Following a successful pilot announced in November 2025, Safaricom has officially rolled out Ziidi Trader to the mass market. The feature is now live on the M-PESA App, allowing millions of Kenyans to buy and sell shares on the Nairobi Securities Exchange (NSE) with zero paperwork and no need for a third-party broker account.

Safaricom has already begun notifying customers via SMS with a message that signals a direct attack on traditional market barriers: “Stock trading is now easier with Ziidi Trader. No account, No paperwork. Buy & sell shares on NSE from your MPESA App.”

Here is a deep dive into what this launch means, how it works, and why it poses an existential threat to existing fintech players.

Frictionless Finance

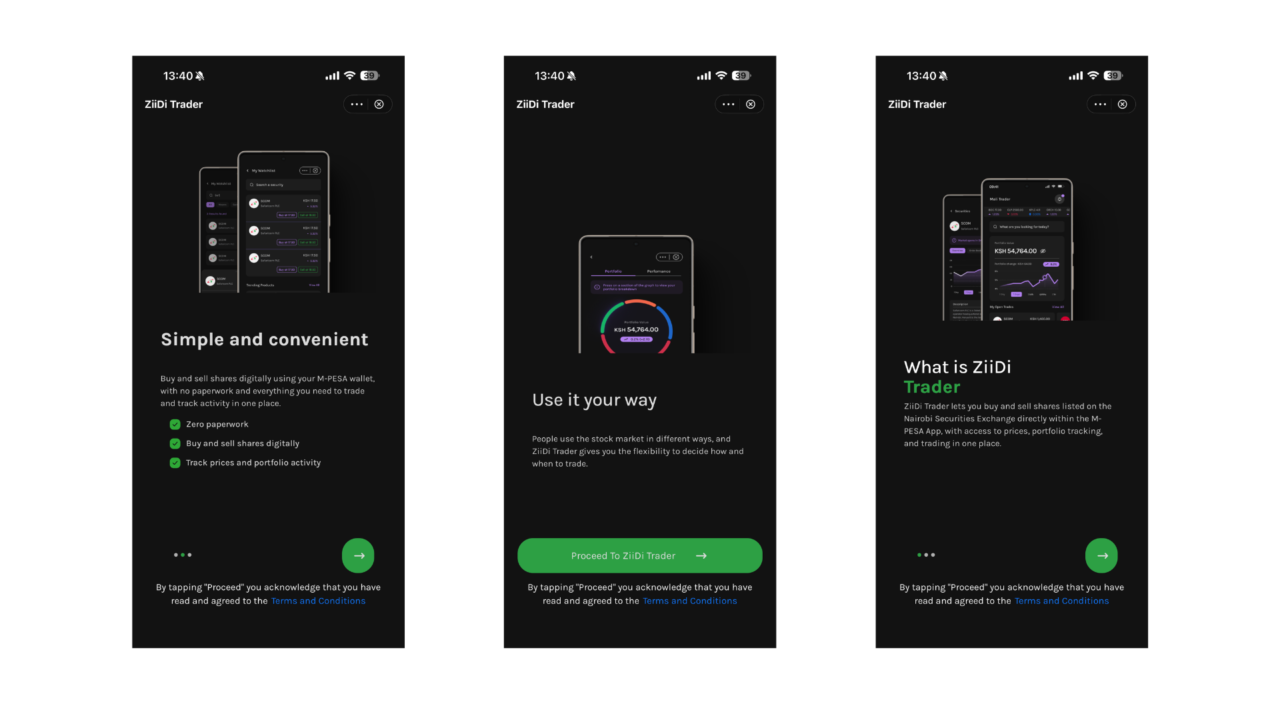

The most striking aspect of Ziidi Trader is not just that it exists, but how seamlessly it has been grafted into the existing M-PESA ecosystem. The user journey, as confirmed by early adopters today, effectively removes the “intimidation factor” that has plagued the NSE for decades.

