Starting January 1st, you will once again incur transaction costs when you send money that’s more than KES. 100. The measures introduced by the Central Bank of Kenya back in March that made transactions below KES. 1,000 free, are coming to an end. Whether this is due to pressure from companies like Safaricom who have reported a huge loss of revenue from the free transitions, it is not known. However, according to CBK, the measures that were put in place back then have proved to be very effective leading to an additional 2.8 Million customers using mobile money.

Of importance to note is that not all measures introduced back in March are coming to an end. Going forward a lot of the things CBK introduced are expected to remain. CBK has also come up with a new set of principles the say should guide payment service providers with guidelines to follow when setting prices for mobile money services. You can read them in the ANNEX Section below CBK’s statement on this page.

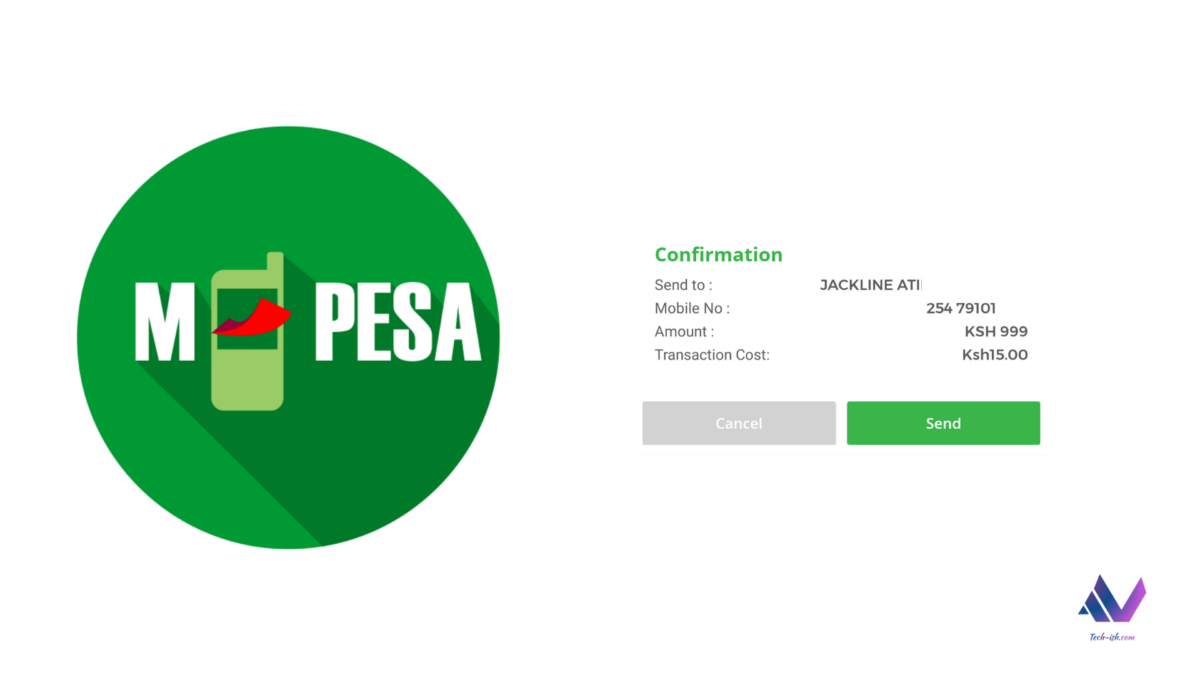

With the coming year, we should expect to see new a new pricing structure for transactions from different mobile money companies. Safaricom for one is expected to revise M-Pesa transaction costs, especially for the transactions below KES. 1,000. It will be quite hard to make Kenyans go back to paying the quite high fees that have been there when they’ve been used to free transactions throughout the year.

These are the new measures effective 1st January 2020 are as follows:

- Transactions below KES. 100 will be free to any customer and network.

- Transactions between Bank Accounts and Mobile Money Wallets to be free. This is great news! Hope NCBA LOOP is listening.

- Transactions between SACCOs and Mobile Money wallets may attract a fee as overseen by the CBK.

- Companies will propose pricing structures that adhere to the Principles set by the CBK.

- Mobile money wallets will still hold up to KES. 300,000 and transactions limit will remain at KES. 150,000 per transaction.

For now, we wait for the revised transaction rates from M-Pesa, the biggest mobile money company in the country. Their revision will automatically affect all the other smaller mobile money providers in the country.

