Insights At a Glance:

- Telecom and pay TV spending in MEA reached $149B in 2024, up 7.7% from the previous year.

- Africa’s demand for mobile data and streaming content is fueling record-high pay TV spending.

- Kenya’s DVB-T2 rollout, DStv’s upcoming flexible plans, and creative streaming hacks are reshaping how we spend on TV.

- Geopolitical tension and U.S. tariffs could threaten future growth, but telcos are adapting fast to keep pay TV spending on track.

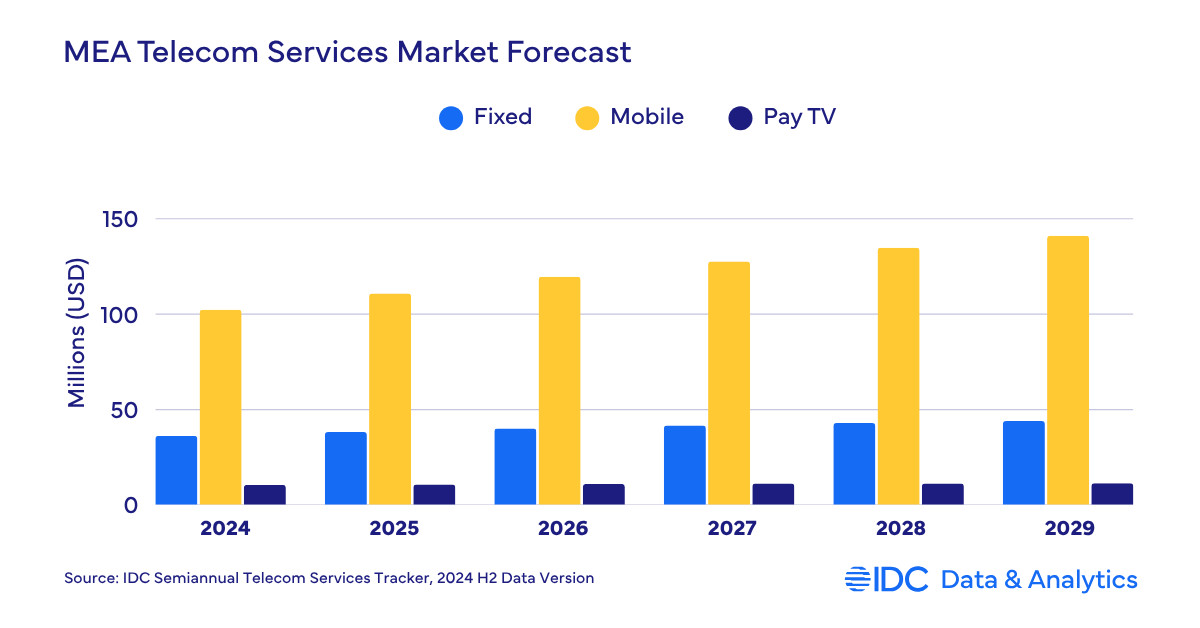

Telecom and Pay TV spending in the Middle East and Africa (MEA) is officially on a hot streak. According to new data from IDC’s Worldwide Semiannual Telecom Services Tracker, the region saw a sharp rise in telecom and pay TV spending in 2024, hitting a massive $149 billion, representing a 7.7% year-on-year jump and dwarfing the global average of 2.2% while at it.

And there’s more where that came from. IDC forecasts that pay TV spending and telecom service investments in MEA will grow another 7.3% in 2025, bringing the total to nearly $160 billion. Africa, in particular, continues to punch above its weight thanks to booming demand for mobile services, internet access, and, of course, more screens and streams.

Africa’s Mobile-First Culture Is Driving Pay TV Spending

So what’s behind this sharp spike in telecom and pay TV spending? A few things.

Across the continent, telecom operators are going all in, expanding fiber and mobile networks to reach underserved areas and meet the appetite for data. In many African homes, a smartphone is the main (or only) screen, doubling up as a bank, store, school, and TV all at once. Even with inflation biting hard in countries like Nigeria, Zimbabwe, and Egypt, people aren’t letting go of their connections. In fact, IDC credits a big chunk of the growth to the resilience of pay TV spending, with users sticking to their subscriptions even amid rising tariffs.

Also, the shift away from traditional voice services continues, as more users embrace OTT apps like WhatsApp, Telegram, and YouTube often as cheaper or more flexible alternatives to conventional TV or landline options.

Kenya’s TV Upgrades Add Momentum to Pay TV Spending Trends

Right here in Kenya, we’ve seen major updates that are shaping pay TV spending behavior. The new DVB-T2 TV standards, which officially took effect on July 1st, are forcing many households to rethink how they access and organize free-to-air channels. If your TV setup got scrambled recently, that’s probably why [See full explainer].

At the same time, DSTV is experimenting with weekly subscription packages in a move that could shift pay TV spending away from the rigid monthly model to a more user-controlled experience. This flexibility is especially appealing as streaming and on-demand content become more mainstream. Even better? Creative Kenyans likes yours truly are figuring out ways to sidestep rising costs entirely, using tools like Chromecast with Google TV to bundle free and paid services into one smooth interface [Read our hack guide]. It’s proof that while pay TV spending is growing, how people spend is becoming smarter.

Telecom Growth Slows Slightly

IDC’s new forecast for 2025 is slightly more conservative than last year’s, trimmed by 1.2 percentage points. That’s because inflation is cooling in some markets, leading telecom providers to revise growth expectations. Still, the outlook for pay TV spending remains steady as demand holds strong.

But challenges loom. The region’s geopolitical tensions plus new U.S. tariffs on telecommunications equipment could increase costs and delay projects like 5G and AI rollouts. IDC warns that these disruptions might not immediately dent pay TV spending, but the indirect effects such as reduced purchasing power, economic instability could eventually catch up.

IDC’s Mark Walker summed it up:

“Tariffs on telecommunications equipment might lead to increased costs for telecom operators, potentially delaying 5G rollouts and AI projects… with longer-term effects including reduced spending power and slower economic growth.”Telcos Are Evolving Into Techcos to Keep Pay TV Spending Climbing

In response, telecom companies across MEA are transforming into full-blown tech companies — or “techcos,” as IDC puts it. That means revamping IT infrastructure, adopting AI, pushing cloud-native platforms, and building smarter networks. These upgrades aren’t just about speed. They’re also aimed at delivering more flexible and engaging entertainment options that drive pay TV spending. The Gulf countries are already far ahead on 5G, and the rest of Africa is expected to catch up over the next few years, alongside low Earth orbit (LEO) satellite deployments and fiber network expansions.

This modernization is crucial to maintaining the current upward trend in pay telecom and TV spending, especially as competition heats up and viewers demand more bang for their buck.

In Kenya and across the MEA region, the way people access TV, mobile data, and internet services is evolving fast. From flexible subscription models to upgraded signal requirements and smarter home streaming setups, your daily viewing experience is changing and so is how you’re spending on it.

Whether you’re tuning in with a smart decoder or juggling YouTube, DStv, and Netflix on one device, your choices are helping drive this pay TV spending surge. The big question now is: Can that momentum survive the storms ahead?