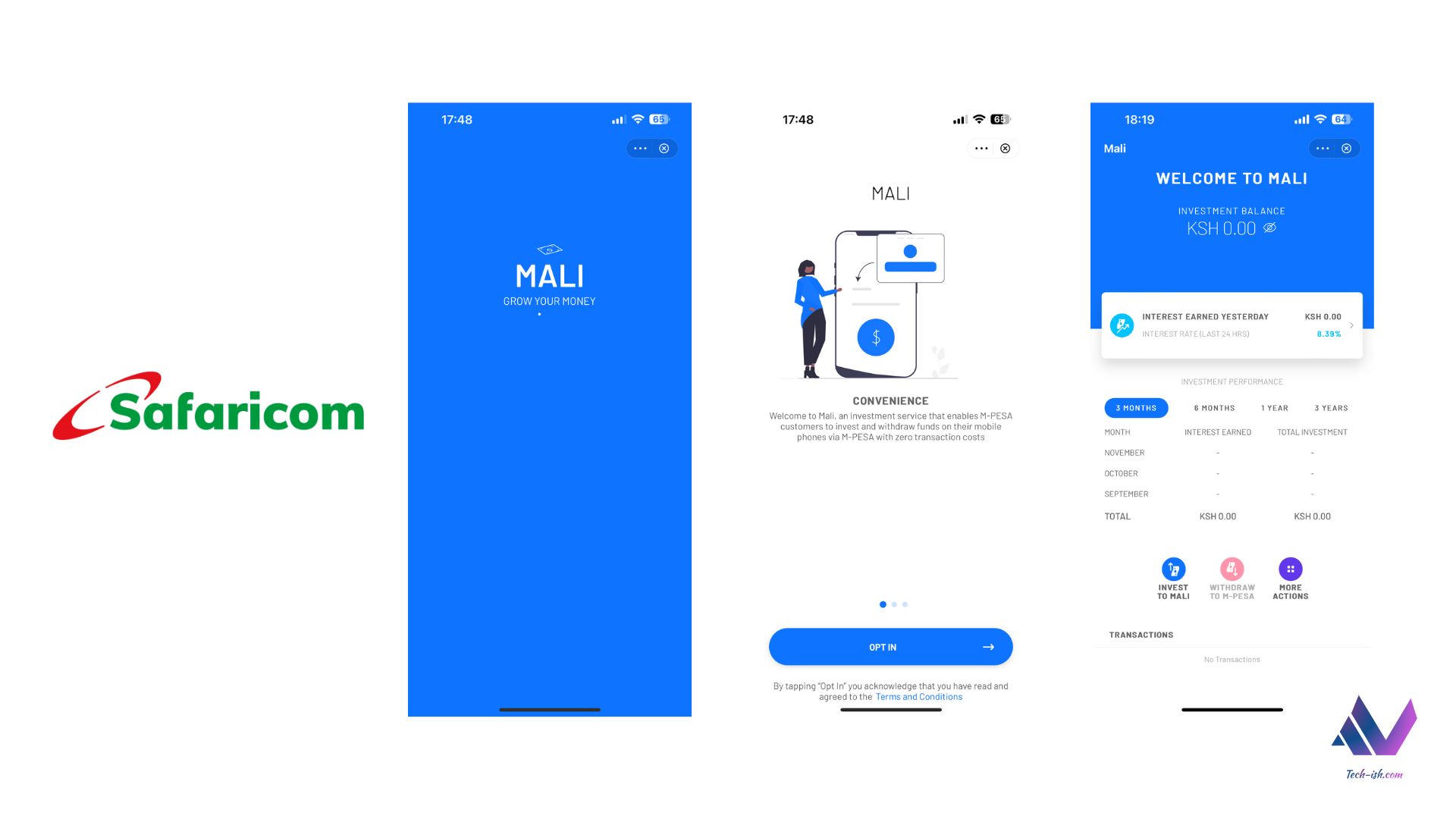

Safaricom has an investment product I’ve been using for a while now called Mali. I’ve not seen any push from the company into getting customers, but I think more people should try it out.

