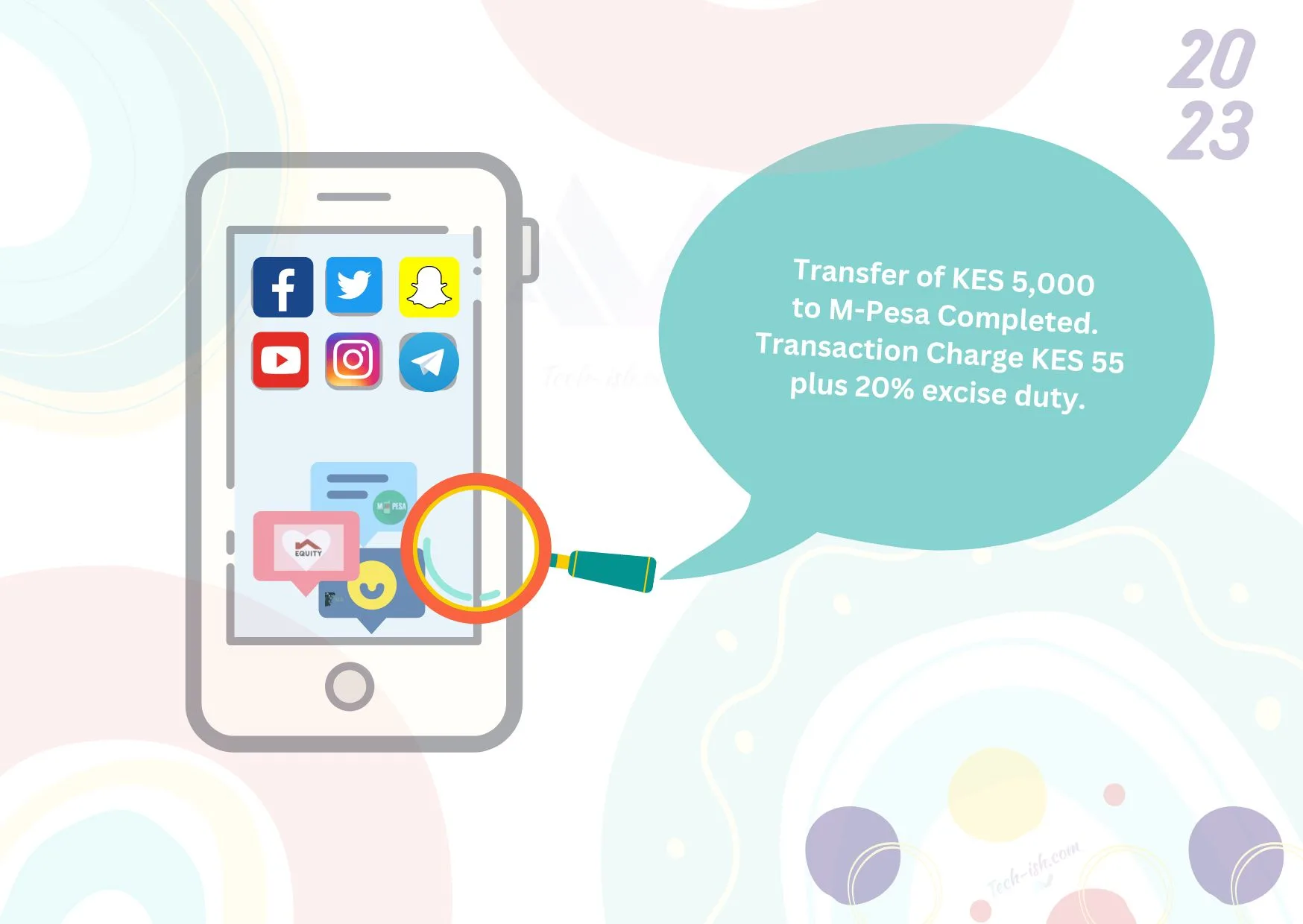

It’s a new year that’s gearing up to be very expensive, given the new policy changes in the country. We’ve been used to having free transactions when moving money between our mobile wallets and our bank accounts. That’s all changing now, and we have two articles on the costs:

We are shifting from using KES 0 for a transfer, to over KES 100 if moving the cash from wallet to bank to wallet. That’s a lot of money. Personally, I don’t believe transaction charges should exist. Money should be able to move the way it has always been moving, freely. Companies offering these services should find profits in other ways. As they have done so in the few years transactions charges haven’t existed.

The obvious way to avoid these charges is: USE CASH. And of course you could have figured that out yourself, I know. But as we both know, since we are all already so accustomed to mobile money – it is easier, safer and faster – it is not possible to go full cash.

So here are some ways to avoid or reduce M-Pesa and Bank charges:

- Withdraw in Bulk

- Transfer cash to M-Pesa in bulk in cycles, depending on weekly/monthly budget

- Shift to digital banks that allow direct payments

- Use interest earning products like Mali

- Always carry some cash

- Shift to cheaper banks

A little explainer on each of the above points:

1. Withdraw in Bulk:

If you want to shift to cash (as we all are more likely going to do), make sure to withdraw in bulk. That way you avoid the constant small fees paid when you withdraw small amounts using mobile money. Use ATMs if withdrawing from Bank to avoid charges when sending to M-Pesa, followed by withdrawal fees.

2. Move cash from Bank to M-Pesa in bulk at the beginning of each week/month:

From the linked articles above, you will notice that M-Pesa to Bank charges aren’t as expensive as Bank to M-Pesa charges. So if you have money on your bank, and want to use it, move it in bulk to your M-Pesa in cycles, depending on your budget. Bulk transfers are cheaper compared to smaller amounts.

3. Shift to Banks that allow direct M-Pesa Paybill and Till Number payments:

For example LOOP allows me to make payments directly to an M-Pesa paybill or till number without extra charges. So now, I need not move money to my M-Pesa account. Other banks should jump on this bandwagon and make payments easier, faster and free.

4. Use interest earning products like Mali

Mali allows you to earn interest daily no matter the money you have in the account. It has no transaction fees, and you can deposit and withdraw money to M-Pesa at any moment. I use it, and I am considering having it hold most of my budget money, as a way of avoiding Bank to M-Pesa charges, while also earning an interest. There may be other money market funds that may allow for immediate withdrawals.

5. Always carry some cash:

For a long while now, many of us have never interacted with physical cash. It seems that needs to change. So after withdrawing in bulk, always make sure you have a good amount of cash with you should a business use a Paybill number or require transfer to a bank account, which would have you incur charges. Many businesses are also seemingly shifting from Till Numbers (which are free on customer side, but costly on the business.)

6. Shift to cheaper banks:

Shift to banks that don’t have stupidly exaggerated fees. Some banks even allow free bank to bank transfers. If not, you can also opt to use Pesalink for transfers, as it may in some instances be cheaper.

Do you have any other suggestions on avoiding or reducing transaction charges? Lay them in the comment section.

For those in ncba transfer of 100 is free..if you need 500 you can transfer 100 severally to evade charges…..for hustlers

If you don’t need much cash…via ncba app you can transfer 100 freely…if you need say 500 you can transfer 100 five times freely…real hustlers can relate

These finance institutions should focus on encouraging money to move freely between accounts, meaning there should be no charges. Charges should be at withdrawing. Better they double withdrawing charges to cover their gap.

No.2 isn’t quite true. Bank to M-Pesa (B2C) transactions are cheaper than M-Pesa to Bank (B2C) through Paybills.