In Kenya, owning a smartphone has become more than just a lifestyle choice. It’s an entry ticket to modern life. From accessing mobile banking to buying CHAN 2024 tickets online, a smartphone is the key that unlocks the digital economy. But there’s one stubborn problem: affordability.

However, Kenya may have cracked the code.

Across emerging markets, the biggest barrier to smartphone adoption isn’t demand. People want smartphones; they know what’s at stake. The issue is that incomes don’t align with device prices. By mid-2025, the average smartphone price in Kenya had shot up to nearly KES 19,000, almost three times higher than in 2019. For most families, that’s the equivalent of a month’s income or more.

Yet, as our earlier housing survey report revealed, mobile phone ownership remains widespread, with households often prioritizing phones over other essentials. Why? Because without one, you’re digitally invisible. You can’t pay bills, study online, or even access healthcare services.

So, how are Kenyans pulling this off? Device financing.

The beauty of “KES 50 a day”

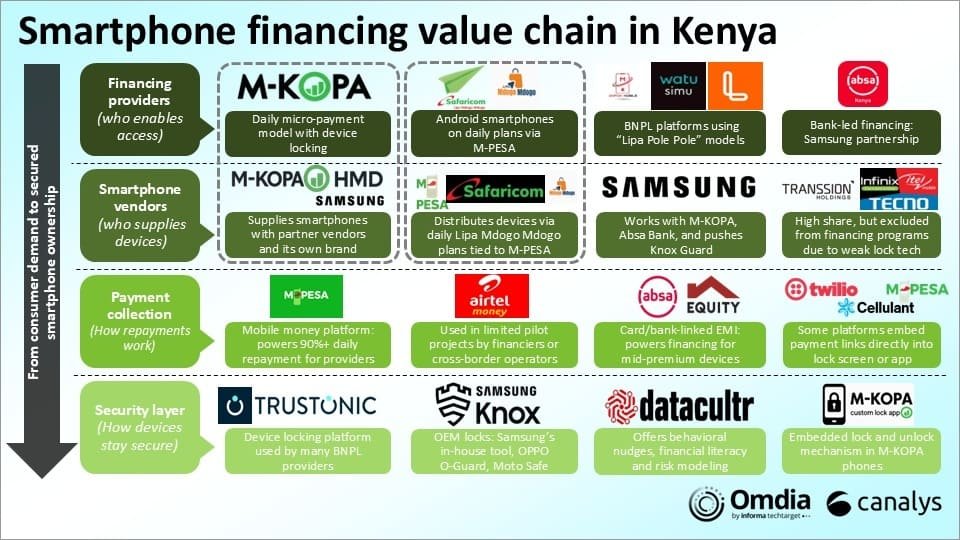

Forget rigid postpaid contracts. In Kenya, over 80% of people earn daily or weekly wages. The market adapted by offering micro-payment models, think KES 30–100 a day, with device-locking tech ensuring you keep up with payments. It sounds simple, but as the smartphone financing value chain map by Canalys (below) shows, there’s a sophisticated machine at work:

- M-KOPA, Watu Simu, OnFon Mobile, and others enable access through pay-as-you-go models.

- Safaricom and Airtel Kenya tie smartphones directly into mobile money platforms.

- Samsung, OPPO, HMD Global, Transsion, Vivo, and Xiaomi brands collaborate with financiers to supply devices.

- Trustonic, Samsung Knox, and Datacultr secure devices and nudge repayment.

Behind the scenes, distributors like Redington and Mitsumi keep the hardware flowing, while banks like Absa and Equity test card-linked financing for pricier models. It’s a multi-layered ecosystem, built to match the quirks of Kenya’s largely informal, cash-first economy.

Affordability meets inclusion

The genius of Kenya’s model is that it doesn’t just put a smartphone in your pocket. It pulls you deeper into the digital economy. As the CA’s new digital divide strategy notes, underserved communities need more than coverage; they need affordable entry points. Smartphone financing provides exactly that.

It’s why today, smartphones account for over 80% of all mobile connections in Kenya, according to our breakdown of 2G, 4G, and 5G subscriptions. Financing accelerates the transition away from feature phones, bringing more Kenyans online for the first time. And this isn’t just about Instagram or WhatsApp. As we covered in how smartphones dominate internet access, the smartphone is Kenya’s primary gateway to the internet. Without one, the promise of e-learning, e-commerce, or e-health remains out of reach.

Of course, access alone doesn’t solve everything. The digital bureaucracy issues highlighted recently remind us that smartphones can only empower people if the services they access are efficient and inclusive. The CHAN 2024 ticketing fiasco, which went online-only and left many fans behind, is a perfect example of how affordability and digital inclusion must go hand-in-hand.

Smartphones open the door, but the ecosystem inside that door needs fixing too.

Why the world is watching Kenya

Kenya has become a live testbed for solving smartphone affordability. The combination of micro-payments, mobile money, and layered security is proving scalable and impactful. Other emerging markets, from West Africa to South Asia, are studying Kenya’s model as a blueprint. And while there are pitfalls like the pricing mismatches exposed in our Onfon Mobile deep dive, the bigger story is how affordability challenges can be turned into opportunities for innovation.

Kenya may not manufacture smartphones, but it has manufactured something arguably more valuable: a system that makes them affordable. In a world where the cost of devices keeps climbing, Kenya shows that creativity, collaboration, and a deep understanding of how people actually earn and live can crack even the hardest problems.

From the slums of Nairobi to the farms of Eldoret, the KES 50-a-day smartphone is more than a gadget. It’s proof that you don’t need deep pockets to stay connected, just flexible ways to pay. And that lesson? It’s one the rest of the world can’t afford to ignore.