In 2019, I wrote an article about the product, explaining it – very simply – as follows:

…Mali is a vehicle. We are investors. We fill the vehicle with money… and then the driver goes around investing our money in different things while earning us interest.

Mali – we’ve since learnt – is a partnership between Safaricom, Genghis Capital, the fund manager, KCB Bank, the trustee, and SBM Bank, the custodian.

When the product went live, I wrote this article, explaining the relationship and fees expected. I’ll talk about those fees a little more down below.

I am writing this third article on Mali because I want to share my experience with the product after using it for a while now (over two months). If you’ve tried it out, let us know in the comments section, or on our socials, what your experience has been like.

Take note that this isn’t investment advice. Do your due diligence on where best you should place your hard-earned monies. These are only my opinions after using a product.

Money Market Funds:

I don’t think of myself as someone with an investment mind. I’ve never invested in anything – well apart from this website. And I have close to zero knowledge on money market funds, buying of shares etc.

Not for lack of trying though. I’ve read lots of articles, investment opinion and advice from different sources. The problem is it all sounds so hard, and the procedures are all but a hassle for returns that many may feel to be a gamble.

That’s why Safaricom Mali just makes sense.

What I love about Mali:

- Takes away the hassle

- Immediate deposits and withdrawals

- Simple, easy, straight to the point user interface

- Free

Zero Hassle:

Opening a Safaricom Mali account is a few simple clicks on your M-Pesa App, and you’re good to go. There’s nothing you really need to understand apart from how interest is earned, and how to deposit and withdraw.

Also, you don’t need extra apps on your phone. And you can always see what interest you’ve earned within 24hrs straight from the mini-app.

Simple deposit and withdrawals:

Depositing and withdrawing from Mali is immediate, and free. This is a big plus when you compare it to many other funds in the country which may take hours or days. While some may take it as a negative, being able to quickly and easily access your money is a huge plus for many Kenyans who don’t have huge earnings to put aside.

Easy User Interface:

The mini-app isn’t complicated. You see your balance, you see your interest earned, and you see how to quickly deposit and withdraw.

If you don’t have a smartphone, or don’t want the app, well *334# is simpler. You also get SMS prompts for your transactions.

It’s not all roses though. Here are some problems I’ve experienced with the app include:

- Not showing balance – this happens quite often and I resort to *334#

- Not being able to withdraw – this has happened a couple of times this month. The fix is just waiting.

- App taking very long to fully load.

Free:

This is what’s still confusing even to me. So we already know deposits and withdrawals are free. But it also seems that the fees mentioned in this article are also kind of hidden already from the customer. So when you see your interest earned, whatever fees that should be deducted will be deducted and the remainder added to your total balance. (This portion will be updated with clarification once that’s received.)

So say, for example, you have KES 1,000 invested and you made KES 5 interest. You will see your balance as KES 1,004.2.

Interest rate in January:

