In an era where digital financial solutions are not just a convenience but a necessity, Equity Bank Kenya has introduced a groundbreaking product: Boostika. This innovative facility is set to work just like Safaricom’s Fuliza, but with a couple of differences here and there. What makes Boostika stand out, and how does it compare to Fuliza? This article delves into the intricacies of Boostika, providing insights into its features, and benefits.

Understanding Boostika: A New Overdraft Facility

At its core, Boostika is an unsecured overdraft facility offered by Equity Bank. Similar to Fuliza, it allows customers to complete transactions even when their accounts fall short of funds. The service offers an overdraft limit ranging from KES 100 to KES 100,000, catering to a broad spectrum of financial needs, from minor purchases to significant transactions.

Key Features of Boostika

- Overdraft Limits: Customers can overdraw any amount between KES 100 and KES 100,000, based on their loan limit, which is determined by account activity and history.

- Eligibility: To qualify, an account must be active for at least six months, ensuring that only consistent users benefit from this facility.

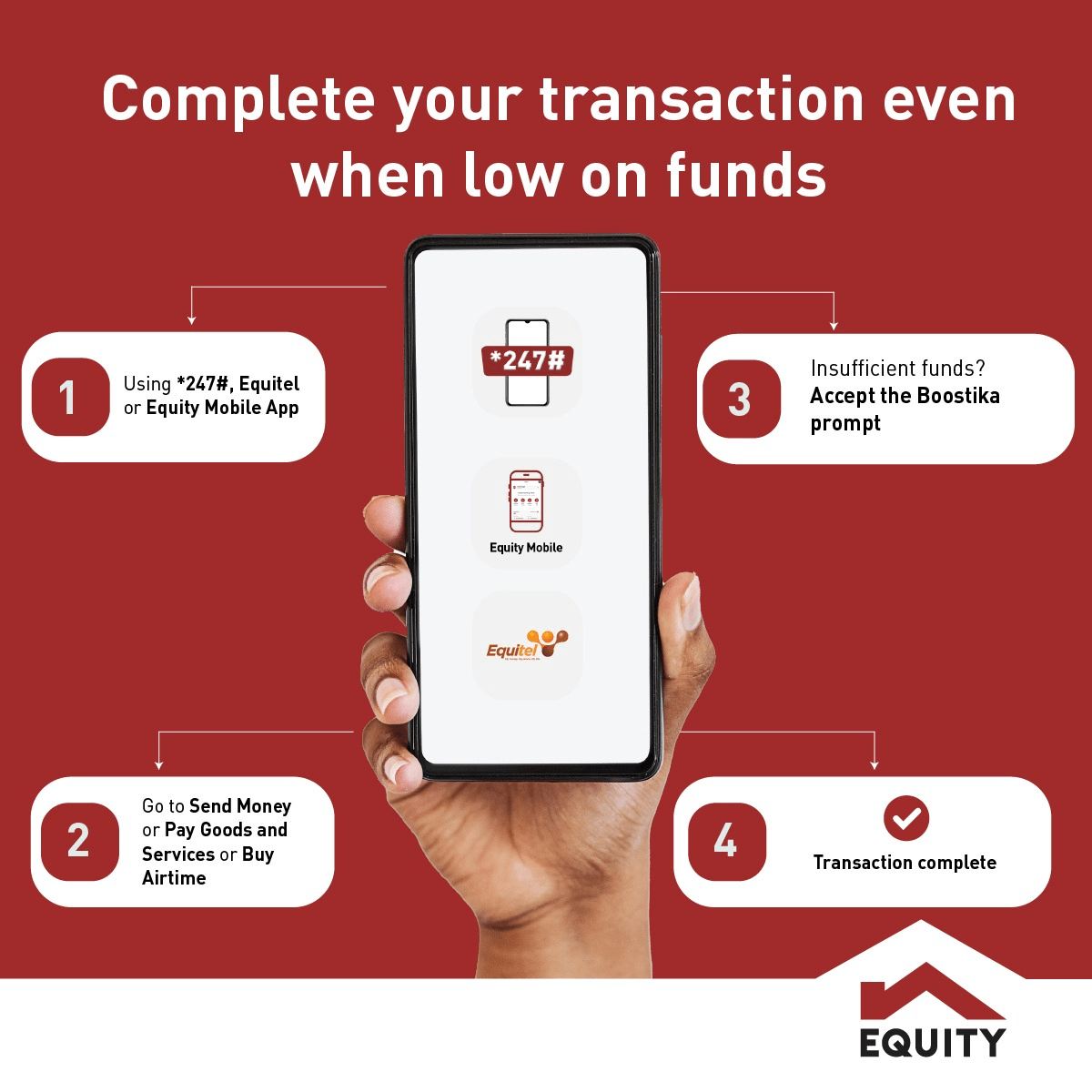

- Access Channels: Boostika is accessible through the Equity Mobile App, Equitel, or by dialing *247#.

- Charges: The service incurs a cost of 8.5% of the withdrawn amount, broken down into a processing fee, interest per month, loan insurance, and an excise duty on the processing fee.

Boostika vs. Fuliza: A Comparative Analysis

While Boostika and Fuliza serve a similar purpose, they differ in several aspects:

- Overdraft Limits: Boostika offers a higher maximum limit (KES 100,000) compared to Fuliza’s KES 70,000.

- Charging Structure: Boostika has a flat rate of 8.5% for overdrafts, whereas Fuliza’s charges vary based on the borrowed amount.

- Cost Effectiveness: For a KES 10,000 overdraft for a month, Boostika is marginally cheaper than Fuliza.

Frequently Asked Questions about Boostika

- Transactions Covered: Boostika covers a range of transactions, including money transfers, payments, and airtime purchases. So you can send money, make payments, buy airtime and more when your bank balance is zero.

- Repayment Terms: The overdraft is repayable within 30 days, providing flexibility for short-term financial needs.

- Loan Limits and Repayment: Customers can check and manage their loan limits and repayments easily through the Equity Mobile App, Equitel, or by dialing *247#.

- Multiple Uses: Users can apply for Boostika multiple times as long as they stay within their loan limit.

- Transaction Security: In case of incorrect transactions using Boostika, customers can request reversals through Equity Bank’s customer care.

Equity Bank’s launch of Boostika is not just an addition to their product portfolio; it represents a significant step in the evolution of Kenya’s financial sector. It addresses a vital need for accessible, flexible, and secure financial solutions, particularly in times when customers are short of funds. The facility’s higher loan limit and competitive pricing model are likely to attract a substantial user base, arguably providing competition to Fuliza.

Boostika’s key benefits include its instant and convenient access, ease of use, and the ability to make seamless transactions without exiting the payment journey. Additionally, its availability through multiple channels, including USSD, mobile app, and Equitel, makes it widely accessible. The unsecured nature of the overdraft, coupled with a manageable 30-day repayment period, positions Boostika as a practical solution for managing short-term financial gaps.