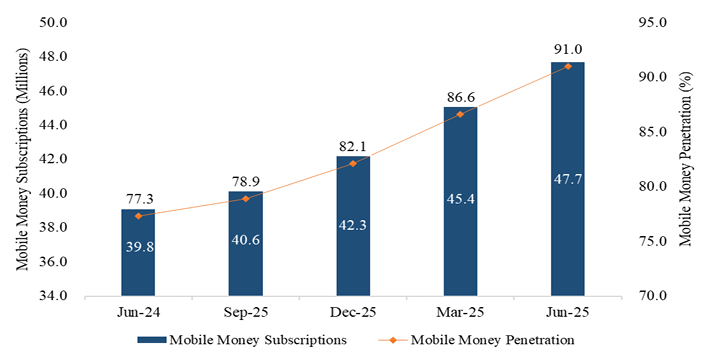

If there was any doubt that Kenya is the home of mobile money, the latest CA stats have settled it once and for all: mobile money penetration now stands at 91%.

As of June 2025, there were 47.7 million mobile money subscriptions, up from 45.4 million in March. Interestingly, Kenya has more SIM cards than people, which implies that not every SIM card is registered and/or actively uses mobile money.

Agent networks also keep expanding, hitting 453,480 registered agents nationwide. Compare that to 415,163 in March — that’s more than 38,300 new agents in just three months.

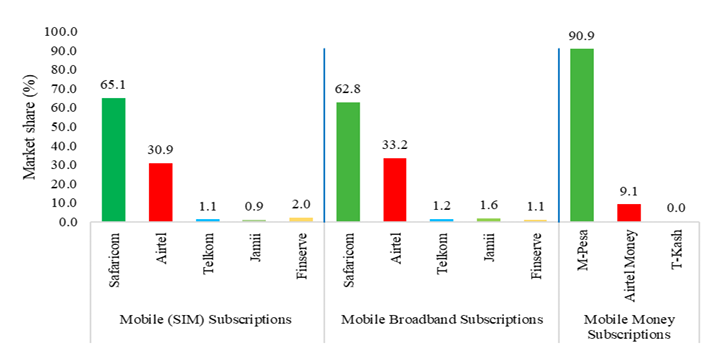

This isn’t just about sending and receiving money anymore. Mobile wallets are now savings accounts, credit lines, insurance platforms, and even investment tools. Safaricom’s M-Pesa remains the giant with a market share of 90.9% in June 2025, up from 90.8% in March. This is the company’s first uptick after steady declines, while Airtel Money held at 9.1%, a huge jump from 2022 when it had only 3.1%. Quick maths should tell you that these two are the only players currently in the Kenyan mobile money industry, with T-Kash absent.

The growth also reflects shifting consumer behavior. Post-COVID, cash is increasingly seen as risky or inconvenient. Why carry wads of notes when you can pay via till or Pochi la Biashara? But there’s also a caution here: with such deep penetration, competition for transaction volumes is fierce. Expect to see more discounts, zero-fee transfers (Airtel Money is already doing this), and bundling of mobile money with data or calls.

For consumers, it’s a win. For regulators, it’s a headache, especially around fraud, consumer protection, and digital credit abuse.

Either way, one fact is clear: in Kenya today, cash is optional. Mobile money is essential.