It is the most common, and arguably the most frustrating, excuse in the Kenyan digital payment ecosystem: the “Fuliza excuse.” You send money to the wrong number, and the recipient claims they cannot reverse it because “Safaricom automatically swallowed the money to pay my loan.”

Recipients have used this excuse to keep erroneous transfers. The logic seems sound: if the money is gone, how can they send it back?

However, evidence from actual transactions confirms that this is factually incorrect. An existing overdraft does not make a transaction irreversible.

The Evidence:

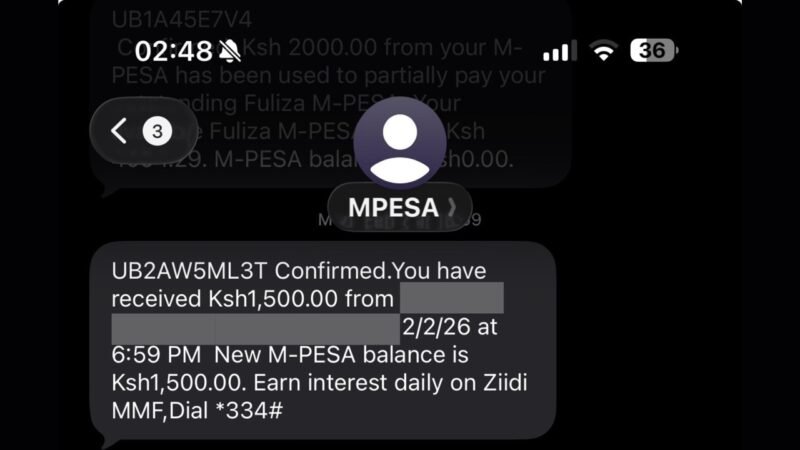

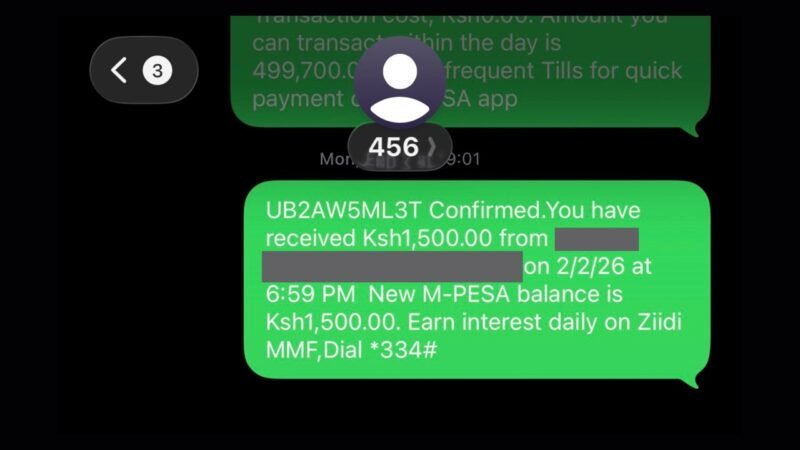

We experienced a specific case involving a transaction of KES 1,500. The timestamps and system messages show a different story.

1. The “Mistake” (6:59 PM): We (the recipient) received KES 1,500. Simultaneously, the system triggered the Fuliza auto-deduction protocol, sweeping the funds to partially pay out outstanding loan.

At this exact moment, the our M-PESA balance reads KES 0.00. Technically, we have no cash in our wallet. But the transaction history remains active and reversible.

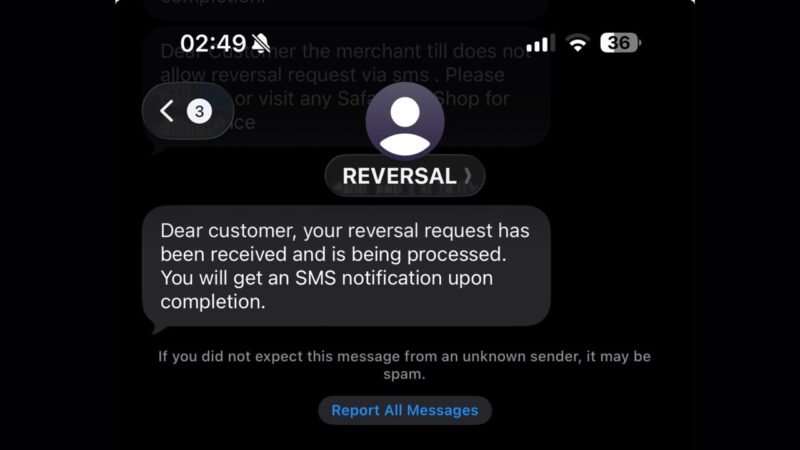

2. The Reversal Request: As the recipients we identified the error and forwarded the message to 456. Safaricom confirms the request is “being received and processed”.

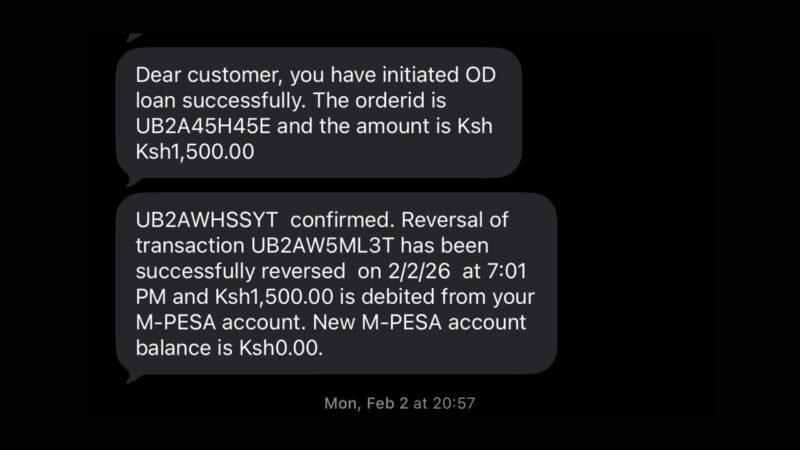

3. The Systemic Rollback (7:01 PM): Just two minutes later, the reversal is executed. The KES 1,500 is debited from the our ecosystem to return to the sender.

“OD Loan Initiated”:

This is the most critical part of the discovery. When the system reverses the money back to the sender, it must also reverse the benefit the recipient gained (the loan repayment).

As shown in the final confirmation text sent to the recipient at 8:57 PM, the system triggers a specific notification:

“Dear customer, you have initiated OD loan successfully… the amount is KES 1,500.00”.

This phrasing is key. The system effectively re-issues the overdraft (OD) loan. Because the funds used to pay the debt were declared erroneous and removed, the payment is voided. The recipient is returned to their previous state of indebtedness.

The ledger is perfectly balanced: the sender gets their cash back, and the recipient gets their debt back.

What You Must Do:

The “empty wallet” argument is invalid. The recipient does not need liquid cash to facilitate a reversal; the system simply unwinds the logic of the transaction.

If you send money to a wrong number and they claim Fuliza took it:

- Ignore the excuse. The recipient cannot manually send the cash back, but Safaricom can.

- Act Fast. In our test case, the resolution process began almost immediately.

- Forward to 456. Send the entire transaction message to 456 immediately.

Beyond the technical reality, there is a serious legal one. Withholding funds sent to you by mistake is a crime, not just ‘bad luck’ for the sender. Kenyan courts have already jailed and fined individuals for theft after they failed to reverse erroneous M-PESA transactions. Hiding behind a Fuliza overdraft is not a valid defence; it is simply a fast-track to a criminal record.