In December of 2019, we learnt of Safaricom’s plan to get into investments of unit trusts with a product called Mali. According to the information, you’d be able to invest as little as KES 100, while earning daily interest.

The news was big, and Safaricom had to issue a statement saying it was still a premature period to comment on future products. Since then though, if you dialed *230# you’ve been able to see both ‘Mali’ and ‘Bima’ with a disclaimer that these are products that are yet to go live.

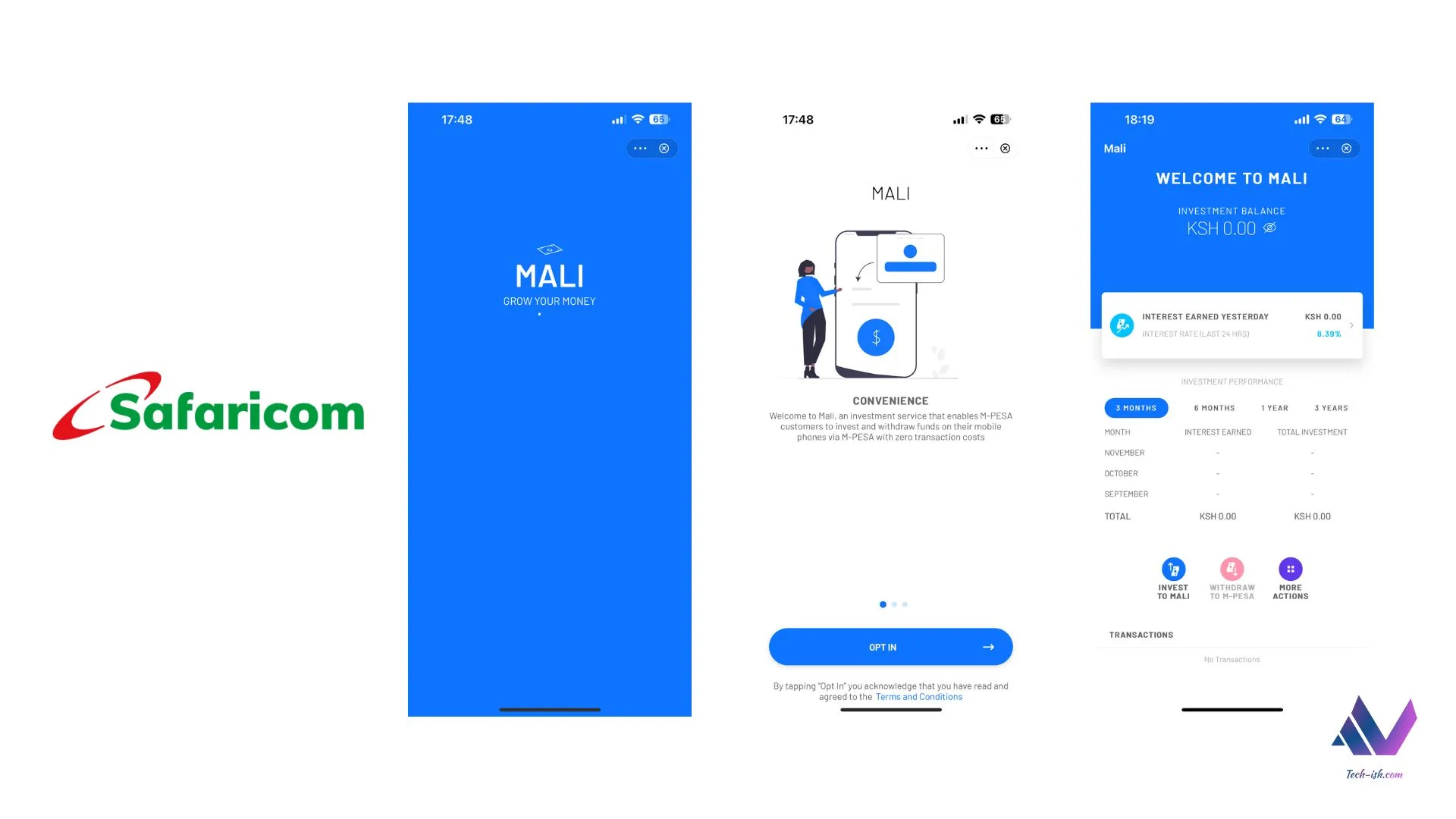

Well, Safaricom Mali is now live. You can access it from the M-Pesa app, under services. This comes a few days after the product received regulatory approval. With it live, we now know who Safaricom is partnering with. That’s Genghis Capital Limited.

How to access Safaricom Mali:

- Go to M-Pesa App

- Under Services Tab, select Mali

- Click Opt in

- You can also use *334#

Benefits of Mali:

- Convenience and

- High Returns

Mali is convenient as it allows you to quickly and easily invest from as low as KES 100, to as high as KES 300,000 per day. Safaricom says there are zero transaction charges when moving money.

You’re also promised returns of up to 10% annually. Though according to Section 4.6 of the Terms and Conditions, if you sign up as an ‘Investor’, you acknowledge the inherent risk associated with the selected investment products. Safaricom and Genghis will not be liable for the consequences of market influences and consequent changes in interest rates.

Mali’s fees and charges:

While there are no transaction costs when moving money to and from Mali, as an investment tool there are charges that apply. It is not clear how these charges will be handled as of yet, but it is important to know of their existence.