Check out the official statement from the CBK:

Official Statement from the Central Bank of Kenya on the end of free mobile money transactions below KES. 1,000 :

On March 16, 2020, the Central Bank of Kenya (CBK) announced emergency measures to facilitate increased use of mobile money transactions instead of cash, in the context of the COVID-19 (Coronavirus) pandemic. These measures ran until June 30, 2020, and were extended until December 31, 2020, after a review.

A significant increase of mobile money usage has been noted over the period the measures have been in place, demonstrating that they were timely and effective. For instance, the monthly volume of person-to-person transactions increased by 87 percent between February and October 2020. Over this period the volume of transactions below Ksh. 1,000 increased by 114 percent, while 2.8 million additional customers are using mobile money. Business-related transactions also recorded significant growth over the same period.

CBK has reassessed the emergency measures with the objective of consolidating the gains made so far and also facilitate a transition towards sustainable growth of the mobile money ecosystem. Following consultations with Payment Service Providers (PSPs), CBK will allow the emergency measures to expire on December 31, 2020, and PSPs will introduce revised pricing structures from January 1, 2021, with the following elements:

- There will be no charge for person-to-person transfers of up to KES.100 to any customer and network.

- There will be no charges for transfers between mobile money wallets and bank accounts.

- To facilitate the integration of Savings and Credit Societies (SACCOs) with the mobile money ecosystem, SACCOs regulated by the Sacco Societies Regulatory Authority (SASRA) may levy a charge for transfers between SACCO accounts and mobile money wallets. CBK will oversee these charges in the context of the products that banks and PSPs offer to SACCOS.

- Going forward, PSPs will propose pricing structures that reflect the “Pricing Principles” that CBK has introduced (see Annex). These “Principles” aim to support the development of an efficient, safe and stable payments and mobile money ecosystem where the customer and public interests are adequately protect

It is noted that the wallet and transactions limits that were announced on March 16, 2020, will remain in force as was communicated earlier. CBK will continue to monitor developments in the payments ecosystem and take any necessary actions.

ANNEX: PRINCIPLES ON THE PRICING OF MOBILE MONEY SERVICES

- Purpose:

To facilitate the development of an efficient, safe and stable electronic payments ecosystem where the customer and public interests are adequately protected. - Specific objectives

a. To increase access, usage and equity in provision of digital payments services;

b. To improve transparency and disclosure in provision of digital payments services;

c. To foster a business culture underpinned by the primacy of customer’s interest;

d. To promote competitiveness and sustainable growth of digital payment services. - Basis

These principles are issued by the Central Bank of Kenya (CBK) based on its mandate of promoting an efficient and effective payment system, and to issue advice and direction while paying due regard to, among other things, efficiency, integrity and public interest. - Principles

4.1. Customer centricity

Adequate consideration of a customer’s needs, preferences and circumstances in the design, pricing and roll out of mobile money services. The primacy of the customer interest must be evident in how services are developed, priced and marketed.

4.2. Transparency and disclosure

Clear description of charges, fees and charges that a customer will incur at the point of sale, are during use of the service. Terms and conditions should be in simple and legible language. Conflicts of interest ought to be disclosed, where there is a risk this will lead to mis-selling of inappropriate services to obtain commissions or fees.

4.3. Fairness and equity

Provision and pricing of mobile money services in a manner that is proportional to the service provided and benefit obtained. Pricing policies and practices should pay due regard to the profile of customers and purpose of the underlying payment.

4.4. Choice and competition

Customers should be presented with cost-effective options. Customers must be presented with mechanisms and channels that enable frictionless comparison, choice and switching, including resolution of complaints, particularly price-related ones, without undue delays.

4.5. Affordability

Provision and pricing of services in a manner that is proportional to low-value and other “public good” related payments. Pricing policies need to strike a balance between short term commercial targets and long-term sustainable growth. - Responsibility

Responsibility for alignment and implementation of these principles rests on the Board of Directors of Payment Service Providers (PSPs). PSP Boards are required to:

a. Champion these principles in their governance and oversight duties by setting the appropriate “tone from the top” that is aligned to the principles;

b. Ensure formulation of internal policies and procedures that actualise the principles across their entire business operations;

c. Hold management accountable for adherence to these principles by staff, business partners and agents associated with the PSP:

d. Ensure timely and accurate submission of information, data and returns to the CBK required from time to time. - Implementation and monitoring

CBK has developed these principles as it embarks on the journey to anchor review of mobile money tariffs and charges based on the intended purpose and objectives above. Implementation will be carried on a gradual basis. CBK will be periodically engaging PSPs to ensure alignment, identify and promote best practice in implementation.