There is an old expression that says you “can’t take it with you” when you die. While this usually refers to physical possessions, in the digital age, it applies to your mobile money wallet too. From family and friends to your valuables, everything is left behind—including your M-PESA balance.

While traditional financial institutions like banks, insurance firms, and unit trusts have well-known procedures for inheritance, there is often confusion regarding mobile money. A common question we see in our mailbag is: What happens to your M-PESA when you die?

The short answer: The account doesn’t disappear, but the money doesn’t automatically transfer to loved ones either. Safaricom has a strict, tiered process for claiming these funds to ensure they reach the right beneficiary.

Here is the comprehensive guide on how to claim M-PESA funds as a next of kin, the legal pitfalls to avoid, and what happens if you wait too long.

The Golden Rule: Do Not Withdraw the Money Yourself

Before diving into the claim process, it is vital to address a common mistake. When a loved one passes away, family members often possess the deceased’s PIN and may be tempted to simply withdraw the funds or transfer them out immediately.

Do not do this.

According to Safaricom, this is classified as a crime. Safaricom does not authorize the next of kin to withdraw money for the deceased simply because they have access; legally, you are not the user. Even if you are the rightful heir, accessing the account via the deceased’s PIN is unauthorized access. The funds must be transferred through the proper succession process.

Step 1: Informing Safaricom

The claiming process begins immediately after the passing. The family or next of kin must officially inform Safaricom of the death. This involves writing a letter to Safaricom indicating your name, your relationship to the deceased, and your specific request regarding the account.

Once notified, the next steps depend entirely on how much money is in the wallet.

The Three Tiers of Claiming M-PESA Funds

To streamline claims, Safaricom has classified accounts into three categories based on the account balance. Each tier requires different documentation.

Tier 1: Balances between KES 1 and KES 30,000

For smaller balances, the process is relatively administrative and involves local governance rather than the courts.

- Requirements:

- The original death certificate.

- Original ID card of the claimant.

- Letter from Provincial Administration: You must obtain a letter from the Chief, Assistant Chief, County Commissioner, or Deputy County Commissioner. This letter must explicitly indicate the claimant’s details (name, contacts) and their relationship to the deceased, confirming they are the rightful recipient of the resources.

- Affidavit: A signed affidavit from a Commissioner for Oaths indemnifying Safaricom is also required.

Tier 2: Balances between KES 30,001 and KES 200,000

For mid-range balances, the vetting process steps up.

- Requirements:

- Claimant documentation (ID, Death Certificate).

- Official Authorization: You need a letter from the Public Trustee (Attorney General’s office) or the Deputy County Commissioner/County Commissioner strictly authorizing you to receive the funds.

Tier 3: Balances above KES 200,000

For amounts exceeding KES 200,000, Safaricom treats the claim as a full succession case.

- Requirements:

- Grant of Probate or Letter of Administration: You must go through the court process.

- The procedure for this in Kenya is governed by the Law of Succession Act (Cap 160).

Timelines: How Long Does It Take?

There are two timelines to consider here: the legal process and the Safaricom processing time.

- The Legal Phase: Obtaining a grant of probate in Kenya typically takes about seven months, but can extend to years depending on the complexity of the estate or family disputes.

- The Safaricom Phase: Once you have the correct documents (based on the tiers above), the Service Level Agreement (SLA) states that the claimant will receive the funds within 24 hours of submission.

The 2-Year Deadline and Unclaimed Assets

Time is of the essence. Next of kin have a two-year window to claim funds from Safaricom.

If the funds are not claimed within two years, they are transferred to the Unclaimed Financial Assets Authority (UFAA). However, all is not lost if you miss the deadline. Funds held by the UFAA do not expire, and can still be claimed from the authority, though the process moves away from Safaricom at that point.

