Insights At a Glance:

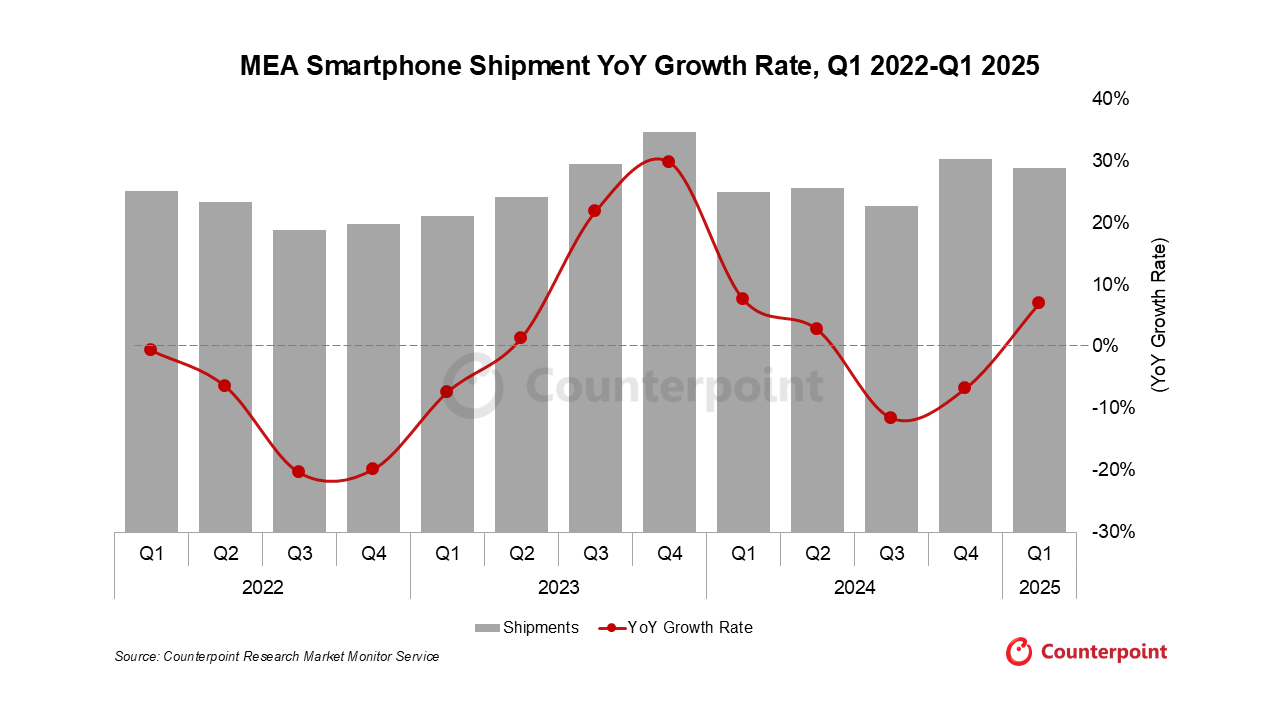

- MEA smartphone shipments grew 7% YoY in Q1 2025, driven by festive demand, easing inflation, and strong sales in the budget segment, especially across Africa.

