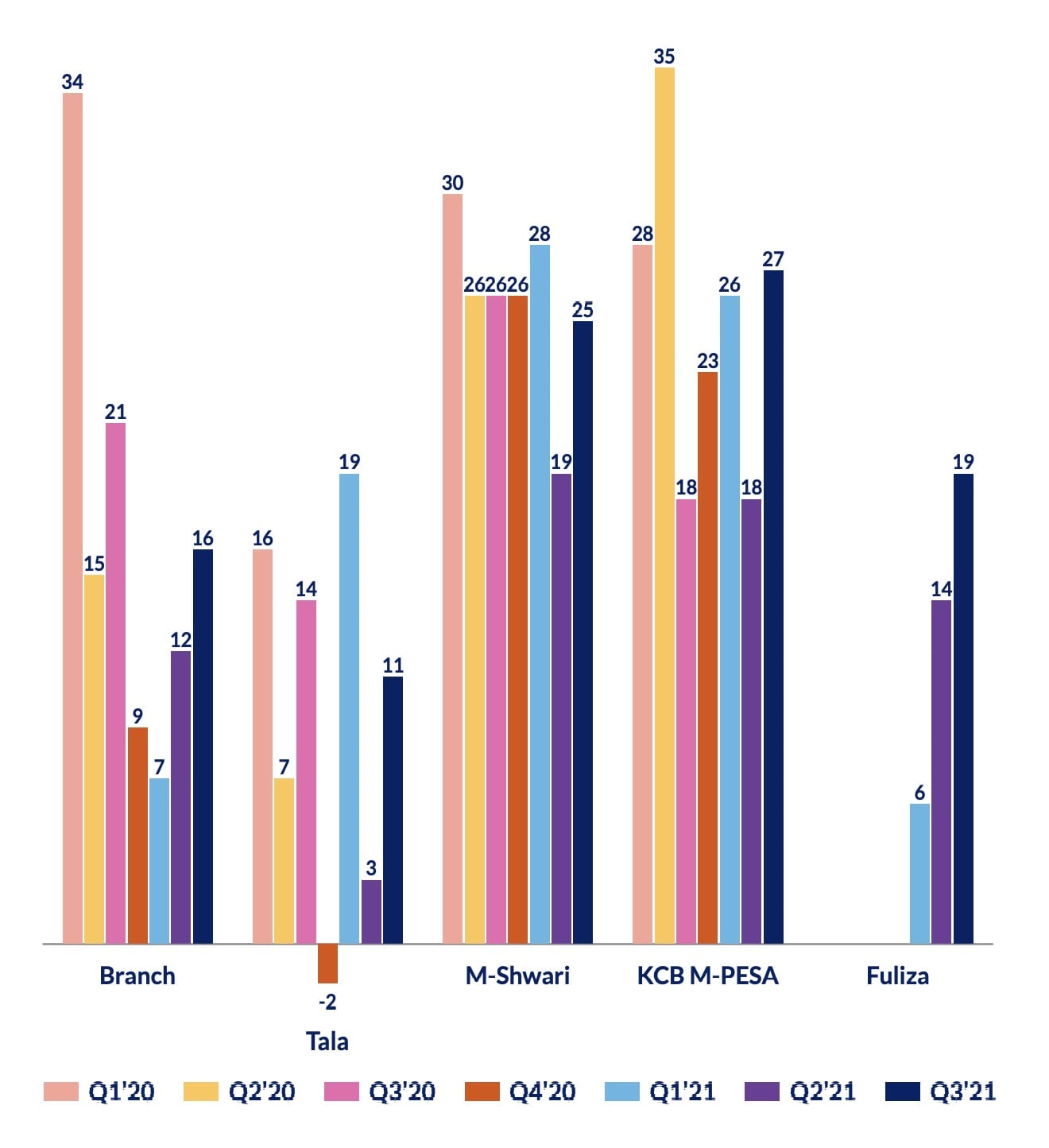

Mobile Money Lenders:

The top 3 preferred mobile money lenders in Kenya in Q3 were:

- KCB M-Pesa – NPS of 27

- M-Shwari – NPS of 27

- Fuliza – NPS of 19

Ajua says consumers in this industry chose a lender based on their interest rates, repayment periods and speed and efficiency.

Speaking on speed, one KCB-MPESA customer remarked, “Loans are processed instantly and have reasonable interest rates. Additionally, they are patient and the limits begin with a large amount.”

One M-Shwari customer shared, “Mshwari provides you a certain due amount at any moment without providing you reasons or terms, and if payment is delayed once processed, you can still acquire the loan without delays.”