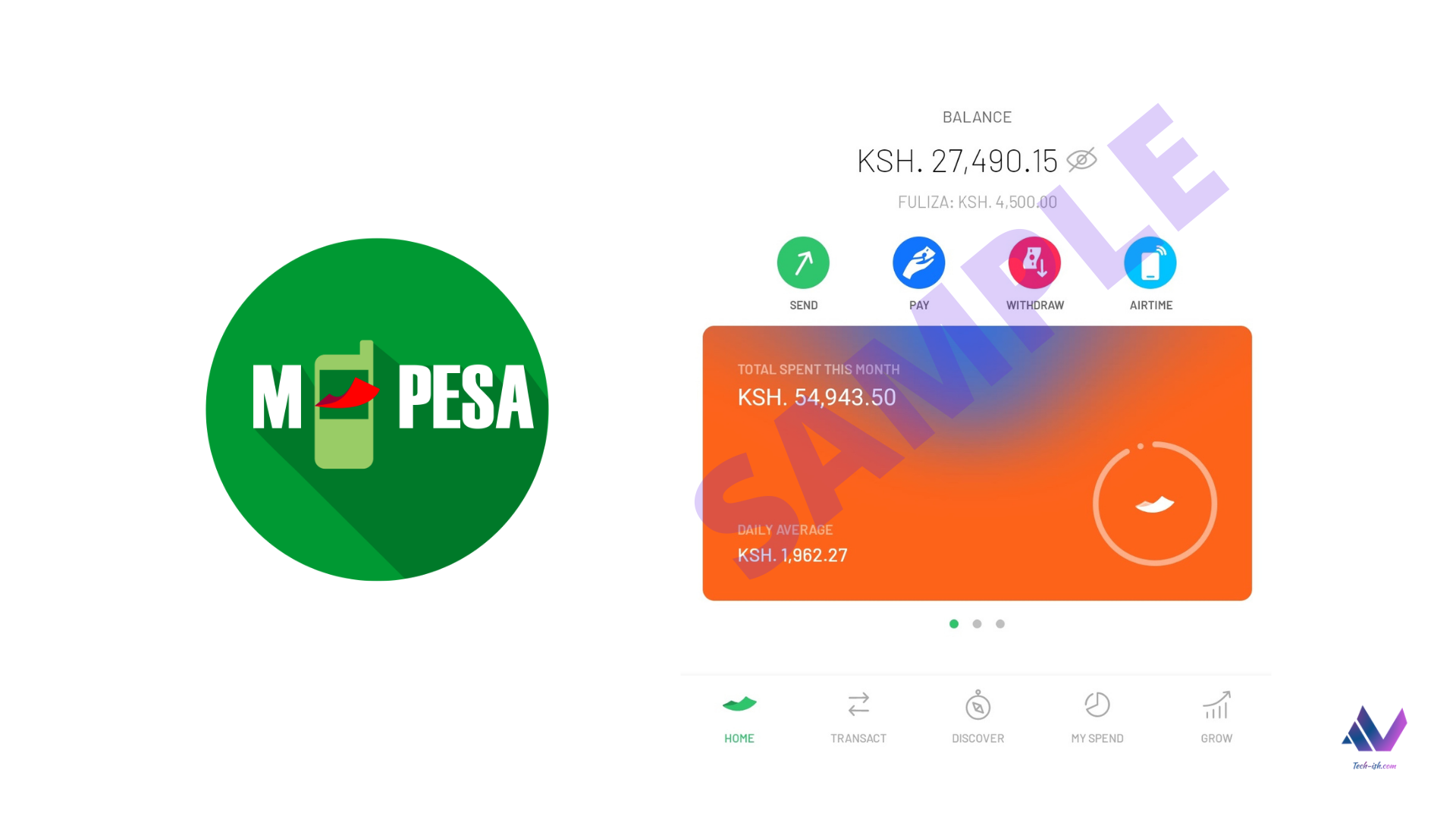

What About Fuliza and M-Shwari?

One of the more relieving aspects of digital credit in this context is the treatment of debt. According to the documentation, loans such as Fuliza and M-Shwari generally “come to an end” upon the death of the user. This typically implies insurance coverage on these digital loan products settles the outstanding balance, preventing the debt from passing on to the family.