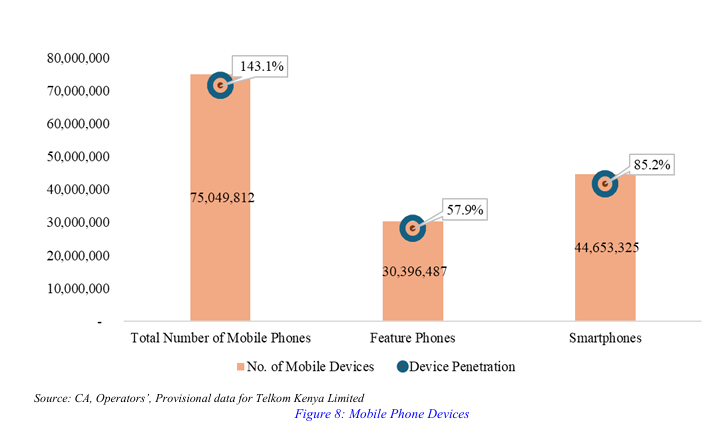

Kenya’s mobile device and data economy continues its upward trajectory, with the latest CA sector statistics showing that the country now has 75 million active mobile devices connected to networks. That translates to a device penetration rate of 143.1%, reaffirming Kenya’s position as one of Africa’s most digitally connected nations.

Smartphones account for 44.6 million devices, up from 43.7 million last quarter, representing 85.2% penetration. Feature phones remain surprisingly resilient at 30.4 million units, up from 29.5 million in the period ending June 2025, driven by device financing and strong demand in rural and low-income markets. This balance between high-end smartphones and feature phones helps explain the nuanced traffic patterns we explore in our companion article on domestic voice and SMS usage trends.

On the mobile data front, subscriptions reached 60.2 million, a 2.9% quarterly increase, while mobile broadband subscriptions rose to 47.2 million, up from 45.8 million, a testament to Kenya’s aggressive migration toward 4G and 5G technologies. Notably, 84.8% of all broadband users are on 4G, confirming its status as the country’s default connectivity layer.

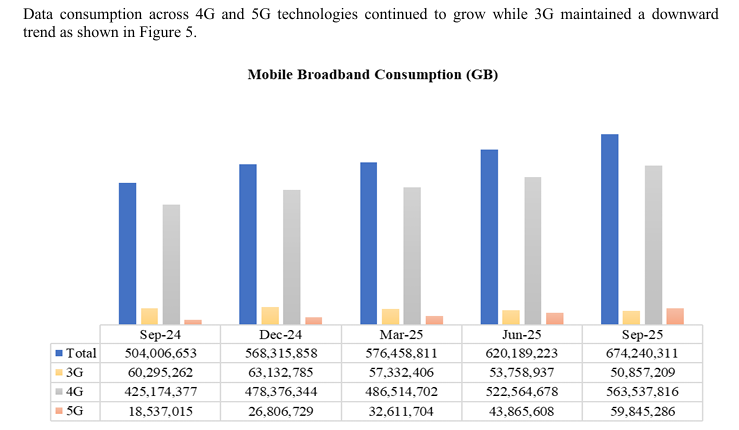

The most eye-opening figure in the report is data consumption. The average broadband user consumed 14.3GB during the quarter, but 5G subscribers averaged a massive 40GB per month, nearly triple the national average and far ahead of 4G’s 14.1GB. The total amount of 5G data consumed has more than tripled between September 2024 and September 2025, rising from 18.5 million GB to 59.8 million GB. This aligns with what we’re seeing globally: once users switch to 5G, their consumption spikes immediately due to higher speeds and improved capacity.

Interestingly, 3G continues its downward trend, reflecting operators’ ongoing spectrum refarming strategies. Kenyans are firmly moving toward LTE and 5G-powered experiences, helped by increasing smartphone affordability and the entry of more mass-market 5G devices.

This surge in data consumption is also mirrored in the growing demand for fixed broadband services, which we discuss in detail in our separate analysis of fixed Internet and ISP market share trends. Together, these shifts paint a picture of a Kenya where connectivity is not just expanding. It is deepening, with users demanding faster speeds, higher reliability, and more data-intensive digital services.

As operators continue to push 5G rollout and device makers flood the market with cheaper 5G handsets, the coming quarters will likely see even sharper growth in broadband consumption. With smartphone penetration edging toward saturation levels, the next battleground will be service quality, affordability, and 5G adoption — and this quarter’s report suggests that shift is already underway.