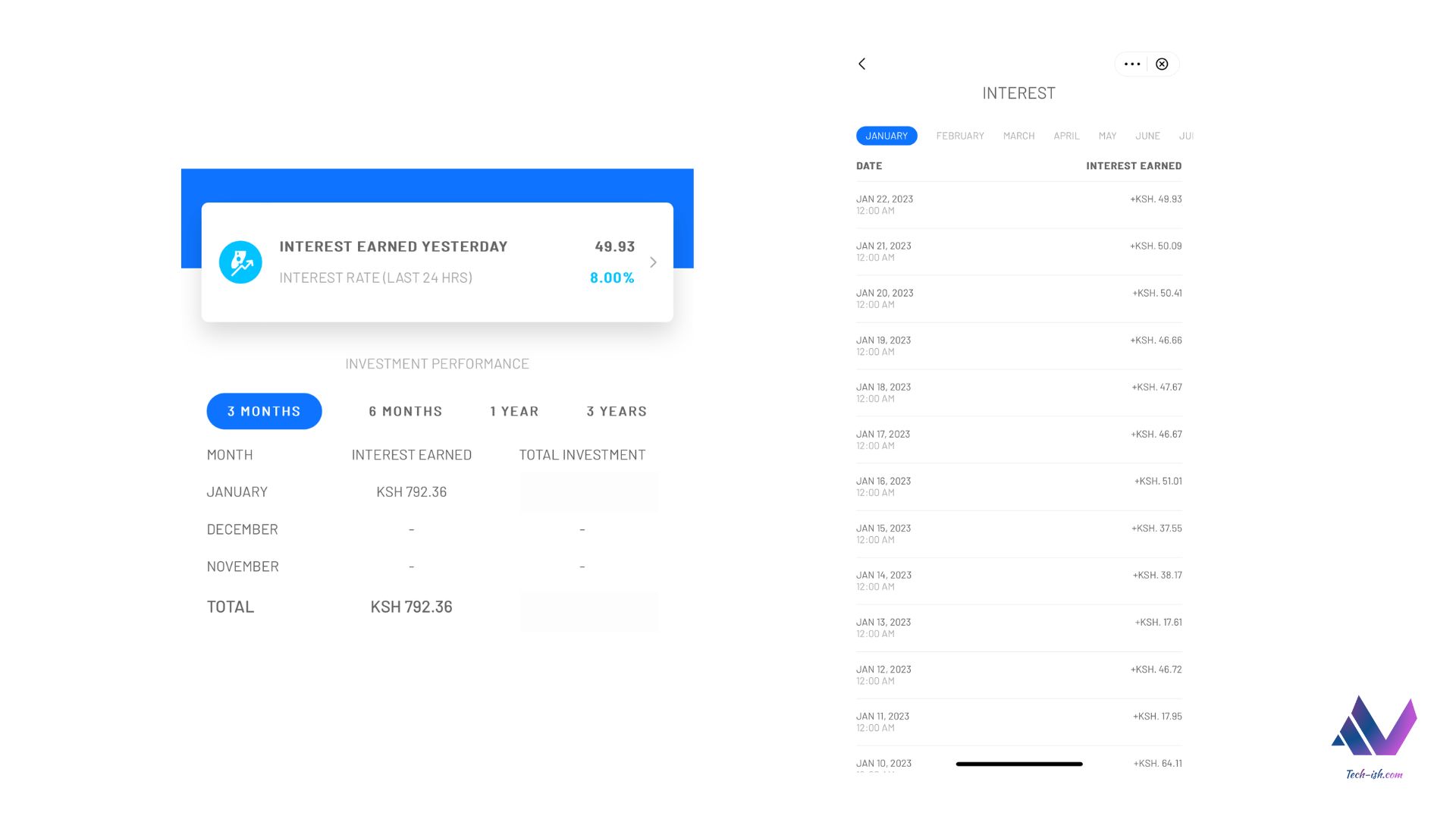

The interest from this tweet is the reason for this article. Down below, I will attach a screenshot showing interest earned in the first 22 days of January. Note that the principal amount invested has been changing as I deposit and withdraw randomly.

I think making these amounts per day is better than making nothing at all. I don’t know if the interest rates stand to improve with more people joining though. It will be interesting to see what sort of developments both Safaricom and Genghis make to the product in the coming months.

Risks:

From the conversations on the Tweet embedded above, the biggest question received was: What are the risks?

As far as I am aware, your principal investment should never be lost. However, this article will be updated with facts if we get a sit-down with the Safaricom Mali team. So, do share any questions you may have on the same.

What could be better:

- Mali is limited to KES 300,000 investment. The Central Bank should find a way to allow higher investment for those who can manage it.

- The fees are hidden to customers, which makes it a little hard to know exactly how much goes to taxes and fees. That should be made very clear. There’s so much space on the app for that data.

- You cannot see data for previous months. That’s why I have only managed to show January stats. I wish I screenshot November and December 2022 data.

- There should also be disclaimers on all the possible risks that customers should be aware of.

This article is for informational purposes only and does not constitute financial or investment advice.

enjoying the product kudos

Am really interested, but am yet to understand the withholding tax on investment amount. How does it work?

Good job ?

Thanks! This is helpful information!