A Fuliza customer mentioned “They give the loan instantly after the lender has been approved to be eligible for the loan. The service is best when maybe you are in an emergency since they are fast and easy in lending and the charges aren’t high.“

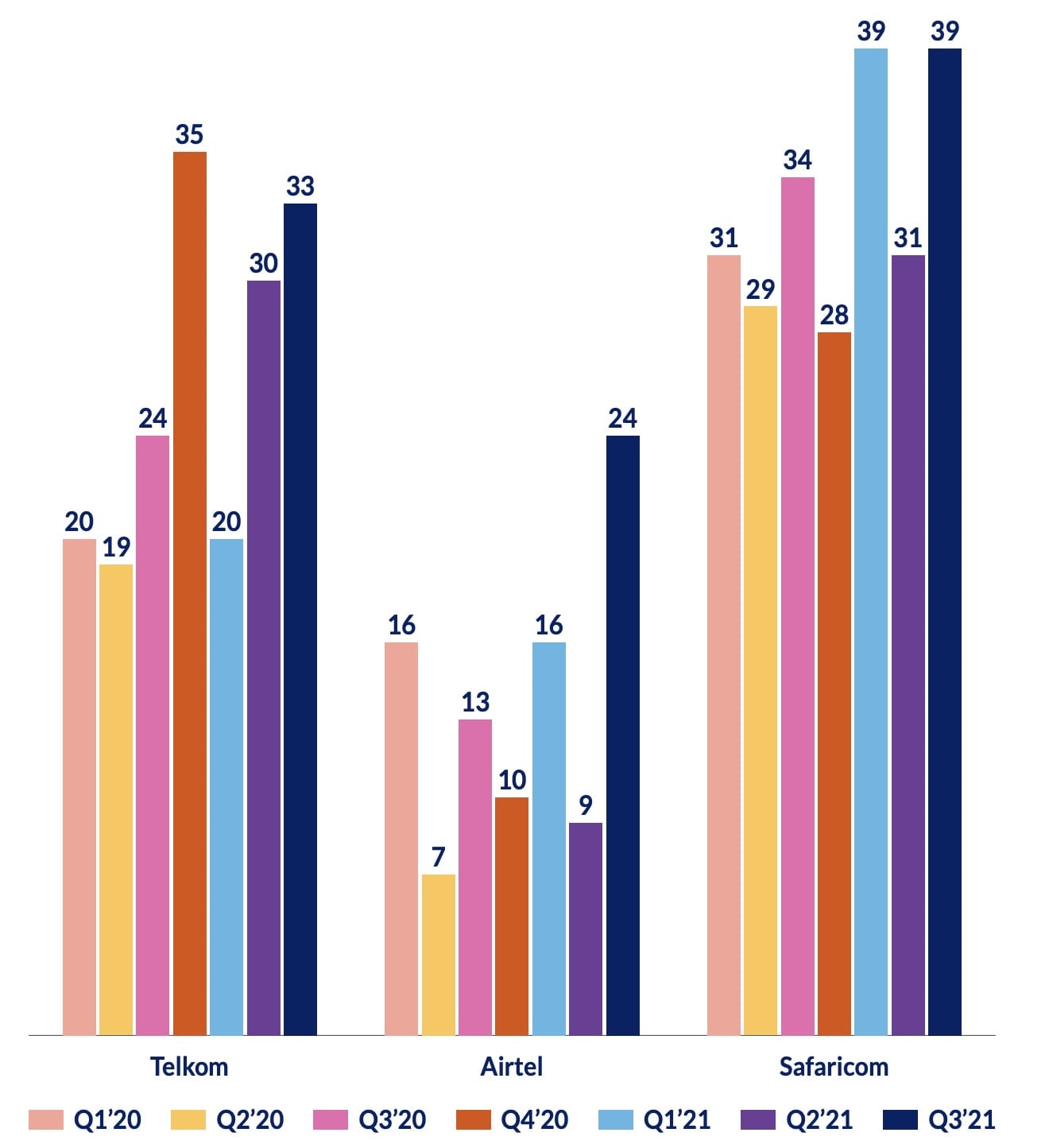

Telecommunications Industry

The top 3 preferred telcos in Kenya in the third quarter were:

- Safaricom – Ranked best in customer experience with NPS of 39

- Telkom Kenya – NPS of 33

- Airtel Kenya – NPS of 24

Ajua says customers in this industry opted to subscribe to a provider largely due to their network coverage, customer service, speed and efficiency.

“Safaricom is more responsive, fast money transactions, good customer service, I mostly use it for transactions, like M Pesa and mobile banking, It’s understandable; it gives out loans based on fuliza and other factors,” said one happy customer. “The cost at which they charge the Internet bundles is inexpensive and helpful to the people who have a low income.” one happy Telkom customer remarked. “Their products, like as minutes and bundles, are inexpensive and accessible.” one Airtel customer shared.

Insurance Industry

These were the top 3 preferred insurance companies in Kenya in the same period:

- Britam Insurance – NPS of 30

- UPA Old Mutual – NPS of 22

- Jubilee Insuarance – NPS of 19

The main reason Kenyans picked an insurer were, customer service, premiums and the speed and efficiency of dispensing claims.

“Britam is simple to join, has a reasonable monthly contribution and is accepted in many facilities.” Said one happy customer. “They are transparent, it has a good turn over, it has enough clients, it takes less time when processing the money to clients in case of the death.” one UAP Old Mutual Insurance mentioned. “Their life cover policy is favorable. Have never had any issue with them for the four years i have been with them.” shared one delighted Jubilee Insurance customer.

Ajua says consumers in Kenya are more empowered than they’ve ever been, they’ve got options and the web has made the markets even more competitive. For businesses to make it, they can no longer afford to give services adequately, they now have to be intentional and go the extra mile to get customers to actually love their brand.