How Ziidi Trader works:

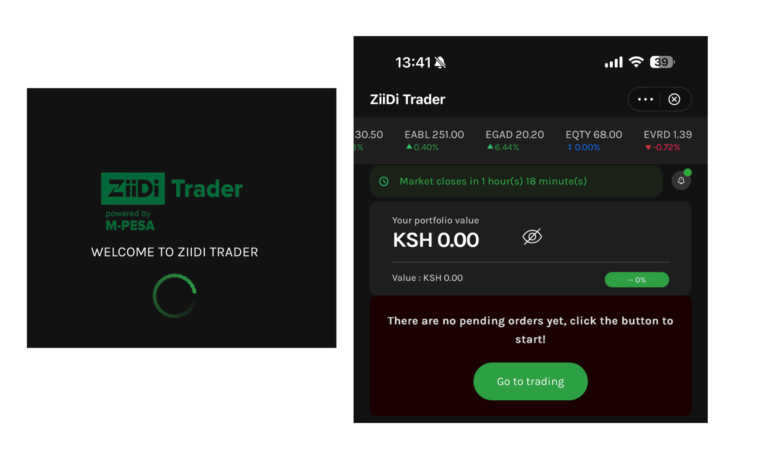

- Access: Users navigate to the Financial Services tab on the M-PESA App and select Ziidi Trader.

- Onboarding: There is no upload of ID scans or waiting for broker approval. A simple “Opt In” triggers the welcome message: “Welcome to Ziidi Trader. Discover NSE Stocks and start growing your wealth one share at a time.”

- Trading: The interface is stripped of complex jargon. Users select a company from the “TRADE” tab, choose “USE BEST PRICE” or set a limit, enter the number of shares, and pay instantly via their M-PESA balance.

This integration transforms the stock market from a remote, elitist club into a utility as accessible as buying airtime.

A Low-Cost Revolution?

One of the biggest hurdles to retail investing in Kenya has been cost: high minimums and brokerage commissions that eat into small profits. Ziidi Trader appears to be aggressively tackling this.

According to a cost breakdown we’ve done (watch video) a purchase of 100 shares valued at KES 4,500 attracts a total transaction charge of KES 68.50. This fee is all-inclusive, covering brokerage commissions and statutory charges (such as stamp duty/levies).

- The Math: This represents a transaction cost of roughly 1.52%.

- The Context: Traditional stockbrokers often charge a minimum commission (e.g., KES 100) regardless of trade size, which punishes small investors. By allowing a KES 4,500 trade to cost only KES 68.50, Safaricom is making micro-investing mathematically viable for the first time.

The Strategic Play: Why Now?

Safaricom’s move is the second pillar of its “Ziidi” wealth management brand. The first, the Ziidi Money Market Fund (MMF), launched in early 2025 and quickly amassed over KES 7.5 billion in assets by leveraging the same “opt-in and earn” simplicity.

By moving from passive savings (MMF) to active trading (Stocks), Safaricom is attempting to solve a chronic liquidity problem on the NSE. Verified data shows that while there are 1.4 million registered investors in Kenya, only ~61,000 (4.3%) are active. The market has been characterized as “boring, slow, and elitist.”

Ziidi Trader changes the incentive structure. It places the “Buy” button next to the money Kenyans already have in their pockets.

Competition:

This launch casts a long shadow over independent fintech apps like Hisa. When Hisa launched, it was hailed as a pioneer for democratising the NSE and US stocks. However, user sentiment has soured over the last year, with complaints regarding slow support, buggy interfaces, and stagnant user experience.

Safaricom does not need to be more innovative than Hisa; it just needs to be more reliable and accessible. With Ziidi, Safaricom has effectively commoditised the core value proposition of standalone trading apps. We expect to see a wave of consolidation or panic-innovation from banks and independent apps in response.

The Risks of Gamification

While accessibility is a net positive, this level of ease introduces new nuances and risks:

- Impulse Trading: By making buying stocks as easy as buying a betting slip, there is a risk that unsophisticated investors may treat the NSE like a casino, buying volatile stocks without research.

- The “Best Price” Trap: The “Use Best Price” feature is convenient, but in an illiquid market like the NSE, “market orders” can sometimes execute at unfavorable prices if there is a sudden spread gap. User education will be critical.

- System Overload: Can the NSE infrastructure handle a sudden influx of thousands of retail trades per second? M-PESA handles millions of transactions effortlessly; the exchange’s matching engine will need to prove it can keep up.

My Verdict:

The launch of Ziidi Trader is a watershed moment for Kenya’s capital markets. It removes the friction of entry, lowers the cost of participation, and leverages the trust of the M-PESA brand. For the NSE, this is the liquidity injection it has been desperate for. For the common Mwananchi, the stock market is no longer a place you visit; it is a place you live, right inside your phone.