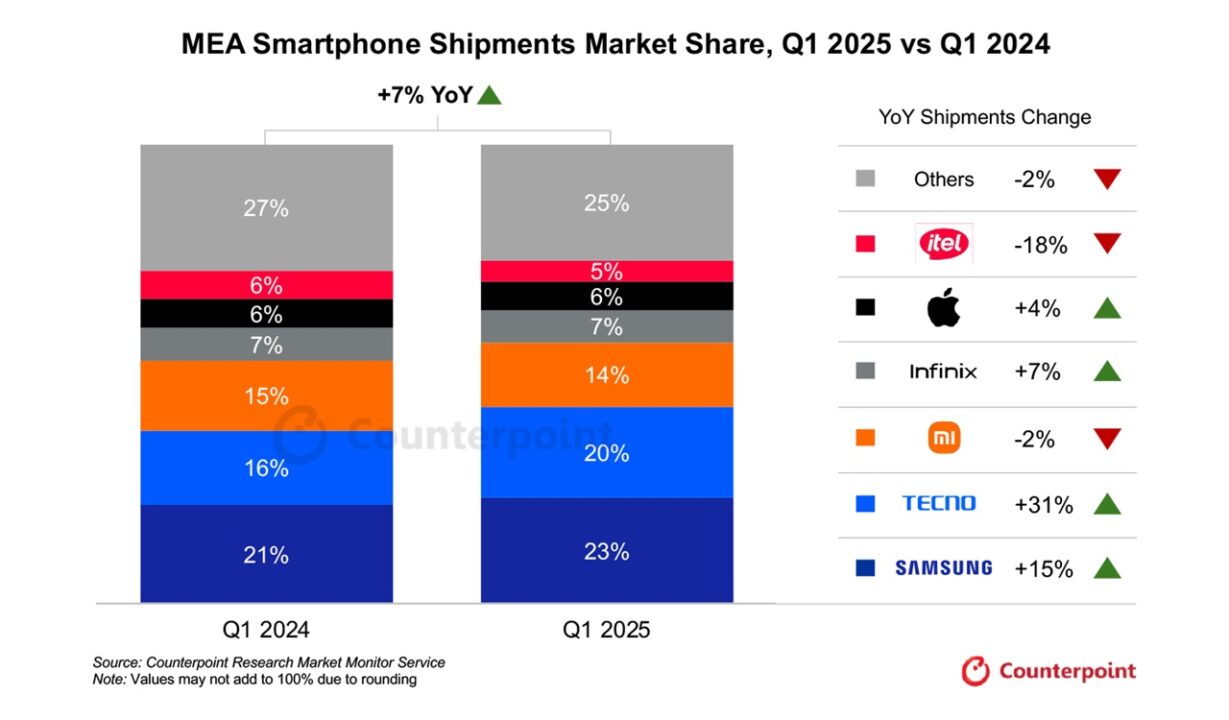

- Transsion led with a 32% market share, as TECNO surged 31% YoY; Samsung grew 15% by trimming its lineup and focusing on mid-to-premium phones; Apple rose 4%, thanks to the new affordable iPhone 16e.

- 5G and OLED adoption hit 33% and 42% respectively, reflecting rising demand for more advanced, big-screen devices even in price-sensitive markets.

The MEA smartphone market — that’s Middle East and Africa, in case you’re new here — just got its groove back. After two quarters in the red, Q1 2025 closed with a 7% year-on-year shipment growth, according to Counterpoint Research. It’s a small number on paper, but a big signal that the market’s back in motion — and Africa is playing a starring role in that rebound.

Let’s walk through who won, who wobbled, and what’s fuelling this uptick.

Transsion Group is Still the People’s Champion

If there’s one constant in African smartphone life, it’s Transsion Holdings. With its trio of brands — TECNO, Infinix, and itel — Transsion scooped a 32% market share, up from 29% last year.

- TECNO was the real MVP here, jumping 31% YoY, thanks to its bigger push in the mid-range space. More promotions, stronger retail presence, and just generally better phones helped it ride the wave of demand.

- Infinix gained some ground in the low-end, but struggled to break through the noise as competition heated up.

- itel, meanwhile, had a rougher quarter, except in the ultra-budget $50–$74 bracket, where it still holds a dominant 52% share. Not bad, but it’s clearly facing some heat.

With other Chinese brands like Realme, Oppo and Vivo eyeing the region, Transsion’s house might need some internal sorting — especially where TECNO and Infinix overlap.

Samsung: Sharper, Slimmer, Stronger

Samsung had a 15% YoY shipment growth, and here’s what’s interesting: it did that by cutting back its portfolio. From 103 models last year to 76 now, Samsung focused on what works — namely, the A series and the $400+ premium space.

It’s also doubling down on Saudi Arabia and the UAE as regional hubs — smart move, considering how connected those markets are to the wider MEA region.

Xiaomi: Budget Play, Mixed Results

Xiaomi saw a 2% dip in total shipments, but the story’s more nuanced. It shrunk its model lineup (from 96 to 74) and leaned hard into the low-end. The result? A 27% YoY jump in LTE phone sales, especially in the $50–$99 bracket.

The catch? Average Selling Price dropped 12%, which isn’t great for margins — but it did help Xiaomi claw back volume in places where Transsion dominates. Mid-range competition is heating up, and Xiaomi’s clearly not out of the fight.

Apple: Quiet but Steady

Unlike last year, Apple grew a modest 4% YoY, but let’s be real — that’s impressive in a region where $1,000 phones aren’t exactly flying off shelves. The secret sauce? The new iPhone 16e, starting at $599, hit the sweet spot in MEA markets. Throw in new Apple Stores, tourism-fueled sales in the Gulf, and flexible payment plans, and Apple’s managing to stay relevant — even in a tough price-sensitive zone.

So, Why the Growth?

Counterpoint credits a few major forces behind the 7% spike:

- And let’s not forget the digital shift: more Africans are using their phones for everything from gaming and streaming to online banking and gig work.

- Festive demand from Ramadan and Easter lined up perfectly with wider device availability.

- Lower inflation gave consumers a bit more spending room.

- Budget phones — especially those under $100 — got genuinely better, with 5G and OLED adoption jumping to 33% and 42%, respectively.

The bottom line? MEA isn’t just recovering — it’s leveling up. And while brands battle it out for market share, consumers are no longer just buying what’s available. They’re buying smarter, faster, and bolder.