Updated for 2024: Click Here

Starting January 2023, Safaricom has revised the charges customers attract while using M-Pesa Paybill services. This also comes as the Central Bank of Kenya re-introduces transaction costs for transactions between banks and mobile money wallets.

Paybills are different from Till Numbers in that the former is for long term use with customers having an account number, and dedicated transaction fees on the end of the customer. Meanwhile the latter, till numbers, are for sale of goods and services, allowing quick transfer of cash without transaction charges on the consumer.

For a long while, Paybills have attracted heavy transaction charges, and that’s now changing, thanks partly to the Central Bank. Paybills that attracted as much as KES 23, will now attract as little as KES 4.

The maximum Paybill numbers will attract for transactions will now be KES 65 instead of KES 113. The minimum is now KES 0 for transactions up to KES 100.

This table breakdown the new M-Pesa Paybill Transaction Charges:

| Amount Transacted | CURRENT Charges | NEW Charges |

|---|---|---|

| 1 – 49 | 1 | 0 |

| 50 – 100 | 2 | 0 |

| 101 – 500 | 23 | 4 |

| 501 – 1,000 | 23 | 9 |

| 1,001 – 1,500 | 35 | 14 |

| 1,501 – 2,500 | 35 | 19 |

| 2,501 – 3,500 | 56 | 24 |

| 3,501 – 5,000 | 56 | 33 |

| 5,001 – 7,500 | 85 | 40 |

| 7,501 – 10,000 | 85 | 46 |

| 10,001 – 15,000 | 113 | 55 |

| 15,001 – 20,000 | 113 | 60 |

| 20,001 – 25,000 | 113 | 65 |

Transaction charges when moving money from M-Pesa to Bank Account:

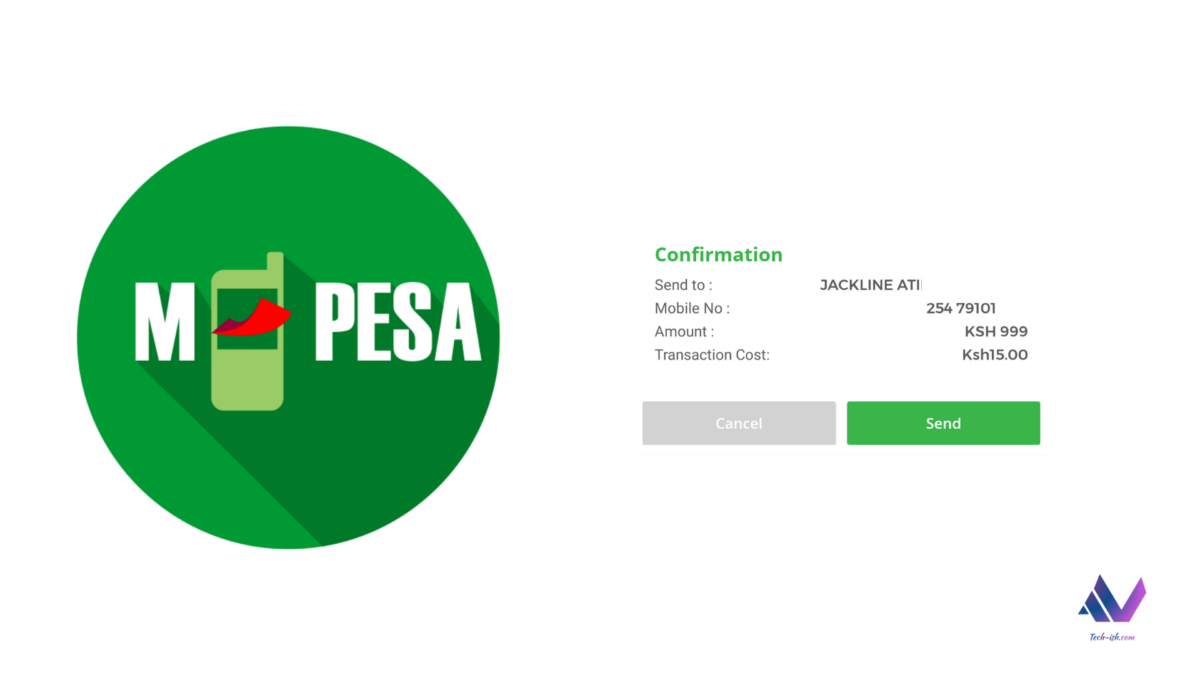

These will also be the fees you will be charged when moving money from your M-Pesa Account to your Bank Account using Paybill Numbers. So say you have KES 14,400 and you’re moving it from your M-Pesa to your KCB/Loop/Equity Bank/Absa account, you will incur a cost of KES 55 to move it.

Moving it back from the bank to your M-Pesa will also incur certain charges, which each bank will specify on. Many banks have already released a breakdown of the transaction charges when moving money from their bank account to your mobile wallet – both M-Pesa and Airtel Money.

Happy new year…

Sometimes it is hard to understand the greediness of our local banks.Fees should only be charged when withdrawing not depositing.

Afool does not learn my friends mlichezwa na bado hii hainihusu tupambane na hali zetu mahasla

For sure these transaction charges came at the wrong time. Should have waited for the economy to improve.

Surely serikali where are you taking us! To grave direct

Now it’s our time to cry this government doesn’t care the wanjiku instead it’s sacks her to finish

We need to appreciate one of the benefit of CORONA VIRUS outbreak that’s free transfer of money from Mpesa to your account. Now the banks will start seeing big queues in their banking halls.

Wrong move, from today I will be withdrawing all my money once in then I keep them under my pillow

????

This is the government that we choose to help us but instead they want to make sure we are going to remain poorer since they have full pockets. May God forgive them.

From today Mimi na pesa yangu ??? hamuioni ng’o,I will go hand in hand with the system

Serious!! This government has come to make us poor completely,is this bottom- up or up – bottom my people. Am Done with e- banking. Yangu hampati ng’o

Everywhere charges, depositing to bank account, withdrawing to mpesa charges, withdrawing from mpesa to cash charges

Acha ikae tuwekee matress

Another wrong move

I better have my cash in house instead of paying such transportation fee. I’ll avoid using Mpesa and bank as much as i can.

This is a bad move,I will try as much as possible to avoid those mpesa charges. What a country? Mwananchi pressed in all corners, disgusting nkt!

Hustler na kazi….. Twende sasa ???

Avoiding the mpesa and e- banking will work for me

This development shall be counterproductive.

Mankind always avoids injury and loss so expect a downturn in economy with these greedy overtaxing which only leads to exacerbating pain and povery.

Now this will reduce the e-banking, I will use my ATM and avoid being charged twice. Not a very good move.

It’s a bad decision

I will now reduce e banking.I will only use it on circumstances beyond my control.I will be using cash.It would have been better for the customers if the charges were one way.The common mwananchi is pressed on all fronts.The same old income but now being subjected to higher costs of living and now this ?

Let’s bottom up and stop complaining

Surely, banks and CBK will regret this. From now on, I will withdraw my money from atms and will avoid mpesa as much as I can.

You charge me on both sides; depositing and withdrawing my money to a bank… This discourages in cash flow in the economy i would now rather save my cash manually…. soon you will realize money not banked anymore nor withdrawn… This move is not soberly thought

Previous was so nice but we have to change with the changes

Is the Central Bank reducing mobility of money? And what is the goal? Won’t this reverse the gains made with mobile money penetrative to the detriment of the microeconomy?