- Withholding Fee – Government charges 15% withholding tax on investment fund and not interest earned.

- Fund manager’s Fee – This will be charged at 2.0% per annum. Genghis is the fund manager.

- Trustee’s Fee – This will be charged at 0.20% per annum. The Trustee is a Bank here referring to KCB Bank.

- Custodial Fees – This will be charged at 0.15% per annum subject to a minimum fee of KES 10,000 per month. The custodian is another bank appointed by the trustee, here referring to SBM Bank Kenya.

Disclaimers:

To invest with Safaricom Mali, you need to be 18 years and above, and have kept an M-Pesa active account for at least 3 months.

In terms of privacy, the fund manager Genghis also has access to your personal information.

You should also not be able to Fuliza to your investment account.

As of writing this, I’ve not been able to add any money to the investment tool. Once I am able to do that, I will have another article on my experience with Mali.

Been trying to withdraw from mali to mpesa in vain. This message keeps popping up ?

Sorry we are unable to process your request at the moment. Please try again in 2 hours

My balance can’t reflect after 3days.i can’t withdraw or is it another scam

I invested my funds yesterday and i checked it ryna …its saying my balance is 0.00

Hey,,why am I not able to withdraw from mali to mpesa,, as in, it ain’t taking the command when I request it to with draw yet for investing to mali icon is active

Did you manage to withdraw?

I want to understand how on earth WHT will be charged on investment. Let’s do the math, let’s say you invest 100k , 15% of that will be subjected to WHT and not the interest earned ? That can’t be viable. So 15% of 100k is 15k while else the fund should earn you 10% which is 100k ? Make it make sense, not withstanding fund manager fee of 2% which 2k, trustee fee 0.2% which is 200 and now the most exorbitant of them all custodian fee 0.15% which would have been 150/= but now in this case it is a min of 10k per month thus 120k pa. This is day time robbery , I hope investors do the actual math before taking it up.

If you invest 100,000kshs after one year you will earn 100,000•(10%—2.2%)=7800kshs

If you withdraw the interest 7800kshs you will have it all.

But if you withdraw your investment 100,000kshs after one year you will get

100,000—(100,000•15%)=

85000 This means after investing you are discouraged to withdraw.

The problems in Kenya is always lack of withdrawing terms. On top of that they, in very few instances ,indicate whether interest rate they pay you is daily, monthly or yearly. They only say interest paid is 10% full stop.

Hello comrades ,nikiuliza hivi ukiinvest like 500 how much will you earn as interest , explain in figures not percent for easy understanding

Ten cents

Who has invested in this, and how is it going so far

Very bad…. I invested few days ago now I can’t withdraw my money any more. They keep saying dear customer we are unable to process your request at the moment try again later. Today being the third day since I tried withdrawing

For people who are doubting safaricom mali just search on your Google “investment trust “and you will get all the information you need and when you say that all of the interests that are charged are many but if you calculate it only comes to roughly 3%so you will get paid interest of 7.75% every day and 10%interest every year that you have invested

Did you day 7.75% every day?

When they tell you interest rate to receive is 10% that means on 100kshs you invest after one year you will receive 10kshs as interest. In other words 100kshs invested brings you 10/360kshs daily, or 10/12 monthly. The interest rate they give is yearly not monthly nor daily

Who has invested already and for how long has this been?

I have for a week now but they are not allowing me to withdraw my money. The keep saying try again later

Fellow Kenyans, their grandiose heist again??♂️. In case of losses, the investor is the one to blame; passing the criteria of being over 18yrs, they blindly gave in to the company’s t’s and C’s. I maybe wrong though?

It won’t help the common mwananchi at all,the company and government will benefit more

Ati custodial fees at 0.15% with a minimum of 10,000 per month? Who is paying this amount? Is it an investor putting in 1k?

Makes sense for me

Is this what the information above means. Lets use figures to analyze this and seek clarification. Lets assume i have invested KES 1000:

IF withholding fee applies, then my 1000/= will be charged 150/=

If Fund Managers fee (fees always charged on the investment amount) or is it charged on interest? If on investment value, then another charge of 20/= if on interest the a fee of 2/=

Lets assume Trustees Fee will be charged to interest then a fee of 2/=

So while I invested 1000 and got an interest of 100, total is 1100/=. Deduct the fees (150+20+2)=172/=

So my net after investing 1000 is 928/=

It doesn’t make sense.

If that is the case, then its not an investment but theft in broad daylight

Yes you’re right. They have denied me to withdraw neither opt-out.

The illusion of customers making money from big organizations

?

Great way to analyse the article. I believe the author will clarify this once he experiences Mali.

Once again, I like your analysis

Yikes! And I’ve literally just invested

Please can the author of this information enlighten more on the gain as we are not ready to loose the little we have?

All those fees are charged on interest but not what you invest

Nope check the specifications of the withholding tax. When it comes to investments fees are charged on the principal.. that 2.35 % will be on principal what I don’t get why on earth would the government tax withholding tax on investments fund not the interest

It’s not a viable investment option. The 15% withholding tax dillutes everything. Again factoring the inflation if you were to opt for a long term investment, it won’t make any financial security sense. Not for me!!!!

It’s not a viable investment option. The 15% withholding tax levied on the investment amount dillutes it all. Factoring inflation if you were to opt for a long term investment, you’ll be losing a lot. Hii nayo nomaa

Yearly or monthly